12 Trends

Reshaping How We Verify, Trust, and Protect

Identity verification has quietly become one of the few technologies everything else depends on. You can’t open an account, cross a border, or access most digital services without proving that you are who you claim to be. It’s no longer a background process — it’s the gateway between participation and exclusion in the modern economy.

Last year, we highlighted growing threats from AI-generated fraud, the tensions between digital and physical identity, tightening regulations, and the mounting pressure for more cohesive identity verification (IDV) systems. Much of that is unfolding now and making headlines. Deepfake detection is shifting from checking visuals to verifying signal origin. Age assurance is moving from optional to enforced. And fragmented IDV stacks are being replaced with orchestrated platforms built for transparency.

As our 2025 predictions take shape, the next wave of challenges is already emerging — even more complex, more autonomous, and harder to control. In 2026, identity is no longer just about people. It’s about AI agents, machines, signals, and systems — all acting on behalf of someone. This shift changes everything: how fraud happens, how we verify identities, who we trust, and who gets to act in digital spaces.

Below are twelve trends that we believe will shape identity verification in 2026 and beyond. Each one raises a simple question with complicated answers: Who or what do you trust — and why?

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

The new face of fraud: Emerging threats and attack shifts

Fraud isn’t exploding in volume so much as it’s mutating in form. What used to be a linear attack — a stolen credential or a forged document — is now a network of automated probes, AI impersonators, and synthetic identities working in sync. The collapse of trust never starts with a breach; it starts when the system can’t tell what’s real anymore.

Trend 1. Unchecked autonomy: The coming oversight crisis

Autonomous AI-powered agents — copilots, chatbots, workflow bots — are already taking over tasks like customer service, document submission, and simple financial transactions. But sooner rather than later, some of them will move further and start acting without real-time human supervision — and sometimes without clear audit trails.

That’s where things get risky. These agents can initiate actions independently, trigger identity checks, or submit documents in someone’s name. When they misfire — making unauthorized or harmful decisions — the question of responsibility becomes murky.

We expect the first agentic-AI incidents will prompt serious questions, such as:

- What causes these breakdowns: unsupervised chains, prompt injections, or weak human oversight?

- How can accountability be traced when a system acts independently?

- Will human-in-the-loop safeguards become not just best practice, but a legal requirement?

“To understand the challenge, think of hiring a personal assistant. You interview dozens of people to find someone competent, aligned with your way of thinking, good at communicating, and able to navigate complex situations. Even then, there’s an onboarding period where you test them in real-world scenarios, teach them processes, and monitor their decisions. Now replace that assistant with an AI agent trained on unknown data, acting autonomously, and deployed instantly — without any trial run, without guarantees, and without legal accountability. That’s not automation. That’s risk squared.”

— Ihar Kliashchou, Chief Technology Officer at Regula

For identity verification, this shift changes the core premise: we no longer verify only people, but also the machines, the agents acting on their behalf. The next evolution of trust frameworks must set boundaries, define fallback protocols, and embed accountability before autonomy scales beyond control.

Trend 2. The deepfake factory: Identity-as-a-service goes mainstream

What used to be an individual effort — crafting a convincing deepfake — is now part of a scalable, plug-and-play ecosystem. Fraudsters can now purchase complete "persona kits" on demand: synthetic faces, deepfake voices, digital backstories, and even fake behavioral traits trained to pass verification.

This marks a shift from artisanal fraud to industrial-scale identity fabrication. For businesses, it significantly increases the risk of falling victim to impersonation fraud. The traditional defenses — visual liveness checks, facial movement analysis, audio inconsistencies — remain foundational, but they need to be enhanced with deeper provenance checks.

The next frontier of verification must move from perception to provenance:

Hardware attestation and cryptographic proofs to validate the capture source.

Origin intelligence — device metadata, source IP, geolocation — to help expose synthetic origins.

Hardware-level watermarking — where devices like cameras or scanners embed cryptographic “proof of origin” directly into images or documents — and C2PA provenance standards, which define how that authenticity data travels with the file. These techniques are emerging as the next line of defense, verifying content at the moment of creation, not after manipulation.

Defending against deepfakes in 2026 requires a mindset shift — from “what does this look like?” to “where did this come from, and how do we know it’s real?”

Trend 3. AI teams up for identity brute forcing

AI-powered fraud attacking identity verification processes is splitting into two clear tracks. At one end, low-effort attackers use cheap generative tools to produce shallow fakes and spoof basic verification. At the other end, advanced actors now chain multiple AI agents to simulate entire identity lifecycles, from document creation to live customer interaction.

One AI generates fake documents or deepfake faces, another mimics real-time voice or video responses, a third tests leaked credentials or manipulates customer service via social engineering, and a fourth adapts tactics based on system feedback.

Such synthetic fraud chains operate like automated teams — fast, coordinated, and hard to trace. By constantly generating and testing new identity variants, they brute-force verification systems, probing every weakness until something passes as legitimate.

— Ihar Kliashchou, Chief Technology Officer at Regula

For businesses, this means the next wave of identity threats won’t come from a single deepfake, but from AI collectives that learn and iterate at machine speed. Defending against them requires layered verification: combining behavioral signals (like typing patterns, navigation style, or response timing), IP intelligence, velocity analysis (tracking how quickly, frequently, or from which location access attempts are made), and traditional IDV techniques (such as document verification, face matching, and liveness checks). No single check will be enough; resilience now depends on how seamlessly different defenses work together.

.webp)

.webp)

.webp)

The trust stack: Governance and regulation

Trust is no longer just an ethical stance — it’s being hard-coded into law, architecture, and algorithms. As AI and identity systems move from the lab to the boardroom, they’re being pulled into legal frameworks that demand transparency, fairness, privacy, and control.

The result: trust is becoming a stacked system, built from regulation at the top, infrastructure at the bottom, and accountability running through every layer. In this new environment, compliance is a permission to operate.

Trend 4. AI governance has become a core business function

AI is no longer confined to R&D teams. It’s now a board-level priority driven by regulations like the EU AI Act, NIST’s AI Risk Management Framework, as well as rising scrutiny in the US and Asia. Gartner® predicts that “By 2027, fragmented AI regulation will grow to cover 50% of the world’s economies, driving $5 billion in compliance investment.”*

In 2026, AI governance will need to become a core business function, just like cybersecurity or data privacy. Enterprises are already creating new leadership roles like Chief AI Officers, and establishing internal frameworks to ensure their AI systems are aligned with ethical, legal, and operational standards.

For the identity verification industry, that means:

AI models must be explainable, auditable, and continuously bias-tested.

Risk assessments and decision logs must be transparent and accessible on demand.

Model training, deployment, and tuning must follow governance and traceability protocols.

Regulators — and, inevitably, customers — will expect proof that your AI system is not just accurate, but accountable. Under emerging laws like the EU AI Act and US federal procurement rules, non-compliant systems may simply be barred from high-risk sectors such as finance, travel, or government programs — not just fined, but locked out.

*Source: Gartner press release, Gartner Unveils Top Predictions for IT Organizations and Users in 2026 and Beyond, October 2025. GARTNER is a registered trademark and service mark of Gartner, Inc. and/or its affiliates in the US and internationally and is used herein with permission. All rights reserved.

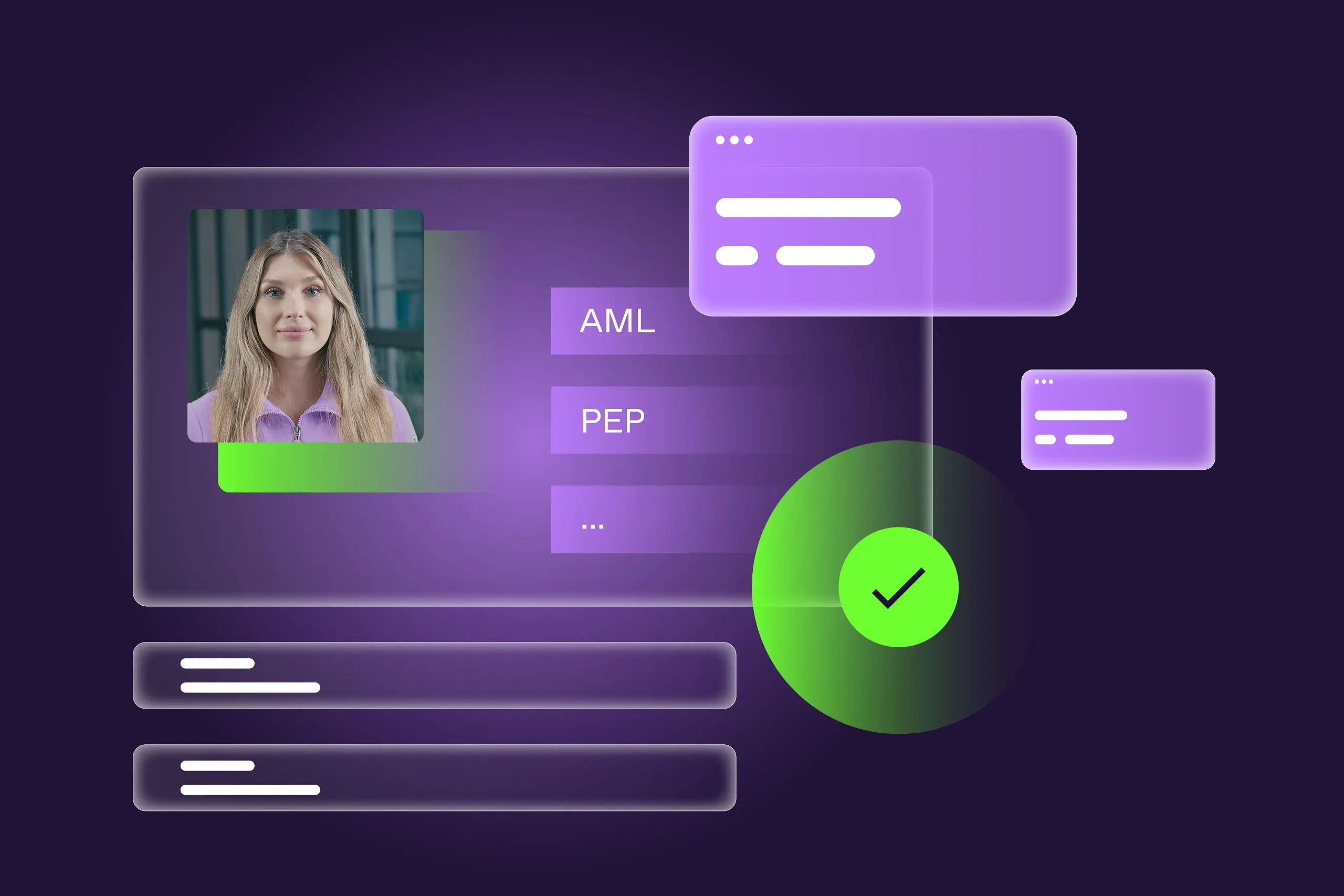

Trend 5. From patchwork to platform: The orchestration era of IDV

Many organizations still rely on fragmented IDV setups — one tool for documents, another for biometrics, a third for sanctions screening.

In such environments, investigation and accountability slow down, making it harder to trace incidents or pinpoint data failures. In 2026, this patchwork isn’t just inefficient — it’s a liability. Regulators now expect unified identity flows, synchronized data handling, and auditable chains of custody. Disconnected systems simply can’t deliver that level of transparency.

— Henry Patishman, Executive Vice President Identity Verification Solutions at Regula

All of this is driving a rapid shift toward platform-based orchestration — not necessarily one vendor doing everything, but one place where everything connects, logs, and complies.

For enterprises and IDV providers, that means:

Single orchestration layers combining multiple tools, like document checks, biometrics, and screening.

Standardized audit logs across modules for end-to-end traceability.

Integrated policy enforcement governing everything from liveness checks to watchlist matches.

In the next phase of digital identity, the platform is less about replacing best-in-class tools and more about making them work together in perfect sync.

Trend 6. Reusable identity at the tipping point

The idea of “verify once, reuse everywhere” has been around for years — a vision where individuals can prove who they are across platforms and borders with a single, secure credential. In practice, this means a reusable digital identity: a verified set of personal attributes stored in a wallet or trusted platform that can be shared again without repeating the full onboarding process.

Governments in Estonia, Singapore, the UK, and other countries are building standards and issuing reusable digital IDs. Yet the model still faces three major blockers — interoperability, liability, and trust:

Will businesses trust third-party verification?

Who is liable if a reused ID fails or is compromised?

Can individuals control their data if IDs are issued by banks or big platforms?

Until these issues are resolved, reusable identity remains limited in adoption. One of the strongest catalysts for implementation would be a unified set of global standards that all players — governments, platforms, and vendors — agree to follow.

The trend is clear: identity verification vendors will move beyond one-time checks and become continuous trust providers — anchoring reusable credentials, supplying cryptographic attestations, and acting as verification authorities in cross-border ecosystems.

At the same time, big tech, banks, and telcos may move faster than governments, offering wallet-based credentials for payments, age checks, and KYC reuse. This could spark a public-vs.-private standards race, and force regulators to intervene to ensure interoperability and consumer control.

Trend 7. Privacy-preserving age checks

Age verification — once an optional check — is now becoming a legal requirement across major markets. From the UK’s Online Safety Act to EU digital platform rules and upcoming US state laws, platforms must know the age of their users. This means verifying individuals who may never have been asked for an ID before.

This change is driven by growing political and social pressure to protect minors from online harm, explicit content, and algorithmic targeting.

For many businesses, this is their first experience handling direct identity data, turning age assurance into a new compliance frontier.

They’re rapidly expanding into social media, e-commerce, app stores, and streaming platforms — essentially any business that provides digital access. Age has become a new trust signal, and failing to verify it properly can now mean fines, app-store delistings, or reputational damage.

— Nikita Dunets, Vice President, Digital Identity Verification at Regula

Balancing this requirement with privacy is the real challenge for businesses. It’s driving their need for privacy-preserving verification methods, such as:

Cryptographic proofs that confirm “18+” or “13+”, etc., without revealing identity details.

Device-based age attributes that are stored locally on secure hardware.

Contextual or behavioral signals that infer age without collecting sensitive information.

Hybrid approaches, where IDV vendors verify once, then issue a reusable, zero-knowledge “age token.”

In practice, the question is no longer “should we check age?” — it’s “how can we prove age safely, fairly, and at scale?”

Trend 8. The quantum countdown: Identity verification prepares for the next encryption shift

Quantum computing is closer than most organizations realize. And it has huge implications for encryption, quietly reshaping the security assumptions that digital trust is built on. While quantum attacks aren’t here yet, adversaries are already harvesting encrypted data today with the plan to decrypt it later.

For identity verification providers, the “store now, decrypt later” threat may have real financial implications. Attackers are already harvesting encrypted identity data — including passports, biometric templates, and proof-of-address documents — with the intent to decrypt it once quantum computers are more accessible. Even if a breach happens today but the data remains unreadable, it still poses a risk of a delayed liability: once decrypted, that same dataset could expose millions of verified identities, forcing businesses to take on costly actions and rebuild trust from scratch.

The second risk lies deeper in the system. Every verification process — from digital signatures on documents to authentication tokens between partners — depends on cryptographic keys.

Once quantum technology can break today’s RSA and ECC algorithms, those keys will no longer prove authenticity. In practice, that means the certificates that verify users, partners, or transactions could instantly become invalid, disrupting compliance and business continuity overnight.

That looming risk is driving a wave of quantum migration — the process of transitioning from today’s encryption standards to post-quantum cryptography (PQC). In 2026, forward-looking organizations will:

Map cryptographic dependencies, understanding which systems and credentials would break first.

Begin testing NIST-selected PQC algorithms and hybrid cryptographic models.

Demand crypto-agility from vendors, i.e., the ability to rotate keys, update algorithms, and patch protocols with minimal disruption.

For the IDV sector, this means the following changes:

Document signing and credential issuance systems must shift toward PQC-compatible algorithms.

Key management and token generation processes need to be fully auditable and agile.

Long-lived credentials (like driver’s licenses, passports valid for 10 years, etc.) must be built to survive the quantum era, which is potentially decades ahead.

Governments and standards bodies are already moving: NIST has finalized its first PQC algorithm suite, the EU’s ENISA is issuing migration guidance, and ICAO is exploring quantum-resistant ePassport frameworks. Quantum resilience is becoming the next compliance frontier, and over 5% of IT security budgets will soon be dedicated to preparing for it, according to Forrester analysts.

Back then, companies scrambled to fix date formats before the year 2000, fearing that systems would fail when ‘99’ turned to ‘00.’ The difference is that this time, we’re not fixing clocks — we’re rebuilding the foundations of digital trust. Organizations that prepare early will treat PQC as a strategic refresh of their security architecture rather than an emergency scramble to catch up. In other words, those who prepare now won’t panic later.

— Henry Patishman, Executive Vice President Identity Verification Solutions at Regula

-2.webp)

-2.webp)

-2.webp)

New identity paradigms

The definition of “identity” is breaking wide open. The next era of identity verification isn’t human-centric — it’s ecosystem-centric. And keeping trust intact will require entirely new rules of engagement.

Trend 9. Machine customers: When algorithms become clients

As internal AI agents gain autonomy, a parallel shift is happening on the other side of the transaction: “machine customers” — algorithmic entities that act, buy, and negotiate on their own — are beginning to participate in the economy. They will book flights, open accounts, sign contracts, and spend money. And each of these actions will require identity verification, authorization, and accountability.

So how do we verify them? Do they need their own digital identity? Should they carry credentials issued by humans or organizations? What happens if they violate policy or commit fraud?

Legal frameworks for “algorithmic personhood” may eventually emerge. Early policy signals are already pointing in that direction: the EU AI Act, the UK’s Digital Identity & Attributes Trust Framework, and NIST’s AI Risk Management Framework all stress that AI systems must remain verifiable and traceable to a responsible human or organization.

But long before regulations catch up, businesses will need practical safeguards. Most likely, AI agents will be verified through the people or organizations behind them — their creators, owners, or operators — using traditional identity credentials. In high-risk scenarios, that trust chain may even extend to physical verification of the human accountable for an agent’s actions.

Until such frameworks mature, companies need to define clear boundaries: which actions and decisions can be automated, how they are logged and audited, and where human oversight must step in as the ultimate decision-maker.

Trend 10. The rise of sovereign ID clouds and local identities

What once looked like a path toward a single, global digital identity is now diverging into national and regional ecosystems.

According to Gartner’s “Top Strategic Predictions for 2026 and Beyond,” by 2027, around 35% of countries will be locked into region-specific AI platforms built on proprietary contextual data. In practice, that means the rise of “digital nation-state ecosystems,” where domestic data, national digital IDs, local AI models, and protectionist cloud rules combine into closed, sovereign infrastructures.

It’s a logical move for governments prioritizing data sovereignty and cybersecurity, but it comes with a price. For global businesses, it means:

Compliance bottlenecks, because every region defines its own onboarding and verification rules.

Cross-border verification failures, where an ID trusted in one country is rejected in another.

Rising operational costs, as identity systems must adapt to multiple technical and legal requirements.

Standards for verifiable credentials — like Decentralized Trusted Credentials or W3C’s Verifiable Credentials — promise to bridge the gap. But in practice, interoperability is losing ground to fragmentation.

For the identity verification industry, this marks a turning point. Global IDV platforms will need to behave more like local operators, offering region-specific deployments, compliance layers, and sovereign data hosting. The next frontier of identity trust may not be global at all — it may be federated, fragmented, and fiercely territorial.

Trend 11. Programmable money: Digital currency that verifies itself

Money is becoming programmable — not just stored or transferred, but coded with rules about who can spend it, where, and under what conditions.

In pilot projects for central bank digital currency (CBDC) pilots and tokenized finance, every digital unit can now carry built-in logic that authenticates itself before it moves: who can spend it, where, and under what conditions. Over 130 countries are now exploring CBDCs, and many — including China, the EU, India, and Brazil — are testing programmable features such as spending limits, expiration dates, and conditional transfers.

In this model, identity and finance converge. Every transaction becomes a verification event. The question "Who are you?" merges with "What are you allowed to do?"

IDV providers will play a foundational role in this convergence. Programmable money can only enforce rules if it’s anchored to a trusted identity. That means:

IDV systems must verify users at the point of issuance, not just at onboarding.

Access rights must be linked to biometric or cryptographic proofs and continuously checked so they remain valid across ecosystems and times.

Of course, the same mechanisms that make programmable money secure could, in the wrong hands, make it traceable. The difference lies in how identity is implemented. The next generation of IDV must reconcile two opposing forces: programmability and privacy. That means embedding selective disclosure, zero-knowledge proofs, and decentralized credential storage, so that transactions can be verified without exposing the person behind them. Modern verification is all about proving the right facts with less data.

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

At the edge of reality: Bonus trend

Trend 12. Proof of reasoning: Verifying the human mind

As verification expands beyond documents and data, one provocative idea is emerging: what if identity checks someday reach the level of thought itself? When algorithms start to imitate reasoning, the next challenge won’t be proving who’s real — but who’s thinking.

As a result, verification will be moving beyond existence and into cognition. “Proof of reasoning” is the next frontier — the ability to confirm that a human mind, not a machine, is behind a decision or action.

Early versions of AI-free assessments will take these shapes:

Behavioral verification based on reaction time, comprehension, or adaptive problem-solving.

Dynamic challenges designed to test live thinking, rather than pre-generated responses.

Role-specific cognition checks in hiring, secure access, or high-risk transactions.

In essence, the ability to think is becoming a new kind of human watermark.

But the paramount questions remain. Can cognitive verification reliably distinguish humans from machines, or does it risk crossing into psychological surveillance? What exactly counts as “proof” of reasoning, and who defines it?

In high-stakes situations like fraud escalation, synthetic-ID detection, or onboarding vulnerable individuals, trained and equipped human verifiers bring what automation still lacks — context, empathy, and evidence-driven judgment. The future of verification may not be man or machine, but a hybrid system where reasoning itself becomes the ultimate credential.

— Henry Patishman, Executive Vice President Identity Verification Solutions at Regula

Final thought

The past decade was about proving who people are. The next one will be about proving how they — and the systems acting for them — think, decide, and behave.

As AI blurs intent and trust becomes programmable, verification is no longer a checkpoint. It’s becoming the infrastructure for truth — the connective tissue between identity, action, and accountability. In that world, the winners won’t be those who verify the fastest, but those who verify the deepest and fairest, building systems that understand not just who — but why.

Verify identity with precision — in 2026 and beyond

Explore Regula’s customizable, on-premises, and reliable solutions for document and biometric verification.

![Worldwide Digital ID Overview: The Current State by Country [+Free List]](https://static-content.regulaforensics.com/Blog/2025/digital_ID_1245_blog_title.webp)