When choosing an Identity Verification (IDV) solution, the pricing model can significantly impact both cost efficiency and overall security. Identity verification pricing varies depending on multiple factors, including the type of solution, the volume of verifications, and the features included.

In this post, we’ll explore common pricing models in the IDV field, provide guidance on the cost of ID verification solutions, and discuss how to choose the right one for your needs.

SaaS vs. on-premises pricing

The primary factor impacting your IDV investment is the type of solution you choose: cloud-based (SaaS) or on-premises.

SaaS is popular for its flexibility and faster time to market, as the entire infrastructure is managed by the vendor. The customer doesn’t need to deploy and update anything on their own, while all the ongoing technical support, hosting, and DevOps teams ensuring 24/7 service availability operate on the vendor’s end. Initial costs are often lower but can escalate as the volume of client transactions increases. On the positive side, scaling is much easier because you don’t have to worry about the technical side of the process.

On-premises solutions,on the other hand, require higher initial expenses for deployment. However, they typically offer lower ongoing costs since they don’t require continuous cloud service fees, and the price per transaction is generally lower, which is especially beneficial at scale. Still, as transactions increase, you’ll need more computing power, which is a notable cost item.

For more details, check out Cloud vs. On-Premises Identity Verification: Which Approach Is Right for You?

Besides these fundamental differences in approaches, it’s also important to consider the different pricing models practiced by different vendors, among both cloud and on-premises solutions.

Transactional model

The most common identity verification pricing model is transactional. In this model, each interaction with the service—for example, verifying a passport or a face—is considered a single transaction. You only pay for successful transactions, meaning when a document is processed and a response is received. This is crucial because sometimes users might scan a document incorrectly multiple times, and you wouldn’t want to be charged for each unsuccessful attempt.

Licensing in this model often includes a set number of transactions—a plan or a package—and each one is deducted as it’s used. Pricing is typically quoted per transaction or per package, making it easier for clients to compare ID verification costs across vendors. As a result, the price per transaction becomes a key metric for comparison.

In essence, this model operates like a subscription, which has largely replaced older models.

However, there are some nuances to consider.

What exactly does a “transaction” mean?

From the user’s perspective, the cost per transaction is a critical factor. However, different vendors may include different features under the same “transaction” label, making it difficult to compare identity verification solutions head-to-head.

Some vendors may define each individual action, such as ID checks or biometric scans, as separate transactions, whereas others may treat a whole session—from start to finish, including all verifications—as a single transaction.

Understanding what each vendor means by, for example, "ID verification" is also essential because it clarifies what you’re paying for. Without this clarity, choosing based solely on price could result in missing out on important features.

Typically, there are at least three plan options. For example, Regula Document Reader SDK includes these checks in its plans:

.webp)

Flat-rate licensing model

Another pricing method is often referred to as flat-rate or user-based pricing, where you pay per user, and transactions aren’t counted (although there’s usually an annual limit).

This model is ideal for use cases where a client has a limited database of users they need to verify, for instance, an access control point. Here, the client may only want to know when users enter or leave. Paying per transaction here would be very expensive in such a scenario, while paying for a certain number of users is more cost-effective.

For example, the mobile version of Regula Document Reader SDK and Regula Face SDK leverage this model, because they are typically used for returning customer verification.

Pay-as-you-go

Unlike flat-rate licenses, the pay-as-you-go model is more common for SaaS. There are two variations:

Postpaid: You use the service and pay afterward. This model is rare.

Prepaid: The client prepays for a certain volume, and if they exceed it, they pay extra at the rate for that volume. For instance, if the package includes 10,000 transactions, and the client ends up using 15,000, the additional transactions are billed at the rate for the 10,000-20,000 tier. The cost per transaction is usually lower in higher tiers.

Clients love this model because it’s convenient, especially when it’s difficult to predict usage volumes at the start. Vendors, however, might find it challenging to manage due to the need for a robust accounting system, especially for complex solutions like IDV.

Is a suggested pricing model negotiable?

Well, yes and no. While clients can approach vendors with their unique needs and request a customized pricing model, vendors are unlikely to deviate from their established models.

For example, if a vendor uses a transactional model, they’ll likely stick to it, possibly offering special conditions, but not changing the entire model. This is because adjusting the licensing system for complex products like IDV solutions is usually impractical.

How to choose? A quick guide

Determine the type of solution you need: Cloud or on-premises?

Identify what you need to verify: Will clients be uploading only one type of document from one country, or various documents from different countries? This is crucial for the next step.

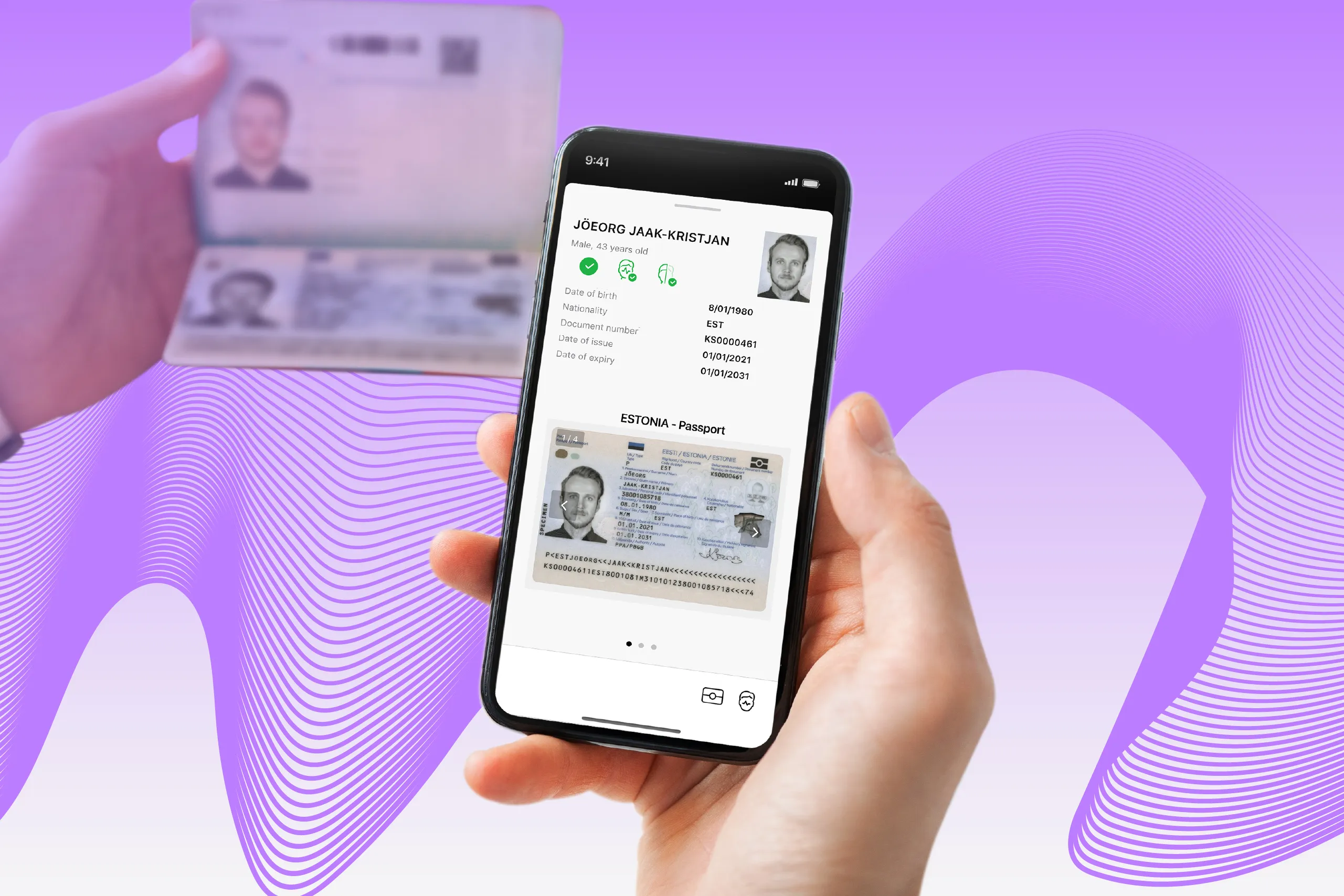

Read the fine print carefully: Understanding what’s included in the checks gives you a clearer picture of the true cost of ID verification. For example, what exactly is covered under “ID verification”? It might range from basic OCR and barcode scanning to comprehensive checks. This significantly impacts the quality and reliability of the results. For example, Regula Document Reader SDK provides a document liveness check and advance authenticity checks, such as comparing the portrait across main, secondary, ghost, and kinegram variants. But that’s not necessarily true for other IDV solutions.

Consider both price and specifications: Yes, some solutions are more expensive, but you need to know exactly what’s included. It might turn out that some critical features aren’t covered, leading to higher costs in the long run.

Try to accurately forecast your usage volumes: For example, while Pay-As-You-Go might seem attractive initially, a transactional model could offer better value in terms of cost per transaction.

Last but not least, never miss the trial stage of the IDV solution you’re considering—this will give you an understanding of how it works and what to expect from the product.

Choosing the right identity verification solution and pricing model can be complex, but you don’t have to navigate it alone. Our experts at Regula are here to help you find the most cost-effective and reliable solution tailored to your specific needs. Get in touch with us today to explore your options and ensure you’re getting the best value for your investment.

.webp)