Comparing vendors is a key step in choosing the identity verification (IDV) solution that best fits your needs, industry, and user scenarios. Typically, companies consider a range of features, including security, compliance with global standards, supported documents, the level of automation, and whether the solution works both online and offline.

This article is intended as a buyer’s guide — not a ranking — and outlines the key considerations to follow when evaluating the best identity verification software. It also offers an overview of some trusted providers on the market.

What to consider when choosing identity verification software

Every organization has its own priorities: industry specifics, budget, regulations, and use cases all influence the choice.

The best identity verification solutions cover the entire IDV process, typically including automated document and selfie verification. To verify a new customer, the software scans the ID, extracts the data, and runs authenticity checks. It then analyzes a selfie for liveness and matches it to the ID photo.

Most IDV tools can perform these steps, but reliability and accuracy vary depending on the technology behind them — and that’s where solutions differ.

Here are key features to consider based on your needs:

When you need document verification checks…

Good IDV software typically offers:

Image quality checks

OCR (optical character recognition)

Analysis of VIZ and MRZ zones

Barcode validation

NFC reading (for biometric IDs)

Photo substitution detection

Template and data consistency checks

Most vendors can provide an extended feature list on request.

To define what you need, consider:

ID format: Your ideal toolkit should be based on the IDs you verify most frequently. Verification flows differ for machine-readable, chip-enabled, polycarbonate, or paper-based documents. Newer formats like Digital Travel Credentials, digital IDs, and mobile driver’s licenses also require tailored approaches.

ID type: Beyond passports or driver's licenses, users may present less common documents, such as seafarer’s certificates or taxpayer cards. Make sure the solution can process these.

Security features: Each ID requires specific checks to be authenticated. For instance, many documents now include holograms, MLIs (multiple laser images), or OVIs (optically variable ink). If you need to verify these remotely, ensure the vendor supports document liveness detection.

Customer location: If your audience is local, choose a provider familiar with regional IDs. For global coverage, look for a broad range of supported documents.

💡Note: A long list of supported countries doesn't always mean strong verification — some tools may extract data but not validate the ID’s authenticity.

When you need biometric verification checks…

Biometric checks based on liveness detection are essential for confirming that the person submitting an ID is real — not a deepfake, mask, or replayed video.

To ensure reliable results, look for tools that include:

Presentation attack detection (PAD):Filters out spoofing attempts using photos, masks, or screens.

Video injection resistance: Detects fake streams injected into the process.

Facial matching and recognition: Verifies that the selfie matches the ID photo and ensures a consistent identity across sessions.

Support for fallback checks: Allows alternative methods (e.g., video calls) in case of failed biometric verification.

Also, make sure the vendor follows standards like ISO 30107-3 for liveness detection and has test results from independent labs (e.g., iBeta or NIST). These are signs of maturity and credibility.

When you need a platform-based solution…

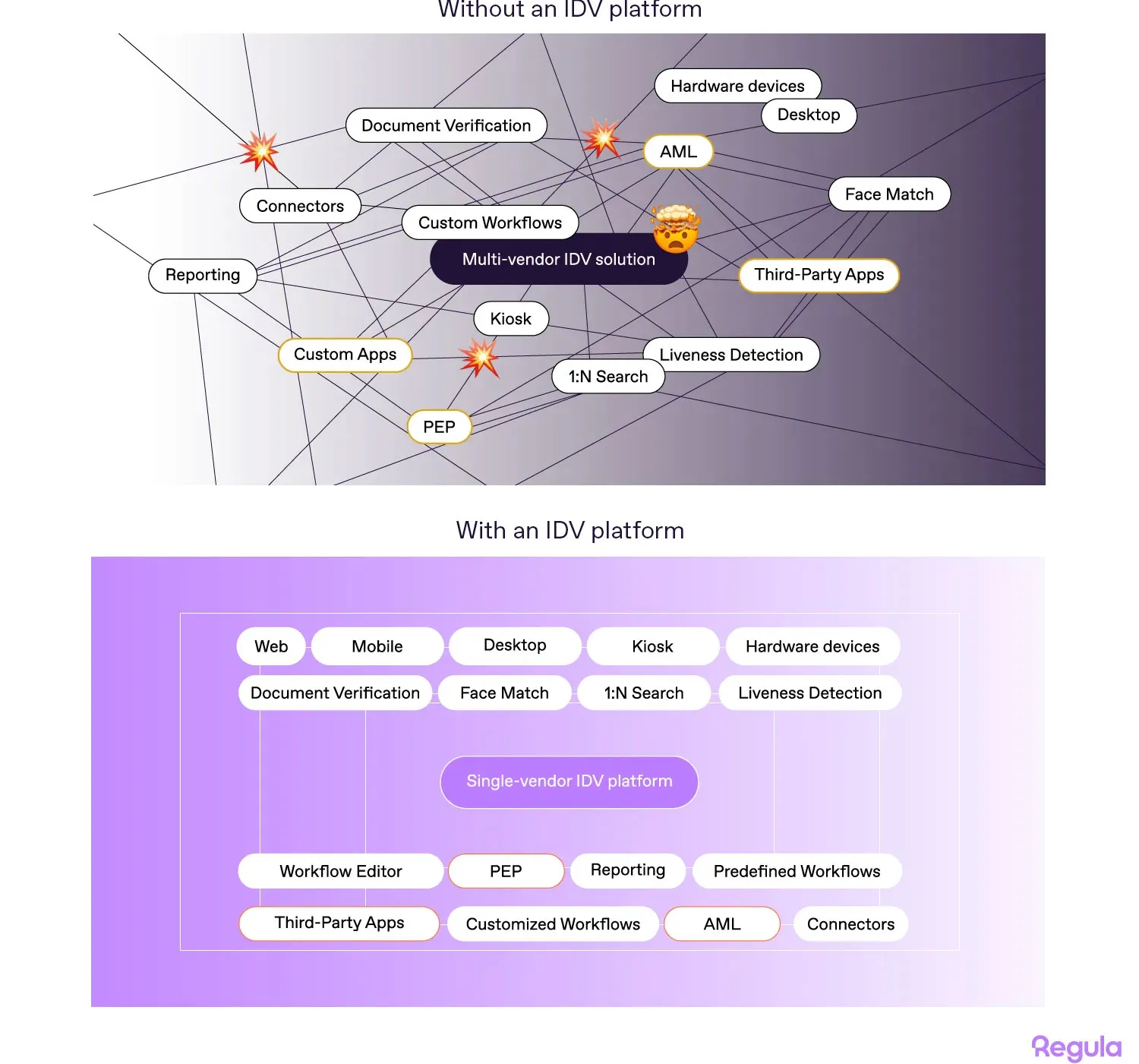

Deploying a complete IDV process can be challenging for large organizations.

They often rely on fragmented IDV workflows, with disconnected tools, teams, and channels, which create extra friction for users and lead to inconsistent verification outcomes.

At the same time, complex deployments, high integration costs, shifting KYC/AML rules, and the lack of centralized reporting make it hard to understand where verification fails, why users drop off, and how to scale IDV effectively.

For this reason, enterprise organizations in regulated sectors such as finance, telecom, or government typically need full-service platforms with customizable workflows that tailor the verification process to different customer groups, risk profiles, and jurisdictions.

In this case, look for the following:

Digital identity orchestrationto combine multiple checks into automated flows for different use cases or geographies.

Built-in fraud detection tools to spot both amateur and sophisticated attempts to bypass the system (e.g., device profiling, IP checks, behavioral analysis).

Low-code/no-code integration for faster deployment across mobile and web platforms, including connection with third-party tools already in use.

Compliance controls for local and global KYC/AML regulations, data retention and residency requirements, and audit trails.

Connectivity to external data sources for compliance-focused checks such as Politically Exposed Persons (PEPs), KYC, and AML screening.

Subscribe to receive a bi-weekly blog digest from Regula

What else to take into account

Beyond core verification checks, consider how the solution handles security, customization, integration and pricing. These directly affect user experience, compliance, and long-term value.

Security and compliance

Compliance requirements vary by region, but here are the key areas to check:

Data protection: Many countries require local data storage and processing (e.g., GDPR in the EU, PIPL in China).

KYC regulations: Common in banking, crypto, and telecom; typically defined by programs like the US Customer Identification Program.

AML laws: Cover high-risk transactions and industries (e.g., FATF’s 40 Recommendations).

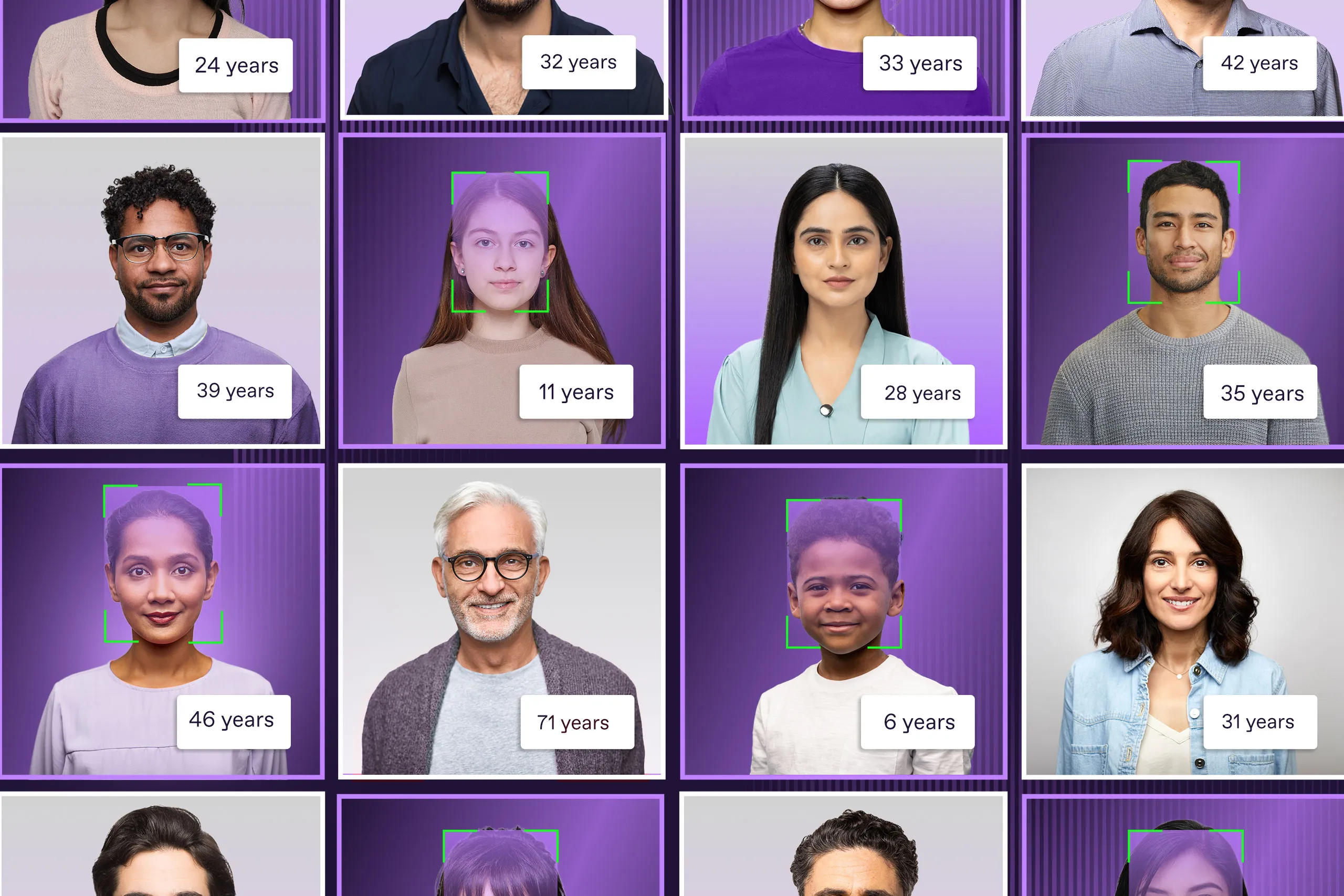

Global certifications and tests: Look for ISO standards (e.g., ISO 27001:2022) and performance evaluations by labs like NIST or iBeta, which test accuracy in age estimation, liveness detection, and more.

Document standards: Make sure the vendor supports updated specifications like ISO/IEC 39794-5 for e-passports and the new portrait-oriented TD1 format adopted by countries like Iceland and Cameroon.

Most top IDV providers meet basic requirements, but you should confirm that they align with your specific legal and compliance needs.

Customization options

Customization affects both system integration and user experience.

Top IDV vendors typically offer localization, white-labeling, and accessibility features. The level of customization often depends on the deployment type — SDK, cloud, or out-of-the-box app.

From a user standpoint, tailored interfaces reduce friction and improve conversion rates. For businesses, custom workflows help serve different user groups or risk levels, which is especially useful if you operate across multiple markets or segments.

Make sure the solution fits into your system and supports the level of customization your process requires.

Implementation scenarios

IDV solutions vary in how they integrate. Most are available as on-premises software development kits (SDKs) or cloud-based software-as-a-service (SaaS) solutions.

Here’s a quick comparison:

| Feature | SDK | Cloud platform |

|---|---|---|

| Setup & deployment | Needs developer resources | Minimal effort required |

| Customization | Fully customizable | Limited customization |

| Data storage | On-premises (you control it) | Stored in vendor or private cloud |

| Data control | Full control | Must trust vendor’s handling |

| Updates & maintenance | You manage it | Vendor manages it |

💡Pro tip: Choose SDKs if you need deep integration and full data control. Go cloud if speed, scale, and ease of use are your priorities — and if your compliance policies allow it.

Pricing model

Most IDV vendors offer one of these pricing models:

Transactional — Pay per check (for instance, per passport verification).

Flat-rate licensing — Per user, regardless of volume.

Pay-as-you-go — Prepay for a set number of checks (e.g., 10,000 transactions) and top up as needed.

The right model depends on how often you verify users, your business size, and whether you're using SDK or cloud deployment.

Before deciding, assess what documents you’ll verify most often, expected monthly volume, and what’s included in each check.

Top identity verification software: 5 recognized options

Below are five of the best ID verification platforms used across industries for secure, compliant onboarding and identity management.

Disclaimer! This section summarizes publicly available information. It is not independent market analysis or product advice.

1. Regula

Regula offers a full-service IDV Platform that brings document verification, biometric checks, and KYC screening into one solution. It supports end-to-end identity lifecycle management — from onboarding to ongoing verification and authentication — with workflow orchestration built to meet changing compliance requirements.

The platform allows you to:

Automate the identity verification process with a secure, fraud-resistant solution.

Capture, verify, and validate ID documents, including mobile driver’s licenses, digital IDs, and DTCs, using extended authenticity checks, OCR, MRZ, and barcode reading, liveness checks for dynamic security features, and NFC-based verification with optional server-side rechecks.

Capture and verify biometric data and user age through face matching (1:1), face search (1:N), liveness detection, and age estimation.

Record user interactions.

Maintain a database of user profiles and personal data, including biometrics, and perform searches.

Manage a complete log of system interactions with users.

Integrate with external services and databases.

And more.

Beyond onboarding, Regula supports ongoing authentication and fraud prevention through biometric search, re-verification triggers, and flexible integrations with external services such as AML/PEP screening — scaling reliably as verification volumes grow.

Implementation: On-premises, hosted cloud

Pricing: Transactional

Countries & territories supported: 254

Document types supported: 16,000

2. Entrust (formerly Onfido)

Following its acquisition of Onfido, Entrust now offers identity verification as part of a cloud-based trust platform, covering onboarding, credential issuance, and ongoing identity management.

Its IDV solution supports a wide range of IDs, including e-visas and digital credentials, using orchestrated flows with document checks, biometrics, fraud detection, and attribute analysis.

Key features:

OCR, MRZ scanning, and NFC chip reading

Passive/active liveness detection with facial recognition

KYC/AML checks, blacklist/sanctions screening

Attribute analysis (e.g., IP, geolocation, device ID)

Support for Qualified Electronic Signatures (QES)

Implementation: SaaS

Pricing: Transactional

Countries & territories supported: 195

Document types supported: 2,500+

3. Sumsub

Sumsub is a flexible IDV platform built for fast-evolving sectors like crypto, online gaming, and fintech. It offers document checks, biometric verification, and AML/PEP screening, with strong support for regional compliance.

Workflows can be customized by risk level, with fallback options like video calls in high-risk scenarios.

Key features:

Active liveness detection with optional manual review

Biometric matching and watchlist screening

KYC risk scoring and fraud prevention tools

Global support for diverse ID types and formats

No-code integration (QR/link) for fast deployment

Implementation: SaaS (no-code option available)

Pricing: Transactional with volume discounts

Countries & territories supported: 220+

Document types supported: 14,000+

4. Jumio

Jumio provides an enterprise-grade IDV platform built for regulated sectors like finance, healthcare, and travel. It includes orchestration, fraud monitoring, and identity intelligence.

It combines standard IDV features with advanced analytics for cross-transaction risk, face morphing detection, and customer risk scoring.

Key features:

Broad document coverage with facial recognition

Liveness detection and age estimation

Proprietary Jumio Identity Graph to detect repeat fraudsters

Real-time AML/PEP screening and sanctions monitoring

API integrations with third-party data sources

Implementation: SaaS

Pricing: Transactional

Countries & territories supported: 200+

Document types supported: 5,000+

5. Veriff

Veriff offers an AI-powered IDV platform focused on automation, fraud prevention, and scalability. Designed for fast-moving sectors like fintech, healthcare, and mobility, it supports global onboarding needs.

Key features:

Document and identity checks with database validation

Selfie-based authentication, age estimation, and AML screening

Proof of address and global sanctions list checks

Fraud Protect feature that analyzes data patterns to detect impersonation and fraud rings

Customizable flows to meet global and local regulations

Implementation: SaaS

Pricing: Transactional

Countries & territories supported: 230+

Document types supported: 12,000+

What else to do before choosing the best identity verification software

Choosing an IDV solution takes time — and that’s a good thing. Don’t stop at browsing vendor websites. Go deeper with these resources to make an informed decision:

Independent IDV market reports: Third-party analysis from firms like Gartner or KuppingerCole gives a clear view of the top vendors, key features, and how well they meet current tech and regulatory demands.

Customer reviews and case studies: Explore platforms like G2, Capterra, or Gartner Peer Insights. Case studies show how a product works in real scenarios. Reviews offer honest feedback, including what works — and what doesn’t.

Support and learning sources: Reach out to vendor support before buying. A fast, helpful response can be a strong indicator of service quality. Also, check out available guides, blog posts, webinars, and FAQs to learn more about the solution and its tech.

Trials and hands-on tools: Many vendors offer free trials or sandbox environments. These are useful, but testing the solution with your real data and flows is the best way to see if it fits your needs.

Bonus: Top identity verification companies on G2

Here’s a snapshot of the G2 Grid® for identity verification providers* in 2026:

| Regula | Sumsub | Jumio | Entrust, formely Onfido | Veriff | |

|---|---|---|---|---|---|

| Net Promoter Score (NPS) | 100 | 73 | 46 | 60 | 70 |

| Likelihood to recommend | 98% | 92% | 87% | 89% | 91% |

| Quality of support | 99% | 91% | 92% | 87% | 94% |

| Meets requirements | 96% | 91% | 90% | 90% | 92% |

| Ease of doing business with | 97% | 93% | 84% | 91% | 96% |

*According to G2 Grid® Report for Identity Verification | Winter 2026

Still have questions? Feel free to reach out — we’re here to help.