Global Survey Reveals Key Reasons Why Businesses Plan to Spend More on Identity Verification

Regula, a global developer of forensic devices and identity verification (IDV) solutions, has conducted a global survey investigating the business impact of investing in IDV, as well as organizations’ plans for the upcoming future. The results show growing demand for IDV solutions, and reveal businesses’ motivations behind this trend: preventing identity fraud, digitalization, and customer-centricity.

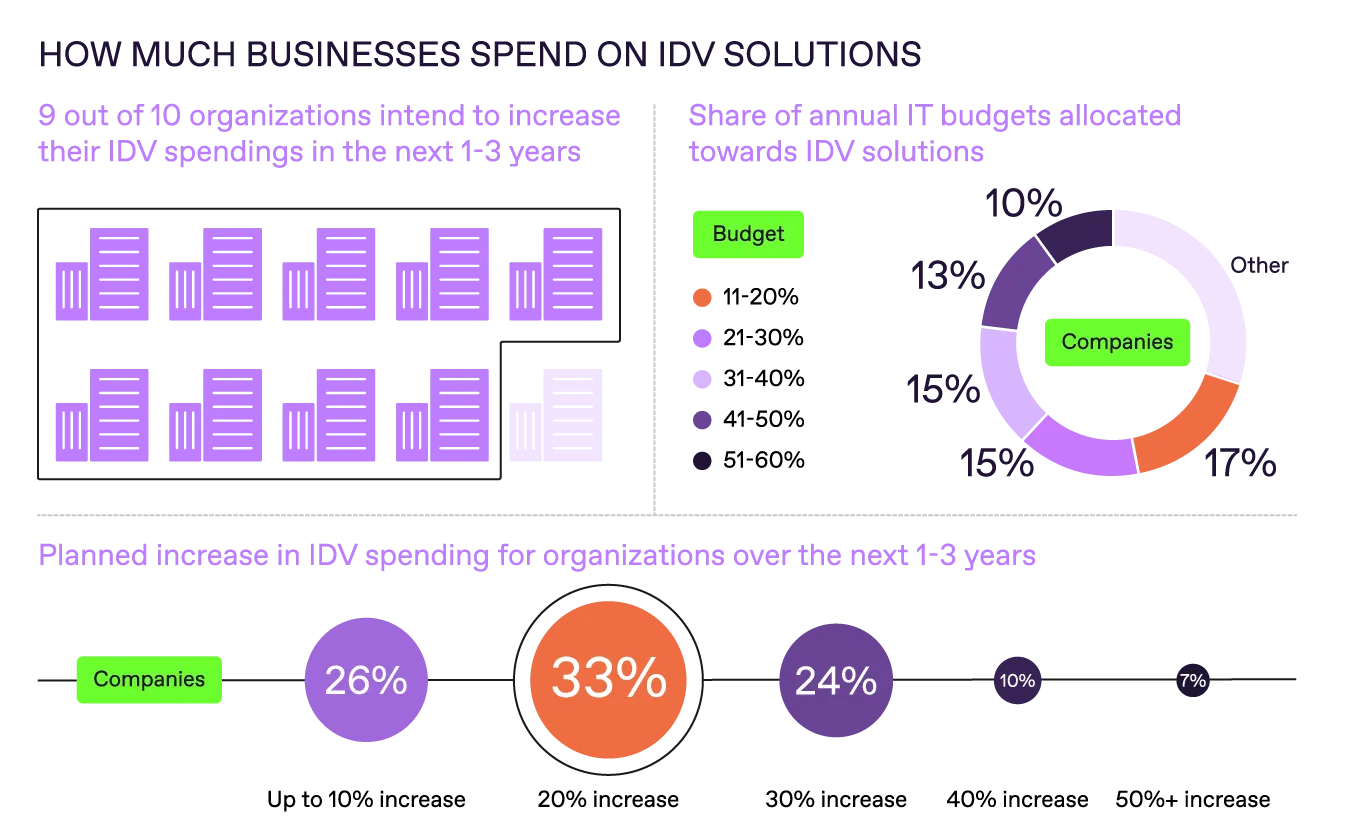

91% of organizations in the Financial Services, Technology, Telecoms, and Aviation sectors worldwide intend to increase their spendings on IDV solutions in the next one to three years. This is one of the key findings of a global survey* conducted by Regula together with Sapio Research company in December 2022–January 2023.

In terms of how much money is set aside for IDV solutions, the most popular choice (17% of businesses, ranging from small to enterprise) is to dedicate 11-20% of their IT budget annually, with 15% of businesses opting for 21-30%. In addition, one third of businesses plan to increase their spending by 20% within the next one to three years.

When investing in identity verification, the most popular method chosen by organizations is digital document verification—65% of the surveyed companies use it in their work, particularly in the Fintech sector (71%). Furthermore, 94% of those who do not currently utilize this method plan to do so in the coming year. This trend is consistent with Gartner's prediction** that by 2023, 80% of organizations will be using document-centric identity proofing as part of their onboarding workflows, an increase from approximately 30% in 2021.

Fingerprint biometric verification is the second most popular identity verification method, used by 60% of organizations, particularly in the Telecom and FinTech industries. One-time passwords hold the third place (58%).

The IDV market will inevitably grow, and we surely haven’t yet seen its peak. With the number of new users rising non-stop, along with the general trend towards digitalization, businesses will have to adapt and implement new methods of onboarding and verification of their customers. It may sound like a challenge to embed a wide spectrum of various IDV solutions; however, the whole process can be easily organized with a single solution from one vendor whose comprehensive approach to IDV solution development makes it possible to cover all the steps in identity verification.

— Henry Patishman, Executive VP of Identity Verification solutions at Regula

Business Drivers

The survey results reveal that preventing identity fraud is the leading reason for implementing an IDV solution, with 43% of surveyed organizations citing it. Digitalization of processes was the second most popular reason, with 34% of organizations selecting it.

Interestingly, customer-centricity is becoming an increasingly integral part of business decisions when selecting an IDV solution, due to rising customer expectations and increased competition (29%), and improved customer satisfaction through easier onboarding and verification (29%). This is especially true in the United States, as organizations there have a particularly substantial emphasis on customer centricity compared to the other countries surveyed.

Determinants of Success

The survey results also showed that businesses typically expect a tangible return on investment after implementing an IDV solution. Over half of respondents (55%) determined that the success of IDV deployment based on improved customer experience stemmed from faster and simpler onboarding processes—this was especially true for the Banking sector (61%). Also, 50% of organizations measured success according to reduced security risks by applying reliable fraud detection techniques, and 45% based their assessment on reduced legal risks by meeting anti-money laundering (AML) and compliance requirements.

The more identity documents an IDV solution supports and the more detailed the descriptions of their security features are, the more seamless and reliable the verification process is. Regula owns and maintains the largest document template database on the market: currently, it consists of more than 12,000 document templates from 248 countries and territories. This helps to validate and authenticate nearly all identity documents, whether on-site or remotely, preventing fraud and mitigating security risks.

Download the full infographic.

*The research was initiated by Regula and conducted by Sapio Research in December 2022 and January 2023 using an online survey of 1,069 Fraud Detection/Prevention decision makers across the Financial Services (including Banking and FinTech), Technology, Telecoms, and Aviation sectors. The respondent geography included Australia, France, Germany, Mexico, Turkey, the UAE, the UK, and the USA.

** Gartner, Buyer’s Guide for Identity Proofing, Akif Khan, Jonathan Care, 7 April 2021.

GARTNER is a registered trademark and service mark of Gartner, Inc. and/or its affiliates in the U.S. and internationally and is used herein with permission. All rights reserved. Gartner does not endorse any vendor, product or service depicted in its research publications, and does not advise technology users to select only those vendors with the highest ratings or other designation. Gartner research publications consist of the opinions of Gartner’s research organization and should not be construed as statements of fact. Gartner disclaims all warranties, expressed or implied, with respect to this research, including any warranties of merchantability or fitness for a particular purpose.