Whenever you install a new app or use a new service, you fill in the forms with personal data. This integration into the new system is actually what onboarding is. “Digital” simply means that you do it online rather than in a brick-and-mortar office.

In this post, we will discuss digital onboarding and how companies from regulated fields, such as fintech, can increase their compliance by implementing it.

What is digital onboarding?

Onboarding can refer to welcoming a new employee, customer, or user to an organization. In the financial field, this term is used to refer to registering new clients. After the process is complete, customers can use the bank's services to open an account or take out a loan. The idea behind the process is to show newbies around and help them switch from new users to active users in no time.

Digital onboarding means you can do it electronically and remotely instead of making your client spend hours on annoying paperwork. Electronic onboarding tools include websites, mobile apps with ID scanners, digital signatures, and other software solutions that simplify and streamline collecting and verifying personal information.

While businesses can use a mix of client onboarding methods, digital onboarding has gained momentum. In the post-COVID world, most people are used to receiving service remotely. According to Business Leader, 67% would now prefer to use an app for their everyday banking needs, and only 17% of consumers would rather visit the bank directly. If you’re unable to provide a digital experience, you may lose a lot of customers to your competitors who do.

For example, financial company Revolut and internet bank Wise allow new clients to open accounts remotely. They don’t have offices, and all the necessary checks are completed via users’ mobile phones.

Digital customer onboarding for regulated industries

Digital onboarding (as well as ordinary onboarding) in regulated fields presents additional challenges. Banks and other financial organizations take care not only of the comfort of their clients but also have to comply with legal requirements.

Financial institutions are often targeted by fraudsters and criminals aiming to perform illegal operations, such as laundering money. Every failure to identify illicit actions puts banks at risk, as governments punish organizations that don’t adhere to all the necessary checks. In addition, there are reputational risks, which can be at least as harmful.

Electronic onboarding is important because it allows regulated fields to comply more easily with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations. KYC and AML require organizations from regulated industries to conduct advanced identity verification. Checking who your clients are without using up-to-date tools is complicated and time-consuming. Manually processing the data also increases the chance of error, and thus penalties for non-compliance.

Digital onboarding allows you to verify new customers’ data automatically, for example, by scanning the ID and matching it with the governmental database. With most of the checking procedures being automated, digital onboarding simplifies the process of security checks, therefore improving compliance.

How does the digital customer onboarding process work?

The digital onboarding process is the same as the offline customer onboarding process, only all the steps have been transferred into the digital space.

The customer onboarding process typically looks like this:

Signing up

Identity verification

Product setup

Let’s have a closer look at each step.

1. Signing up

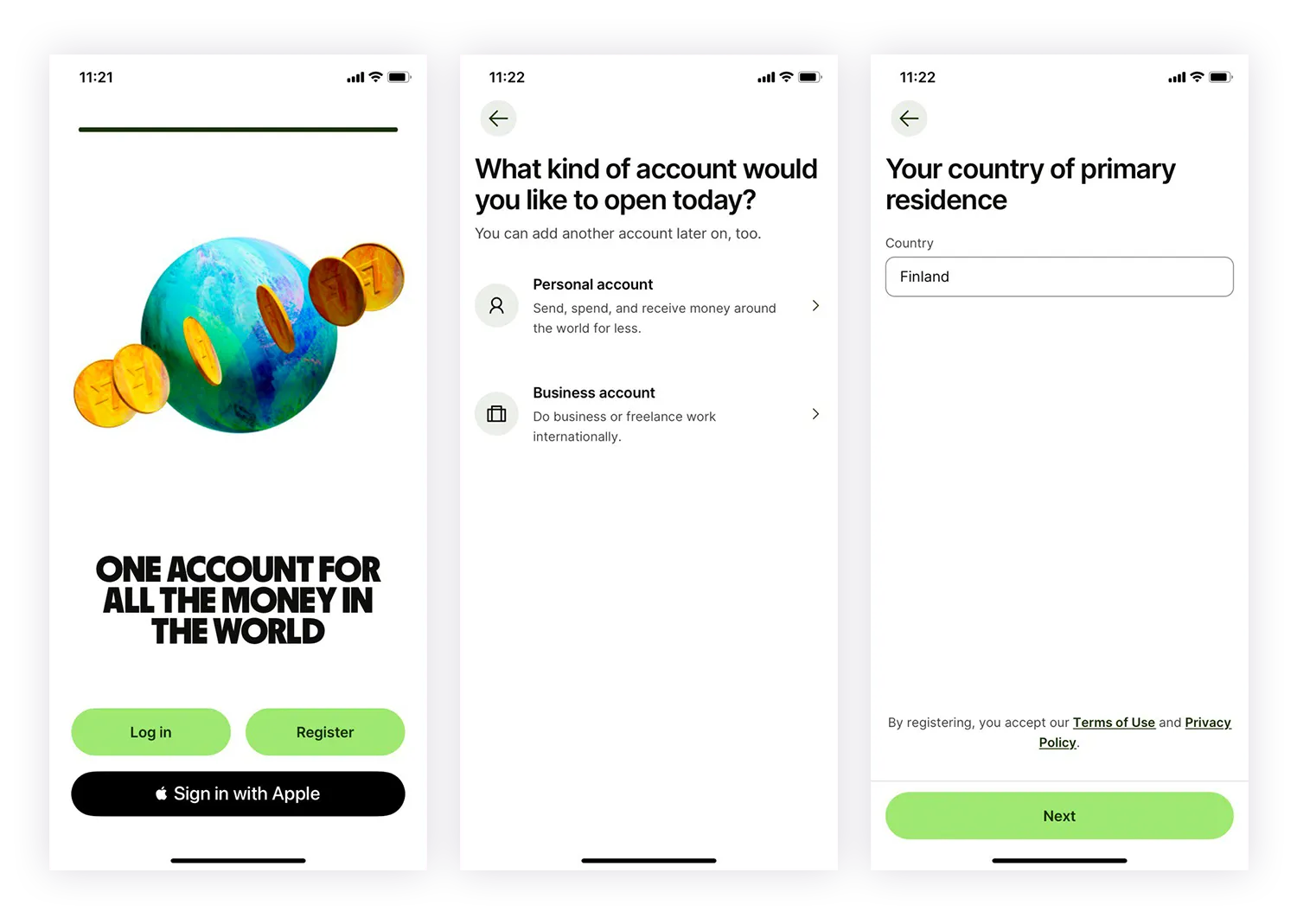

You need to collect the user’s data to create an account. Source: Wise

The first step to onboarding a new client is to create an account. Users typically only need to fill in their phone number or email—the rest of the information can be provided later. Setting up an account in an app takes only a few minutes instead of 30 to 60 minutes when visiting a traditional bank.

2. Identity verification

ID document verification is an integral part of identity verification. Image source: Coinbase, AppFuel.

Identity verification is an obligatory step for banks and other regulated industries, which must follow the KYC procedure. KYC requires institutions to identify the user's identity before providing services to them. Typically, it involves advanced means of verification, such as document authentication and biometric checks.

The exact remote identity verification workflow may differ depending on the business. Some services ask users to take a picture while holding up their passports. Some of them request separate document and portrait submissions, as it allows for a more thorough examination of both. Recently, many apps started to conduct liveness checks. They ask users to move their face closer/further away from the camera, rotate their head, etc., rather than providing a static selfie. This helps them ensure the data isn’t fake, but is being provided by a real living person.

For example, suppose you establish this workflow using Regula. In that case, the process might look like this:

| What users do | What happens behind the curtain |

|---|---|

|

|

The verification process can be even more serious for some services, including additional checks for AML and watchlists. For example, banks often have access to government-backed databases and a designated department that checks user profiles. Only if everything is in order is the account set up.

3. Product setup

Explaining how the product works is necessary to reduce product abandonment. Source: Tutorial flow for the ClearPay app by Marin Chitan

To introduce the user to the service, guided tutorials are often implemented. They help the user learn how to use the service and can be implemented in a textual or even video form. This step is very important. According to Wyzowl, a whopping 55% of people say they’ve abandoned a product because they didn't understand how to use it.

Benefits of digital onboarding

According to a study by PwC, digital onboarding can increase conversion rates by up to 50%. Organizations that choose not to implement it retain only about 40% of their potential customers. Clearly, onboarding customers from the comfort of their homes is an important step to improving your business processes and making customers happy.

There are many other benefits to using digital onboarding methods over traditional methods.

Client-centered approach

Digital onboarding allows you to be more client-oriented, helping customers onboard whenever and wherever is more comfortable for them. Being remote-first, it doesn’t require clients to come to your office and spend a lot of time, which many consider inconvenient. Plus, a touch-free workflow is an additional safety measure in the post-pandemic time.

Remote onboarding helps to boost customer satisfaction and increase their loyalty to the brand. Research by Salesforce Future of Financial Services shows that 78% of banking customers prefer to use a bank’s website or app to establish relationships with the bank. Moreover, digital onboarding can increase customer satisfaction by up to 20%.

Time and cost-effectiveness

On-site onboarding results in higher operational costs. Digital onboarding saves employees time filling in forms and verifying customer data. Since many administrative tasks are automated, you can reduce costs and use resources more efficiently. A study by consultancy firm Oliver Wyman indicates that it costs only $30 to onboard a new customer with the help of digital tools, as opposed to $150 in a traditional bank.

For example, the Swiss bank UBS worked with Regula to set up digital onboarding services. They report that the enrollment process is now fully automated, available 24/7, and takes just a few minutes with as little action from the customer as possible.

Improved accuracy

By using software to onboard new customers, you exclude the human factor, which is often responsible for many errors. Digital forms automatically flag incorrect responses so that issues can be resolved in a timely manner. Special ID document data parsing tools can correctly identify the document type and fetch all the necessary information to be consistent throughout your systems.

Increased security

Digital onboarding methods can provide greater security and confidentiality, often involving using secure electronic signatures and encryption technologies to protect client data. This can help to reduce the risk of fraud and data breaches, which can be costly and damaging to a business. IBM revealed that human error was the primary reason for 95% of cybersecurity breaches. Increased automation can reduce this risk factor.

DBS, a leading Singapore bank, auto-approves 98% of new customers. This has helped them to significantly reduce labor costs while remaining confident about their compliance rate.

Increased retention

Remote customer onboarding has been proven to attract customers and improve their retention. In the digital world, the electronic onboarding process can become a necessary competitive advantage in the market. Good customer experience is so important for customers that 35% responded that they switched their banking provider in search of a better user experience, according to the 2022 SalesForce Future of Financial Services report.

N26, a German mobile bank that operates in all European countries, has developed a 100% mobile account-opening process that can be completed in just a few minutes. Thanks to their user-friendly experience, the bank has been named “Best Bank in the World 2021.”

Conclusion

Digital onboarding makes the process of registering new customers easier and more efficient. By using online tools for filling in and verifying forms, you provide a better customer experience for your users. Digital onboarding helps to improve security and decrease costs, making it a necessary innovation for any business.

Finding a reliable partner to cover your digital onboarding is a big deal. You must thoroughly evaluate the technologies behind the offered solution and the track record of already implemented projects. For more than 30 years, we at Regula have served as an identity and document verification expert. We have helped dozens of companies, including global giants UBS and Pearson VUE, to innovate their digital onboarding. If you’re planning to set up or streamline digital onboarding in your organization, we’re here to help.