In recent years, many property transactions have moved online, and so have various related identity scams. A study commissioned by the American Land Title Association found that fraud and forgery consume 21% of title insurers’ loss and expense dollars, with an average claim of over $143,000—more than five times that of other claim types. In practice, this means that even a relatively small number of fraudulent deals can eat a huge share of title insurance claim money.

That’s why more and more companies that work in the real estate industry are adding document authentication and facial recognition with liveness detection. But in what contexts, exactly?

In this article, we will look into how identity verification actually works in real estate: where it’s deployed, what it does, and what benefits you can expect from it.

Subscribe to receive a bi-weekly blog digest from Regula

What does ID verification do for real estate?

In the context of real estate, the ID verification process confirms a person’s identity using government credentials and biometric evidence, and then ties that proof to a transaction (sale, lease, notarization) or an access event (tour, lobby, amenity). Additionally, the person’s records may be initially or regularly checked against sanctions/PEP screening databases, especially during large deals.

Latest government initiative

It’s not always up to companies to regulate how they approach ID verification for real estate transactions: sometimes governments take matters into their own hands, especially in the cases of purchases by non-residents. Saudi Arabia has updated its Law of Real Estate Ownership by Non-Saudis (July 2025) and is now building the digital mechanisms to let foreigners purchase property.

Draft executive rules indicate buyers would authenticate using Saudi national digital ID (via Nafath) and complete the transaction through the Ministry of Justice’s Najiz e-notary and documentation services. The final rules will set the exact identity-capture steps; for now, the government has confirmed inter-agency work to activate the digital-ID requirement ahead of the law taking effect.

Anti-money-laundering (AML) checks as part of IDV in real estate

One more procedure that accompanies identity proofing in almost every sale is anti-money-laundering checks for estate agents. Buyers and sellers not only want to know who they’re dealing with, but also whether that person is even allowed to perform the transaction. Luckily, the same ID document and selfie steps feed directly into answering those questions.

Once identity is verified, estate agents are able to complete the rest of the AML process:

Customer Due Diligence (CDD): Runs within the same flow of digital identity verification in real estate, using document authentication and selfie with active liveness.

KYB/Beneficial ownership (for entities): The structure and each beneficial owner’s ID are verified according to the same standard; authority evidence is kept for the signer.

Screening: Sanctions/PEP/adverse media checks are performed at onboarding, and again right before wiring instructions or deed execution.

Source of funds: The payment route is matched to the verified party (statements, payroll, prior sale evidence); account names should align with the ID file.

Records: Chip validation results are stored, as well as barcode/MRZ vs. print parity, liveness mode, face-match scores, and screening logs.

In the end, the same identity verification steps that support AML checks for estate agents also provide support teams with evidence when disputes arise.

Use cases of digital identity verification in real estate

The IDV process itself doesn’t change drastically across various use cases, of which there are a few:

Title and settlement (mostly in the US and Canada)

Safe Harbour conveyancing (in the UK)

Identity-gated self-guided tours

Guest ID at booking (for short-term rentals)

Applicant ID bound to screening (for tenant screening)

Title and settlement

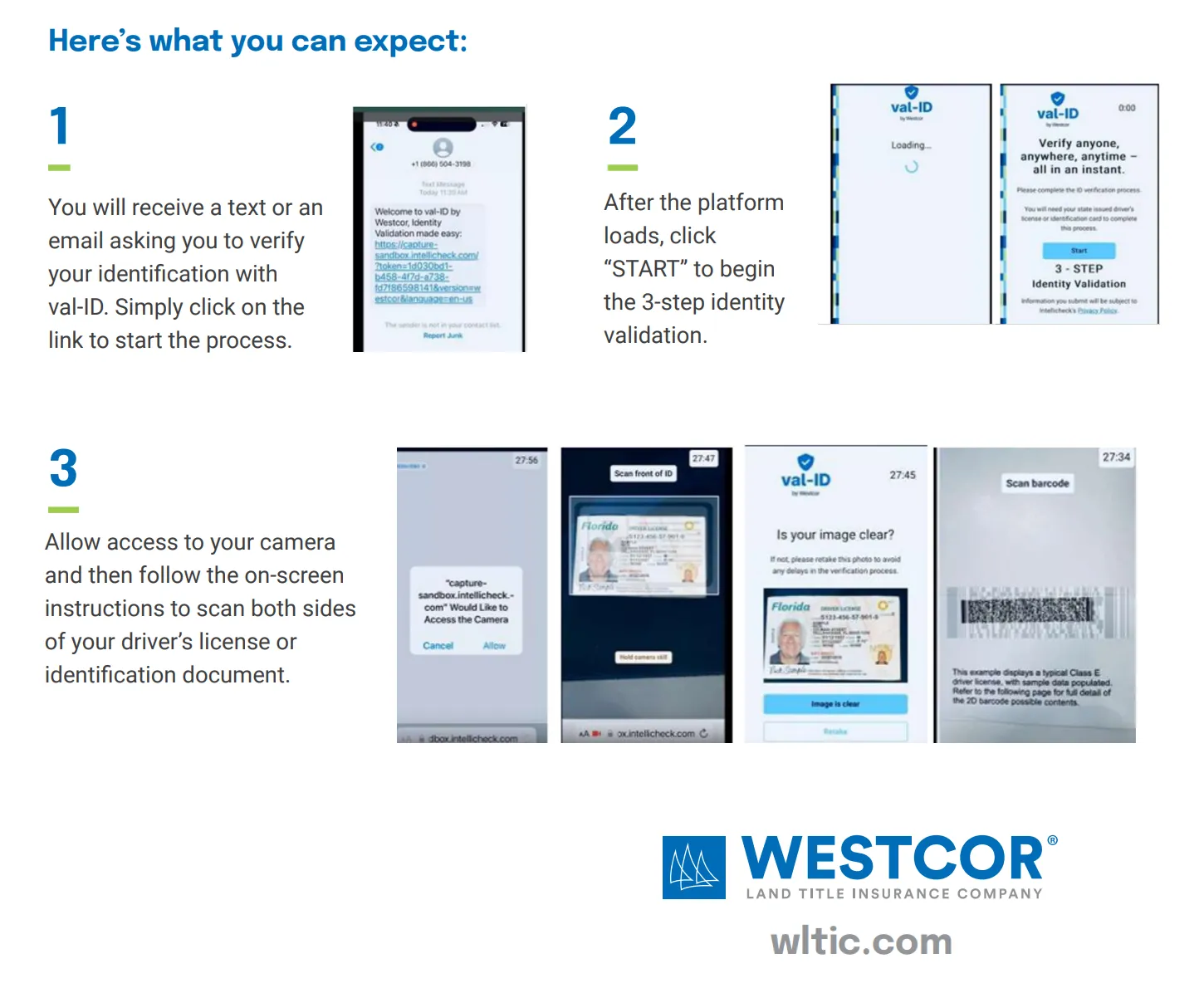

In 2024, Westcor, a US title insurance company, launched an ID verification service to verify sellers/borrowers via email/SMS links. Their stated goal is to cut the risk of seller impersonation and speed up the resolution of mismatches well ahead of closing day.

Screenshot of Westcore's manual.

Their system (called val-ID) runs as follows:

The closer sends a one-time link by SMS/email.

The party scans their ID; the system parses the barcode/MRZ and reads the chip if present.

A guided selfie with active liveness is captured.

The platform compares the live capture to the chip portrait/printed photo.

A pass/hold with reason codes lands in the closer’s dashboard.

Artifacts are stored for underwriter review.

Likewise, another title insurance company, Doma, rolled out identity validation to its independent agents and approved attorneys as well. The flow is virtually the same: document authentication, data consistency checks, and facial verification act as key parts.

Conveyancing

In England and Wales, HM Land Registry (HMLR) has built digital identity checks into conveyancing and offers Safe Harbour if those checks are followed correctly. Being in Safe Harbour gives assurances, as HMLR will not bring a recourse claim against you for ID verification failures in a registration application tied to fraud.

To enjoy this benefit, conveyancers must perform:

Chip-first evidence collection: Read the NFC chip on an ePassport or eID, validate the issuer’s digital signatures, and extract the embedded portrait; a photo or MRZ alone doesn’t satisfy the standard.

Face-to-document binding: Run an active liveness selfie and compare it to the chip portrait using a matcher with published benchmark results and tight error limits.

More technical details can be found in Practice Guide 81 and Practice Guide 82.

Self-tours

We’re increasingly seeing a combination of ID document verification and facial scanning for unattended tours, which became popular during the COVID-19 pandemic. Without an agent or a landlord present, it has become critical that visitors are verified to keep the property and other potential tenants safe.

New practices = new scams

Back in 2020, when self-touring was still a new concept, a fraudster posing as the landlord texted a visitor a functional lockbox code to access a property near Kansas City’s 39th Street area. After the tour, they asked for $1,600 via a bitcoin machine at a nearby gas station and promised to email the lease afterward. The visitor complied only to discover that they had been scammed.

This worked because the fraudster was able to acquire a one-time lockbox code the same way a normal prospect would: by signing up for a self-guided tour with basic details—and little verification.

What’s more, facial recognition is often used not only for tours, but also for registration on rental platforms. For example, both Rently and Invitation Homes ask for face scans up front: users upload a photo of their ID, and then take guided selfies as the system prompts them to turn their head to the left and right (a typical example of active liveness detection).

Short-term rentals

Similarly, websites like Airbnb require all primary hosts, new co-hosts, and booking guests to verify their identity using a government-issued ID. Depending on the region, some users may also be able to choose facial recognition as part of completing identity verification.

Screenshot of Airbnb's ID verification page.

Tenant screening

A number of rental property management websites offer an advanced tenant screening feature, which, among other things, involves identity verification. For example, TurboTenant performs both government-ID checks and selfie biometrics checks combined with full background, credit, and eviction checks.

Screenshot of TurboTenant's tenant screening service page

Practical benefits of ID verification for real estate

Real estate companies and agents, as well as potential buyers, can benefit from robust ID verification in the following ways:

Fraud reduction

Teams that implement ID verification for real estate transactions can easily catch seller impersonation, swapped photos, and barcode/MRZ mismatches while there’s still time to pull the plug on the deal. An RFID chip scan plus barcode/MRZ parity testing is hard to spoof, while a selfie with active liveness adds an extra layer of security. Attempts to share a “photo of an ID on a screen” simply don’t survive document-liveness video or face checks.

Cleaner cycle time

Another win is cycle time: catching identity defects days ahead avoids last-minute rescheduling, re-papering, or rescission. Many remote notarization platforms package the ID proof (credential analysis + selfie/liveness) with the recorded session, so that post-closing teams have evidence without hunting through email threads.

Clear footing with regulators

Rules in several markets now call for stronger proof of identity during sales and recording. Good workflows for digital identity verification in real estate produce the evidence that examiners and carriers want to see. Some evidence that is good to retain for posterity includes chip certificate validation, barcode/MRZ vs. print parity, liveness checks, face-match scores, timestamps, and identity details for reportable cash deals.

Smoother customer support

When something goes wrong, proof can end arguments very quickly. A verified identity tied to the key moments of a deal saves hours of back-and-forth. When a tour, application, signature, or recording is backed by artifacted identity proof (chip, liveness, etc., as mentioned above), customer support has factual data to operate with.

The end result is fewer chargebacks and complaint tickets, and less time spent rebuilding timelines after the fact.

Making real estate transactions secure with Regula

Identity and AML checks for real estate agents happen at virtually every stage of any type of deal: sellers proving themselves to title companies, renters getting facially verified before a tour or lease, landlords screening tenants, and more. As we look to the near future, we may also see increased use of reusable digital IDs or wallets, as already seen in countries like Saudi Arabia.

For identity verification to be robust, compliant, and user-friendly, real estate companies need to put their trust in reliable solutions for document and biometric checks. Solutions like Regula Document Reader SDK and Regula Face SDK are strong examples: they easily integrate with existing mobile or web applications and perform multiple advanced ID verification checks for real estate.

Regula Document Reader SDK instantly processes images of government-issued IDs, verifies their real presence, and authenticates them to move the deal forward efficiently. Meanwhile, Regula Face SDK conducts immediate facial recognition and prevents fraudulent presentation attacks (use of static face images, printed photos, video replays, video injections, masks, etc.) at any stage of any deal.