What to expect in this blog

How do gambling and lottery platforms make sure players are who they say they are?

This article explains the essentials of identity verification in the industry, discusses common verification techniques and their challenges, and provides real-life examples of how platforms are successfully using advanced ID tools.

Online gambling and lotteries comprise a massive and lucrative industry, but it’s also an industry with strict regulatory oversight and a high risk of fraud and money laundering exposure. Operators are under increasing pressure from national and international bodies to comply with a range of guidelines, and not everyone is succeeding: in 2024, regulators fined gambling companies more than $184 million globally.

That’s why more and more businesses in the industry are adopting robust ID verification solutions to protect themselves and their customers. In this article, we look into why identity verification in online gambling and lotteries is so important today, and how it’s being implemented.

Subscribe to receive a bi-weekly blog digest from Regula

What makes ID verification so important for online gambling and lotteries?

This may be the wrong question to start with, since some form of identity verification is simply mandatory for licensed online gambling or lottery platforms in many jurisdictions. For example, UK law now mandates that all online gambling businesses verify a customer’s age and identity before the customer can deposit funds or place a bet. What’s more, they are forbidden from delaying ID checks until a withdrawal—a practice that previously allowed some fake accounts to slip through.

There are three main reasons to perform ID checks for gamblers:

They prevent underage gambling: Operators are legally required to confirm that each customer is above the minimum gambling age (18, or 21 in some jurisdictions). They must check each new player’s date of birth against identity documents or databases to make sure no minors can place bets.

They make platforms compliant with KYC and AML rules: These regulations oblige operators to confirm each customer’s identity and assess their risk before allowing gambling. This helps prevent criminals from using gambling sites for money laundering or fraud. Verifying identity (e.g., name, address, and date of birth) is the first step in performing due diligence on players.

They enable self-exclusion on demand: Many jurisdictions also maintain self-exclusion programs for problem gamblers (e.g., GamStop in the UK, or CRUKS in the Netherlands). Casinos and lotteries must verify a player’s identity to check if they have self-excluded or are banned, and block them from registering if this is the case.

Just like gaming ID verification, this process protects both the players and the business. It shuts out minors and self-excluded individuals from the platform, prevents fraud, and keeps the operator on the right side of the law.

How casinos and lotteries employ identity verification

Identity verification in online gambling and lotteries is a mix of technological solutions: the process typically combines several layers of checks to maximize accuracy and catch fraud. Here are the main methods in use:

ID document scanning and verification

Online platforms integrate document verification SDKs that guide the user to capture a clear image of their ID (e.g., a passport, driver’s license, or national ID card) with their mobile device. The software then extracts the data and performs a series of authenticity checks on the document. These checks include validating the MRZ or PDF417 barcode against the printed text, inspecting the document’s visual security features against a template database, and detecting any tampering.

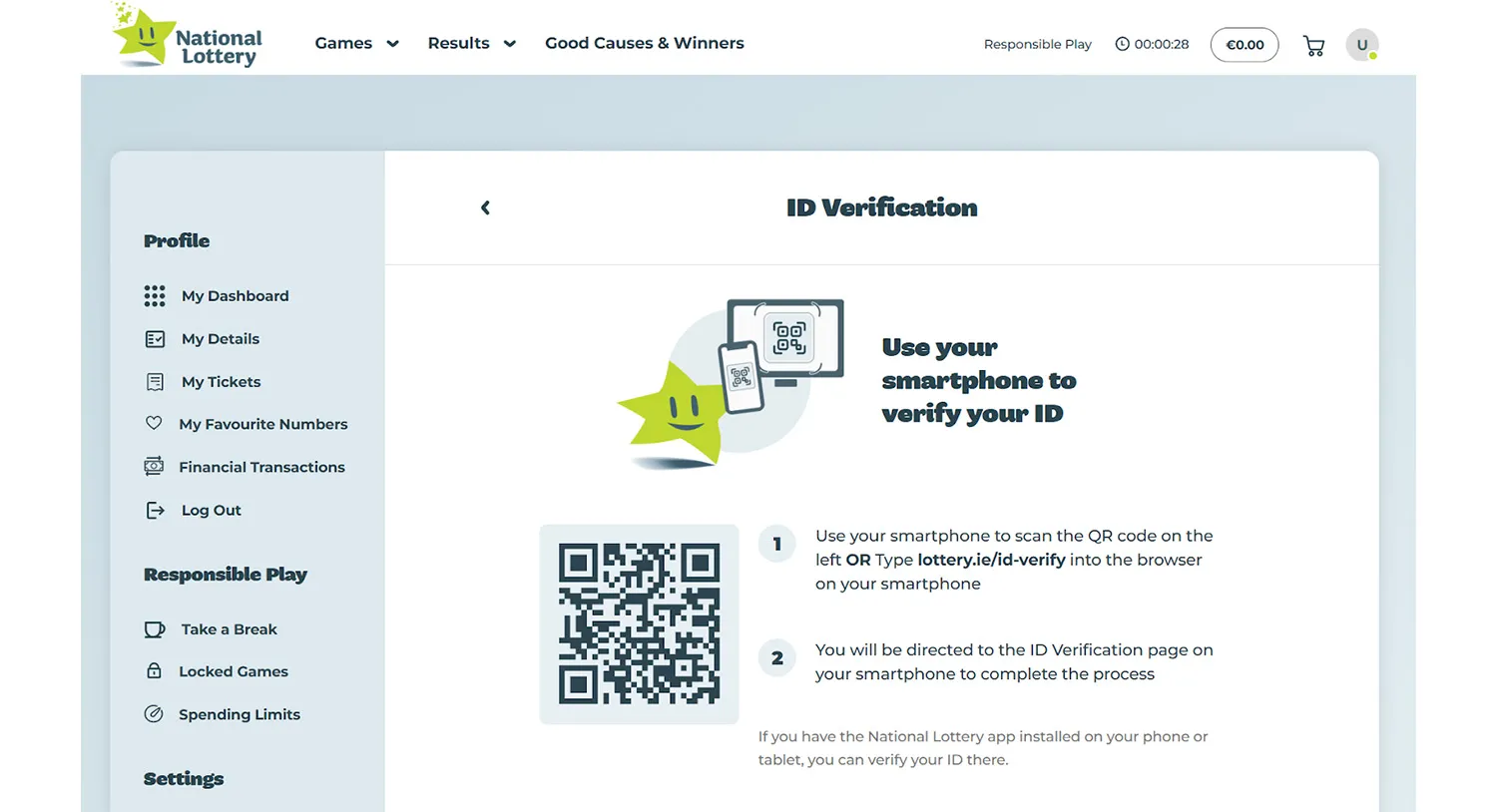

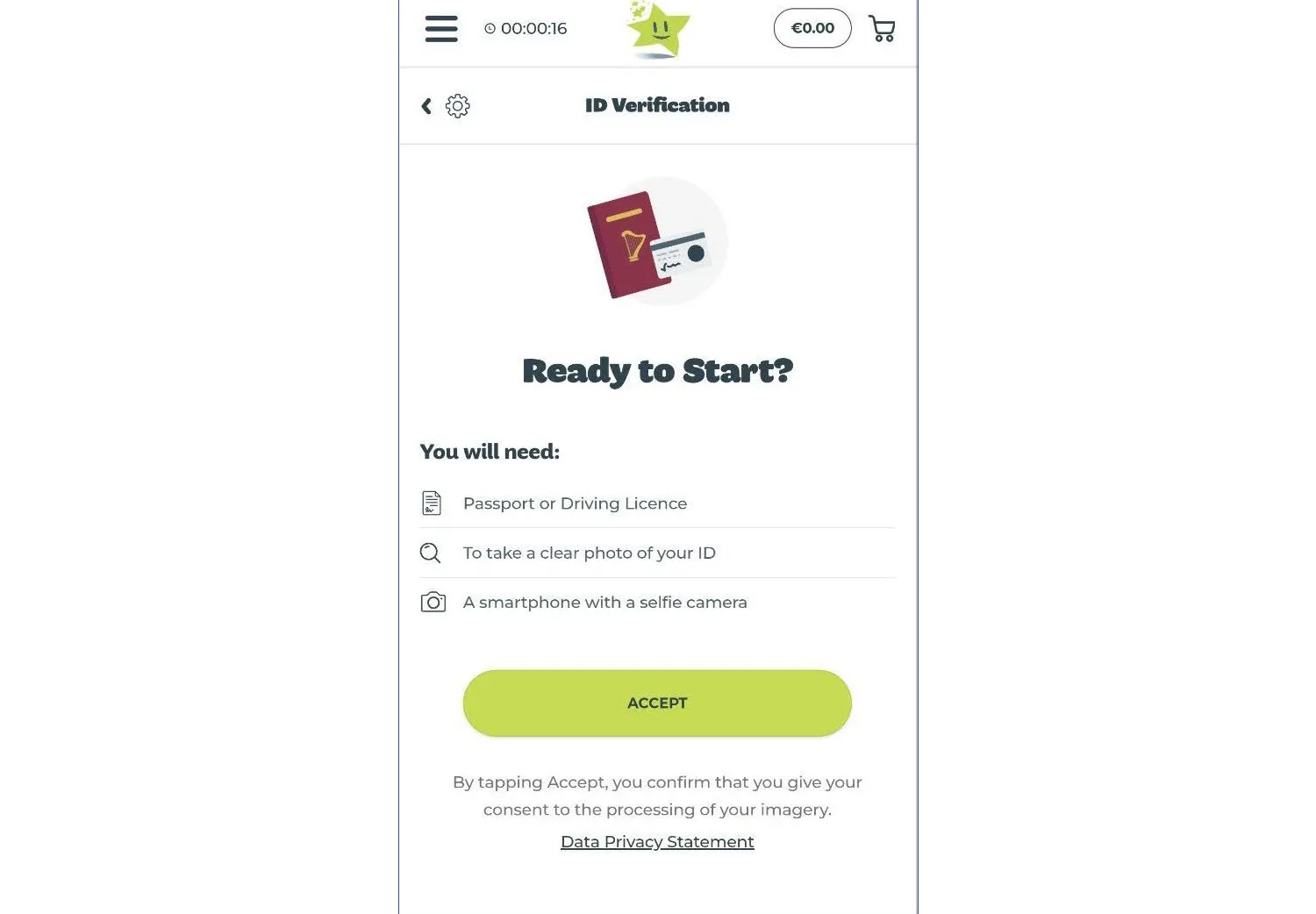

Ireland’s National Lottery immediately redirects a new customer to ID verification via smartphone before any operations can be performed.

However, not all ID verification procedures are created equal: while some are comprehensive, others are rather simplistic and aim to verify only one parameter. For example, in Texas, USA, a recent initiative deployed age verification in self-service lottery kiosks. To buy a ticket from a vending machine, a player must scan their driver’s license’s 2D barcode, which is then verified via the state DMV database to make sure the customer is over 18.

According to this Texas Lottery flyer, no data from the barcode is stored: it is only required for one-time age verification.

It’s worth noting that some countries have even pioneered the use of national digital IDs to simplify the process. For instance, Sweden’s BankID system allows users to verify their identity and age via their BankID credentials, which are issued by banks and tied to government ID data. Swedish online casinos are known to use BankID for player login and onboarding, which not only makes registration extremely fast, but also secure, since BankID is highly trusted.

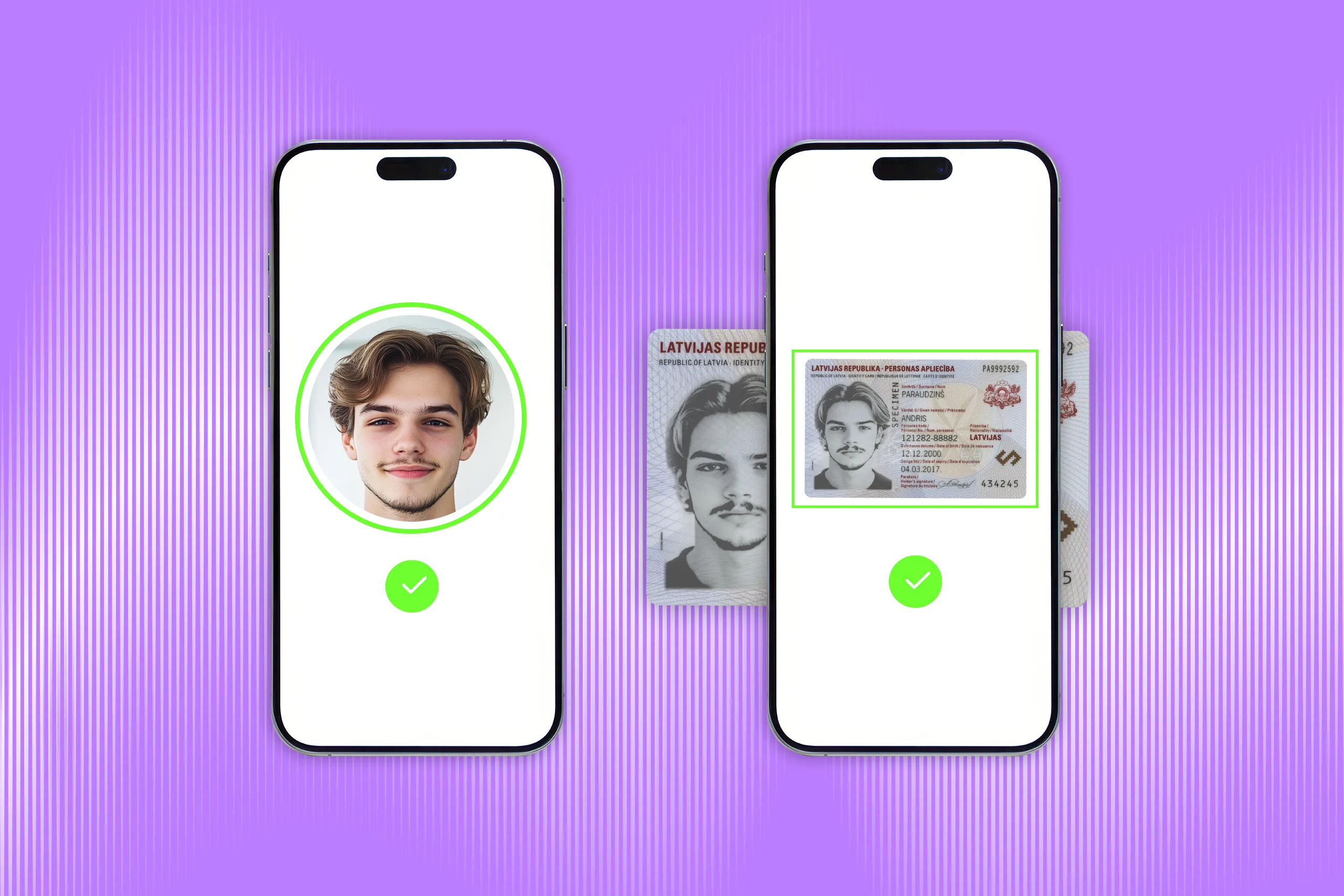

Biometric selfie comparison

Because a stolen ID will pass the above checks, many platforms add a biometric step to confirm that the person creating the account is actually the holder. Usually, this means asking the user to take a live selfie and then using facial recognition to compare that face to the photo on the identity document. If the face doesn’t match, the registration is rejected regardless of the ID document’s status.

To participate in Ireland’s National Lottery, a player not only needs to present their ID, but also take a selfie.

Equally important as face matching is liveness detection—making sure the user’s selfie is taken from a live person and not a photo of someone else. Liveness detection can be active (when a system asks the user to perform an action) or passive (when a system detects subtle signs of life from a single frame, like skin texture and depth). While active liveness detection is arguably more secure, it also feels more intrusive for users; that’s why the passive alternative is more commonly used.

A side note: lottery ticket verification

Lottery tickets are considered bearer instruments, which means that whoever holds an unsigned winning ticket can claim the prize. And while the operator cannot really be certain if the ticket has been stolen, they can at least make sure it is not fake.

That’s why many operators perform lottery ticket verification when handing out prizes: they scan the ticket’s barcode or QR code. Each ticket’s code corresponds to a record in the lottery’s central computer system and essentially confirms that the ticket was legitimately sold, and it knows whether that ticket’s numbers are a winner.

In addition, some systems now integrate age estimation based on the selfie image. Software like Regula Face SDK can use facial features to estimate whether the user’s age falls within a certain threshold. It’s not a standalone method for age verification by any means, but it can still act as one more mechanism to detect underage users.

Various database checks

Once the player’s identity is confirmed, operators will also cross-check the profile against one or multiple databases, including:

Self-exclusion lists: As previously mentioned, the verified identity is checked against a national self-exclusion registry or the operator’s own list of barred players. If there’s a match, the account is blocked or further investigated.

Fraud databases: Some companies also maintain internal databases of known fraudsters (e.g., people previously caught cheating) and high-risk individuals. They can compare new sign-ups to these records and prevent repeat offenses.

Sanctions and PEP screening: Since gambling companies are subject to AML rules, they sometimes screen new customers against international sanctions lists and politically exposed persons (PEP) databases. If someone is a known criminal or a high-profile political figure, the operator may need to conduct enhanced due diligence or even refuse the customer to avoid facilitating illicit activity.

Additionally, operators conduct AML-related reviews of customer profiles. These checks are part of standard compliance procedures: aligning the identity data with the declared source of funds, and flagging any unusual patterns.

Common challenges in verifying player identities

Identity fraud

This is always the biggest challenge for any organization, as high-quality counterfeit driver’s licenses or passports are widely available on the black market. What’s more, attackers may also use stolen personal data to create synthetic identities or hack existing accounts.

The advanced ID verification technologies mentioned above are capable of reliably tackling these threats. For example, Switzerland’s Grand Casino Luzern (more specifically, its online gambling platform mycasino) has vastly improved their verification accuracy and cut down onboarding time with Regula Document Reader SDK. Prior to this implementation, they relied on manual reviews, which were rather slow and error-prone.

Some other ways of bypassing identity verification for gambling involve not replacing the document, but the face. In such cases, operators deal with presentation attacks: photos, masks, screen displays, or even AI-powered deepfakes. However, solutions like Regula Face SDK can thwart such threats with precise facial recognition and liveness detection.

Balancing security with user experience

Sometimes, identity verification for gambling can be too robust, which spoils the user experience during onboarding. A complicated verification process adds friction for new players: asking someone to not only scan, but also tilt their documents, smile at the camera, and/or wait for approval can lead to drop-offs—unless the procedure is implemented smoothly. At the same time, businesses don’t want to risk fraud or non-compliance.

That’s why ID verification needs to be perfectly balanced so it’s as secure and user-friendly as possible. The industry’s trend is to adopt risk-based verification, where low-risk customers can pass with a quick database check or ID scan, whereas higher-risk applicants trigger deeper checks.

Staying compliant with regulations

Online gambling is regulated differently in every jurisdiction, and operators that serve international customers need to deal with a patchwork of rules. Age limits, accepted ID types, data privacy laws, and KYC procedures can vary widely by country or state.

Here are some examples:

The minimum gambling age is 18 in most of Europe, but 21 in many US states (and even 20 for casinos in some countries like Japan).

Some regulators allow a grace period for verification, while others (like the UK) demand immediate verification upon signup.

Certain markets require specific local methods—in the Netherlands, a licensed online casino must perform multiple checks: verifying the user’s identity details via the bank-linked iDIN system, confirming that their bank account (IBAN) matches their name, scanning their ID document, and querying the CRUKS exclusion database—all before allowing play to begin.

If these details are not taken into account, operators may suffer from financial and reputational damage. A recent case in point was Bet365, a popular online gambling service in the UK, which had to pay £582,120 (appr. $735,442) for anti-money laundering and social responsibility failures. Among the other violations, Bet365 was fined for failing to undertake independent gaming identity verification checks, instead relying on customers’ annual self-verification of KYC data.

How Regula protects both players and the gambling industry

Robust identity verification keeps online gambling and lotteries fair and safe for all parties, and free of crime. The main challenge is to implement it in a way that doesn’t drive away customers and is compliant with all relevant requirements.

This can be achieved with the help of solutions like Regula Document Reader SDK and Regula Face SDK, which can easily integrate with your existing mobile or web applications.

Regula Document Reader SDK processes images of documents and verifies their real presence (liveness). The software automatically identifies the document type, extracts all the necessary information, cross-validates it, and confirms whether the document is genuine with a comprehensive set of authenticity checks. Regula Document Reader SDK supports all major dynamic security features, including holograms, optically variable inks (OVIs), multiple laser images (MLIs), and, most recently, Dynaprint®.

At the same time, Regula Face SDK conducts instant facial recognition and prevents fraudulent presentation attacks such as the use of static face images, printed photos, video replays, video injections, or masks. It can also perform age estimation, informing operators on whether the user’s age falls within a certain threshold. When combined with document verification, the pair offers a reliable age assurance solution by validating the user’s age both from their ID and through biometric analysis.

In practical terms, Regula’s software can be integrated as the key part of your onboarding process. Eager to learn more? Book a call, and we will help you make your identity verification compliant, secure, and customer-centric.