Despite the rise of digital IDs and biometrics, the Social Security Number (SSN) remains a critical part of identity verification (IDV) in the US. This is a core piece of Personally Identifiable Information (PII) used across Government, Healthcare, and Banking.

But while an SSN is a unique identifier for every US citizen, as well as permanent and temporary residents, it isn’t well protected. That makes it a prime target for identity theft—especially during events like tax season, when scammers are highly active.

In this article, we’ll explore how SSN verification works, where it fits into existing IDV processes, and what businesses that rely on it should watch out for.

The anatomy of an SSN: What data does it include?

Issued by the Social Security Administration (SSA), an SSN can be obtained by US citizens or eligible residents by applying for a Social Security card. This card also contains the holder’s name and signature. In most cases, the SSN is a lifetime asset for its bearer.

Historically, the SSN was issued to track individuals, but today it functions as a national identification number for taxation and other official purposes.

There are three types of Social Security cards:

For citizens and permanent residents

For temporary residents eligible to work in the country (marked “VALID FOR WORK ONLY WITH DHS AUTHORIZATION”)

For other groups (marked “NOT VALID FOR EMPLOYMENT”)

The SSN is a nine-digit number. The first three digits are the area number, the next two are the group number, and the last four are the serial number. However, this classification is largely symbolic today.

In 2011, the SSA introduced SSN randomization to better protect the integrity of the numbers and extend their longevity nationwide. Particularly, area numbers no longer reflect the state of issuance, and previously unused area numbers became assignable—except for 000, 666, and 900–999.

This means that an SSN is now a randomized sequence of digits, unlike other structured numerical identifiers found in documents, such as national ID numbers or machine-readable zone (MRZ) codes. This is where the challenges for SSN validation lie.

Subscribe to receive a bi-weekly blog digest from Regula

SSN validation: Three methods in use

The SSA offers two legal options for companies to validate SSNs.

First, the Social Security Number Verification Service (SSNVS) is a free online tool that matches the SSN holder’s name and SSN with the SSA’s database. This option is primarily for employers who want to verify their new employees’ SSNs for wage reporting purposes or employment eligibility.

Second, businesses can use the Consent Based Social Security Number Verification (CBSV) service—a paid option that performs quick, automated checks and can handle large data batches. Importantly, the SSN holder’s written consent is required.

In addition to SSA-provided methods, third-party SSN validation services are available through credit reporting agencies or IDV vendors.

There are a wide variety of free “SSN checkers” on the web, which can spot formatting errors and invalid ranges—but can’t verify if an SSN belongs to a real person.

Therefore, SSN validation is about cross-referencing data with official records. However, while this procedure confirms the number’s validity, it doesn’t confirm its holder’s identity. This benefits scammers who widely exploit SSNs in their fraudulent tactics.

What are examples of SSN-related fraud?

Before we dive in, it’s important to note one more time that SSNs don’t confirm the holder’s identity, and lack built-in fraud protection—unlike MRZ codes, which include check digits that IDV software can automatically validate.

Plus, SSNs are widely exposed in data breaches and on the dark web, making them almost as easy to find as selfies on social media—something fraudsters actively take advantage of.

SSA scam

The fact that this type of fraud exists at all shows just how serious the threat is. By impersonating Social Security Administration (SSA) workers, scammers may contact victims by phone, email, letter, or even through social media, claiming there’s a “problem” or a “benefit” related to their account. They create pressure to act quickly, often instructing the victim to pay in a specific way. This tactic lets them steal personal or card details, which can then be used in future scams.

How to stay protected from SSA scams

The SSA is well aware of the growing number of scams targeting SSN holders. To help the public stay safe, the agency regularly publishes helpful resources—including videos, step-by-step guides, and advice for victims—on its official website. A dedicated section outlines common scam tactics and what to do if you’ve been targeted.

Identity theft

In the US, SSNs remain one of the most critical identifiers that enable scammers to impersonate someone in various scenarios—from claiming tax refunds and government benefits to submitting fake job applications and making online purchases.

For example, scammers may send emails posing as a victim’s bank, claiming their card was used for a suspicious transaction and asking them to confirm their SSN. Once the victim enters their number, it can quickly lead to identity theft and financial loss. Unfortunately, once stolen, an identity can be used in many other attacks targeting other companies.

Synthetic identity fraud

Stolen SSNs are often used to create synthetic identities—a Frankenstein-like “person” made from a mix of real and fake data. Combining a legitimate SSN with a real address or name makes the fabricated identity more convincing, while the photo and date of birth can be generated using AI. This makes synthetic identity fraud hard to detect in systems where a valid SSN is a core identifier. These made-up personas can be used for a range of fraudulent activities—from loan scams to money laundering.

How to strengthen SSN validation with modern methods

Since the SSN card is not a reliable identifier on its own, it must be supported by additional verification checks to confirm the user’s identity. The most important ones are document and biometric verification, which offer more detailed information about the user.

Let’s take a closer look at how these methods work in the US.

Document verification

Verifying users remotely by checking other government-issued IDs, such as passports or driver’s licenses, is a reliable method. It involves many steps, including recognizing and cross-validating data from the visual inspection zone (VIZ), MRZ, and barcodes. It also includes checking dynamic security features such as holograms, Optically Variable Ink (OVI) elements, and Multi Laser Images (MLIs). Despite the complexity, when properly set up, the entire verification process takes just seconds for the user.

In countries where biometric IDs with electronic chips, such as passports, are widely used, businesses often build their entire IDV process around them. With NFC verification technology, it’s easy to check and validate electronic IDs and extract all the necessary details about the user.

Success story: Discover how UBS streamlines customer onboarding with e-passports.

The US represents a unique case. While there are various types of IDs—from passports to voter cards—non-biometric driver’s licenses are most commonly used for verification in the country.

What makes it more complex is that each US state issues its own license, each with a different design, layout, and even set of personal details presented. To bring more consistency, the Real ID Act deadline entered into force in May 2025. Introduced back in 2005, the document sets standards for issuing driver’s licenses and identification cards and prohibits the use of non-compliant IDs for official purposes, such as boarding domestic flights, after May 7, 2025.

The key visual difference between compliant and non-compliant REAL ID licenses is the yellow star emblem. On Idaho’s 2023 license, it appears in the top right corner.

Due to these variations, a vast number of US driver’s license templates are needed for remote IDV. Regula’s database now includes over 16,000 ID templates from 254 countries and territories, with 2,978 US document templates, including 739 Real ID-compliant IDs.

Beyond detecting fraud and confirming validity, document verification also enables automatic data entry. This not only streamlines onboarding but also reduces the risk of human error.

Biometric verification

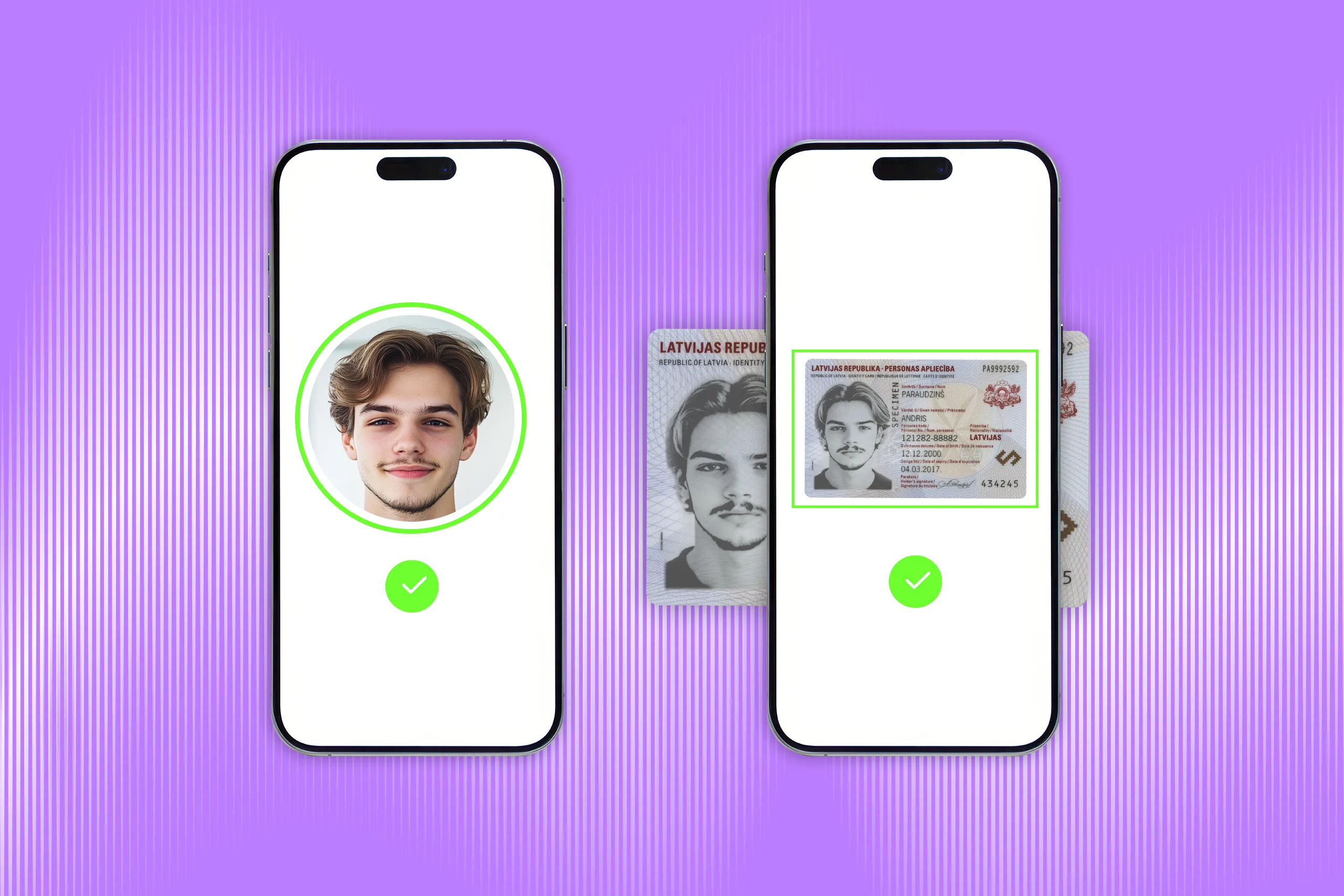

The next essential step to strengthen SSN validation is adding biometric checks to the process. This involves capturing a selfie from the user and matching it against a known image.

Since the SSN card doesn’t include a photo, the main portrait from an official ID—such as a driver’s license—can serve as the reference image. Notably, many US driver’s licenses also include ghost photos, which can be used during the document verification step to enhance accuracy.

Biometric verification also requires liveness detection to confirm that the selfie is taken by a real person and there are no fraudulent tricks like printed photos or deepfake presentation attacks.

When successful, biometric verification completes a robust, fraud-resistant IDV flow.

Final thoughts

The main weakness of SSN validation lies in the limited information the number provides on its own. To confirm there's a real person behind the number, you need more data—pieces that fit together like a jigsaw puzzle to reveal the full picture.

Starting with just a name and SSN, you can build a complete profile by following this chain:

| Identifier | Where to obtain | How to validate |

|---|---|---|

| Social security number, name | Social security card | Official databases |

| Name, address, photo | Government-issued ID | Document authentication software |

| Photo | Selfie | Biometric verification software |

Although SSNs are far from perfect, they’re still widely used. But to stay ahead of fraud and avoid financial losses, SSN validation must be just one layer in a multi-factor IDV strategy.

Regula can help you build a secure and streamlined process with advanced tools:

Document Reader SDK ensures robust verification of US IDs and documents from around the world. It performs all critical authenticity checks on-premises, protecting user data and supporting smooth implementation.

Face SDK verifies that the selfie is genuine—not a deepfake or on-screen image—and matches it with a reference photo. This iBeta-tested solution works in any lighting conditions and completes checks within seconds.

Book a call to explore how Regula can support your IDV needs.