Fintech companies combine financial services with modern technologies by offering customers remote banking and payments available from anywhere and at any time. This industry is showing steady growth, as such services are a convenient way for people around the world to manage their money. According to Statista, the Digital Payments market will gain 4.8 billion users by 2028.

Still, big money always carries big risks. In particular, the booming (and, conveniently, fully online) Fintech market looks attractive for fraudsters. On average, companies from the industry lose about $51 million per year to fraud.

For this reason, robust identity verification (IDV) has become a critical asset for mobile banking applications, digital payment services, crypto lending, and trading platforms.

In this blog post, we’ll zoom in on the peculiarities of Fintech ID verification, as well as the mandatory features effective IDV solutions must include.

IDV-related challenges all Fintech companies face

The core mission of any IDV solution is to ensure that each customer is the individual they claim to be. However, the way this process is executed depends on the industry in general, and the expectations of the company in particular.

Identity verification in Fintech implies high technology dependency and no in-person interactions. Here are four major difficulties Fintech companies have to cope with when implementing IDV software:

1. A variety of regulations

All Fintech companies are required to comply with anti-money laundering (AML) policies, including Know Your Customer (KYC) legislation, as well as detection of Politically Exposed Persons (PEPs). Usually, this means an organization must verify each user’s identity one way or another. The difficult part is that there is no universal list of requirements fitting every jurisdiction on the market.

Each country has its own set of requirements for companies occupying a specific industry niche. In particular, KYC for Crypto providers may differ significantly from rules for payment services.

For instance, the verification process on Binance, a cryptocurrency exchange service, includes the collection of personal details, such as nationality, full name, and date of birth, home address, ID verification, and selfie submission, with an obligatory active liveness check both for selfie and ID. The full verification procedure can take about 48 hours or more.

Revolut, one of the most popular neobanks in the EU, onboards new clients through video selfie and ID submission. The company usually verifies new customers within about 24 hours.

2. Intense fraudulent activity

Fintech companies often don’t have any physical offices where customers from high-risk groups can be verified. Since all the processes are handled digitally, additional anti-fraud protection is required for these businesses.

Fraudsters attempt to exploit every possible vulnerability in order to get onto the list of “verified clients.” This typically gives them access to financial assets, such as loans they will never return, and sets the stage for more sophisticated scams of a criminal nature, for example, money laundering and terrorism financing.

According to a Regula study, the majority of Fintech companies perceive synthetic identity fraud (87%), deepfake voice fraud (80%), and video deepfakes (76%) to be real threats, with most expecting all of these threats to grow in the future.

3. Reliance on unauthorized devices during verification

Another problem associated with fraud is that customers of Fintech companies typically use personal devices to complete identity verification. As third-party elements of the chain, their smartphones, laptops, and PCs can be a weapon in the hands of cybercriminals.

The results of the verification session can be fraudulently modified on the customer’s end. For example, fraudsters can alter the result of a selfie check from “failed” to “passed.”

For this reason, companies shouldn’t trust the data obtained from a user’s device. Instead, they should adopt the zero trust to mobile framework, which employs server-side reverification for better secur

4. Poor customer experience as a threat

As players in an online-only industry, Fintech businesses have to cope with another specific challenge.

Customers choose digital financial services because they are meant to be the more convenient way to manage funds—a feature that Fintech design agencies prioritize over many others. A Fintech identity verification procedure that’s too complicated could be a hurdle some clients won’t jump over. This may affect conversions and lead to higher abandonment rates.

For instance, digital nomads surveyed by Regula noted the following frustrating IDV aspects:

Limited document types accepted by apps (35%)

Poorly designed user interfaces and complex navigation (28%)

Lack of localization (16%)

Also, some Fintech companies provide only one channel for onboarding (such as through their website), so it’s especially critical to make this process seamless for customers.

Subscribe to receive a bi-weekly blog digest from Regula

What features are a must for a Fintech identity verification solution?

Fintech companies are at the crossroads of traditional banking and financial institutions and cutting-edge technologies. This requires them to keep a balance between smooth user experience—24/7 availability, online transactions, and cross-platform access—and security defenses to reduce risks, including fraud and identity theft.

Since customer onboarding is the first touch point between companies and clients, IDV software as a key component of a KYC solution should stay consistent with this approach.

.webp)

The key components of identity verification for Fintech companies.

Here are the critical characteristics of an IDV solution tailored to the Fintech industry:

Compliant with local requirements

Fraud resistant

Customer-centric

Technically sustainable

Compliant with local requirements

KYC compliance is a crucial part of the deal when it comes to strictly regulated niches. If an IDV vendor meets all requirements, it means more than going through the necessary paperwork. Such a solution will also perform better in particular use cases and scenarios.

For instance, the Liechtenstein Blockchain Act, which entered into force in 2020, requires money-laundering supervision and advanced due diligence from all fintech companies providing services in connection with tokens or virtual currencies. To comply with all the recent requirements, the Liechtenstein Cryptoassets Exchange (LCX), enhanced its biometric authentication by integrating secure identity document verification. As a result, the company has better defenses, while their customers can enjoy a frictionless experience.

Fraud-resistant

The Fintech industry encounters both biometric attacks and identity fraud cases. Cybercriminals employ various methods: using spoofs such as on-screen selfies to pass facial recognition, submitting AI-generated photos of identity cards and passports, and opening new accounts under stolen or never-existing identities.

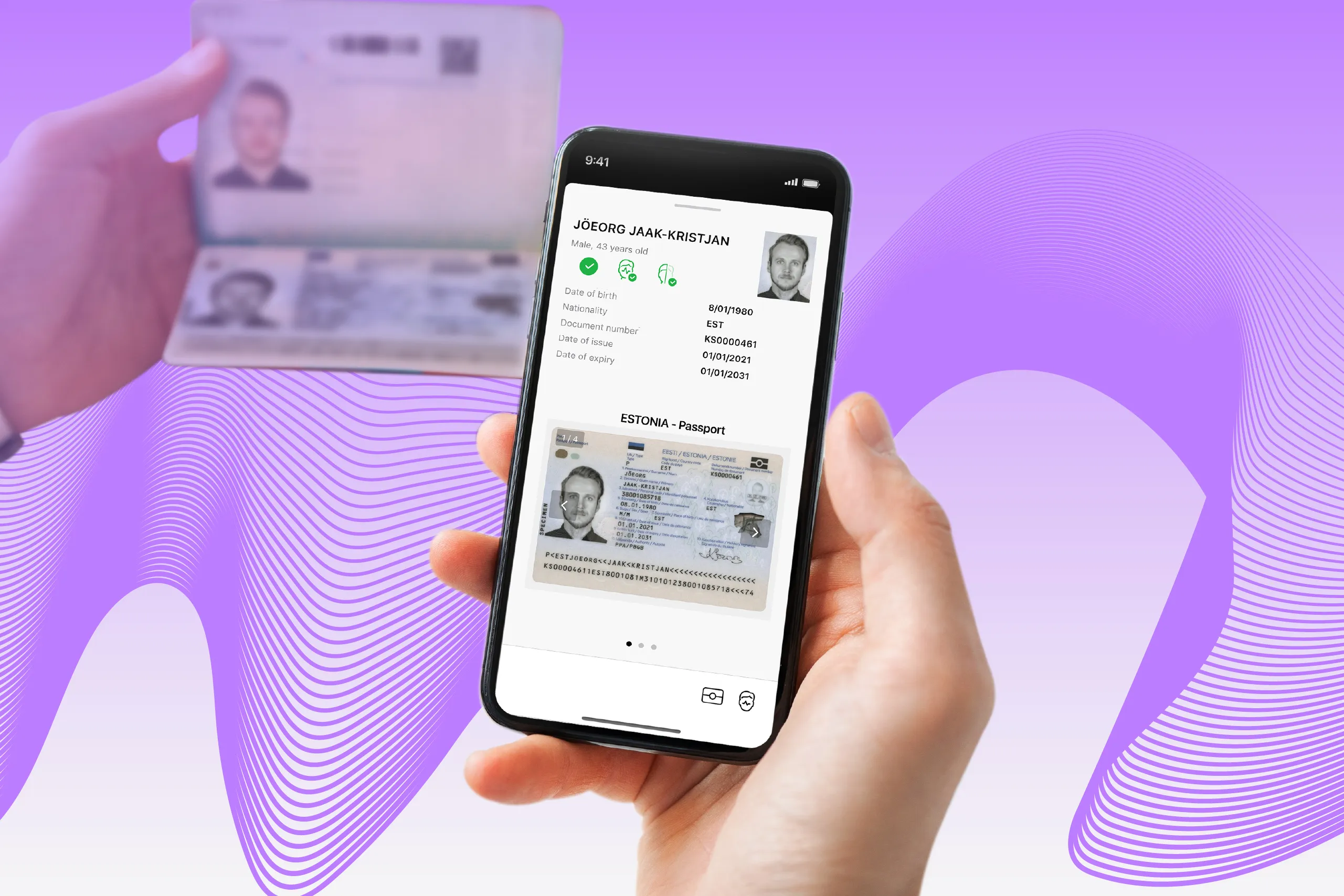

To successfully address these challenges, companies should rely on solutions combining biometric and identity document verification. In particular, software must feature selfie and document liveness checks, NFC chip verification for electronic documents as one of the mandatory authenticity checks, and server-side re-verification to ensure a mobile session isn’t compromised.

Customer-centric

Since there is a strong link between customer satisfaction and application performance, the IDV process in Fintech should be as frictionless as possible. It’s also important to maintain language localization to meet the expectations of clients from different countries. The diversity of IDs eligible to submit matters as well. All this requires fully customizable IDV solutions.

Technologies like advanced face or document capture can help you establish a hassle-free flow. Plus, there is a one-shot check that Regula offers to many clients, in which all personal data and biometrics for verification can be obtained from a single image (a user with their ID in their hand).

Technically sustainable

Despite Fintech companies often being associated with younger generations, people of different ages use their services daily. They might be using the latest model of smartphone, or a low-budget device featuring a basic camera and display resolution. And of course, there are various OSs.

These differences in customers’ daily habits and tech background should be considered when implementing an IDV solution. In particular, the software must perform well on different platforms and devices, including older versions.

Secure your Fintech future with Regula

Considering all the key requirements of our clients from the industry, Regula can provide you with the following benefits from our face verification solution and identity verification SDK:

Complete customer verification through facial recognition and ID checking

Identity fraud detection and prevention thanks to scrutinized authenticity checks of biometrics and IDs

An ID template database of over 14,000 items from 250 countries and territories, so your business can go global

NFC TestKit to thoroughly test our solutions in near-realistic conditions during the trial period

Localization in over 30 languages and customization

Book a call with one of our representatives to find the best option for your case.