In hospitality, understanding guest needs has always been key to great service. But today, understanding alone is not enough.

People are used to getting news feeds, videos, and ads tailored to their preferences. Naturally, they expect the same kind of personalized experience when they check into a hotel, rent a car, or use other travel-related services.

That’s why more hospitality businesses are shifting toward personalized guest experiences—services shaped around each customer’s needs and expectations.

But in a digital-first world, personalization must go hand in hand with security and compliance. This is where guest identity verification (IDV) comes in as the foundation for trust.

Let’s look at how IDV helps hotels, resorts, and rental providers deliver personalized services throughout the entire stay.

Subscribe to receive a bi-weekly blog digest from Regula

IDV technologies to implement in hospitality

Although most hospitality providers aren’t regulated as strictly as banks or financial institutions, compliance still matters. First, they must collect and verify customers’ personal data, which means following strict data protection laws. Second, they may offer services that require age verification and other checks specific to certain jurisdictions.

Traditionally, identity verification for hotels and rentals involves scanning passports, filling out forms, and manually entering data into a guest verification system. On top of that, a manager or receptionist must confirm the person’s identity, age, and eligibility to access services.

Modern IDV solutions automate much of this. They combine document authentication, facial matching, liveness detection, and data validation—quickly and accurately.

Here’s how hospitality companies can use this tech stack to build seamless, personalized guest identity verification and experiences:

Instant document verification—IDV software can verify a passport in seconds, checking all security features and data, including visual elements, machine-readable zones, photos, and expiration dates.

NFC verification—Biometric documents with embedded chips require a separate check. NFC-enabled devices can read the chip data and validate its integrity, allowing for remote, secure guest identity verification.

Biometric verification—Facial matching compares the photo on an ID with a live selfie, confirming the person’s identity and that the document truly belongs to them. This is a crucial part of the guest verification system.

Liveness checks—This tech detects whether selfies or documents are real and not altered or AI-generated (such as deepfakes). Regula’s solution applies liveness checks to both biometric data and documents.

Automated data entry—IDV software can instantly extract and enter personal details from an ID into a database. This speeds up registration, reduces errors, and saves time for both guests and staff.

Now, let’s see how these technologies play out in real-world guest verification experiences.

#1 Set a pre‑arrival, remote check‑in

When guests arrive at a reception or service desk, they usually need to show an ID to register. If done manually, this process takes time and often makes people wait in line—not a great start for customer satisfaction.

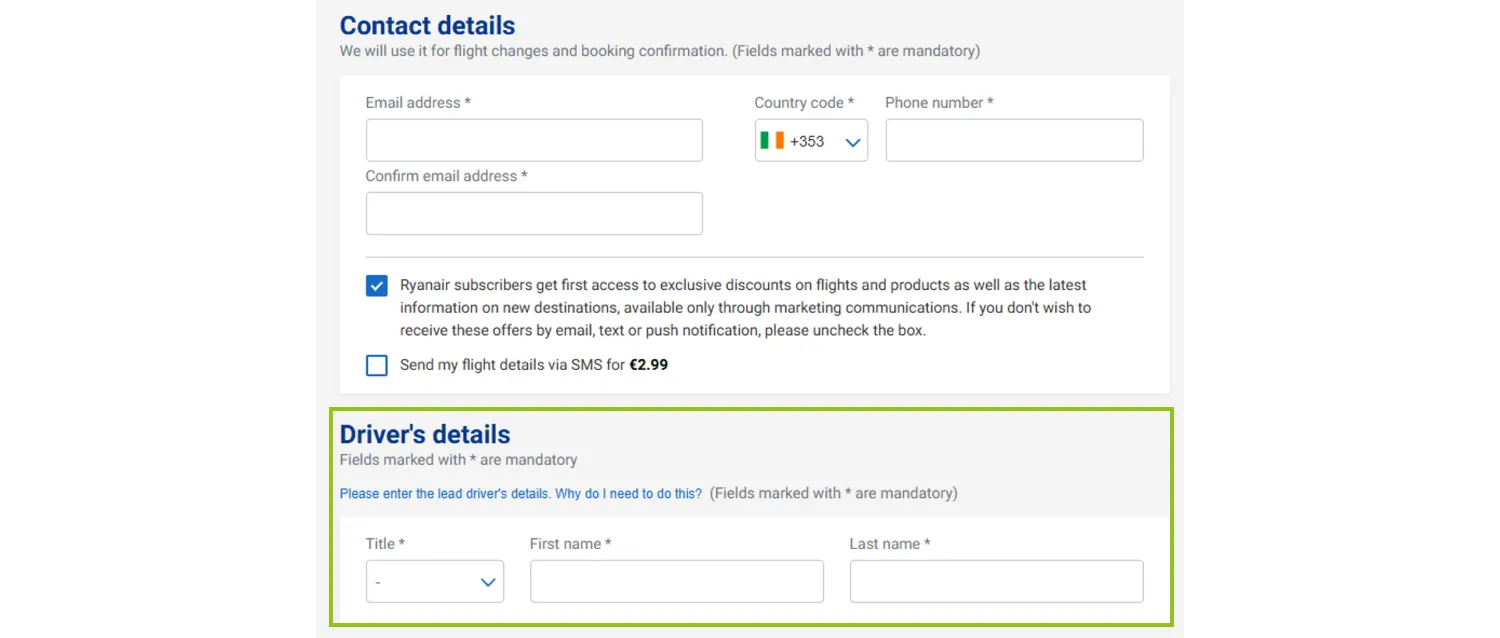

To reduce friction on arrival, many hospitality businesses—especially rentals and hotels—are introducing mobile check‑in. This lets guests upload their details and ID remotely, verify their identity, and complete registration in advance. What’s more, identity verification for travel often embraces several related businesses, such as airlines and car-sharing services or rental companies.

Ryanair passengers can add a rental car as an extra when booking a flight. They must then enter the driver’s details and contact info in the same form before checkout.

At hotels, a typical remote check-in might look like this: after booking, a guest scans their passport or other ID and takes a selfie in the hotel’s app. The system checks the document, matches the face, and confirms liveness. Once verified, the guest can pay and receive a digital key.

Tip: To personalize the stay, offer extras during hotel guest identification, such as in-room breakfast or a choice of pillows.

When the guest arrives, they can go straight to their room without visiting the front desk, thereby skipping any lines. Their unique digital key, stored in the app, unlocks the room and hotel facilities using Bluetooth or NFC.

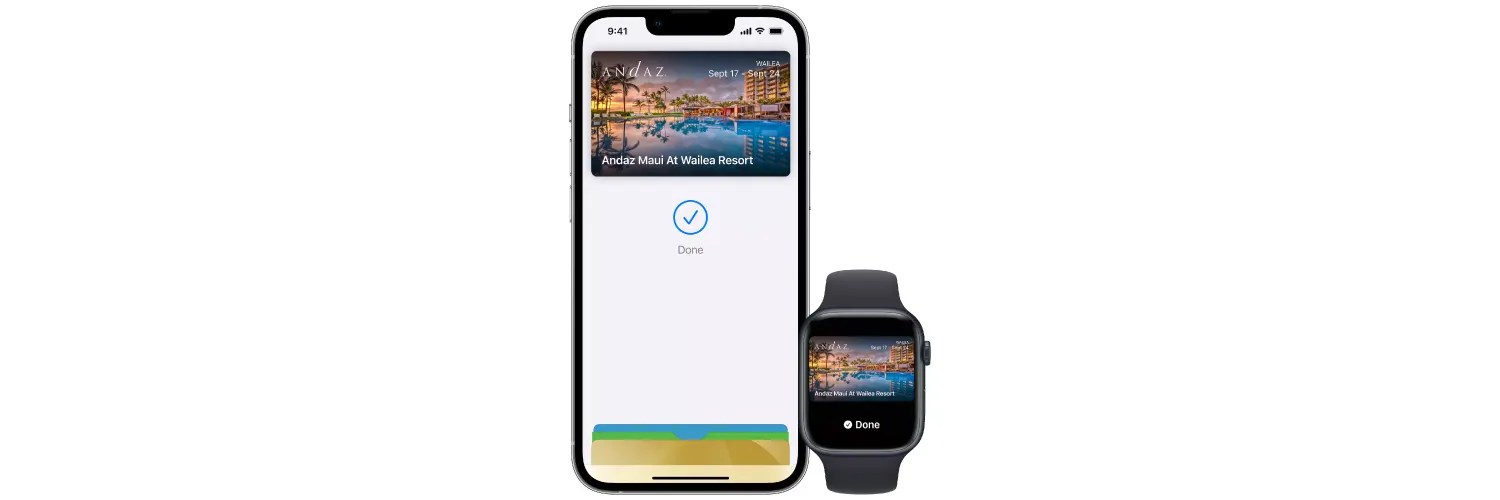

Contactless arrivals are already in use worldwide. For instance, Hyatt issues digital keys through its World of Hyatt app. Guests can store their key in Apple Wallet after registration.

Hyatt guests can add their digital keys to iOS smartphones or wearables after registering in the app.

#2 Enable biometric payment

More people now use their biometrics—primarily selfies and fingerprints—for digital payments. This method is supported by major platforms like Apple Pay, Google Pay, and Samsung Pay.

Biometric payment systems rely on IDV. During registration, the user submits a biometric sample, such as a selfie or fingerprint. To confirm it’s not a fake, the system runs a liveness check. Then, it compares the sample with the presented biometric feature to approve or reject the transaction.

By offering biometric payment, hospitality businesses can save time and build guest loyalty. After all, no one wants to manually enter card details if they’re already using facial recognition to pay elsewhere. In fact, Oracle’s Hotel 2025 report found that 49% of guests prefer contactless payments during their stay.

This feature can be implemented in a few different ways:

In-app biometric payment during remote hotel guest identification.

Self-check-in kiosks with facial recognition.

Contactless terminals at the front desk.

#3 Establish frictionless self‑service during a stay

Guests, especially those staying longer, often want to access additional services during their visit. Smart IDV helps make these personalized guest experiences smooth and secure.

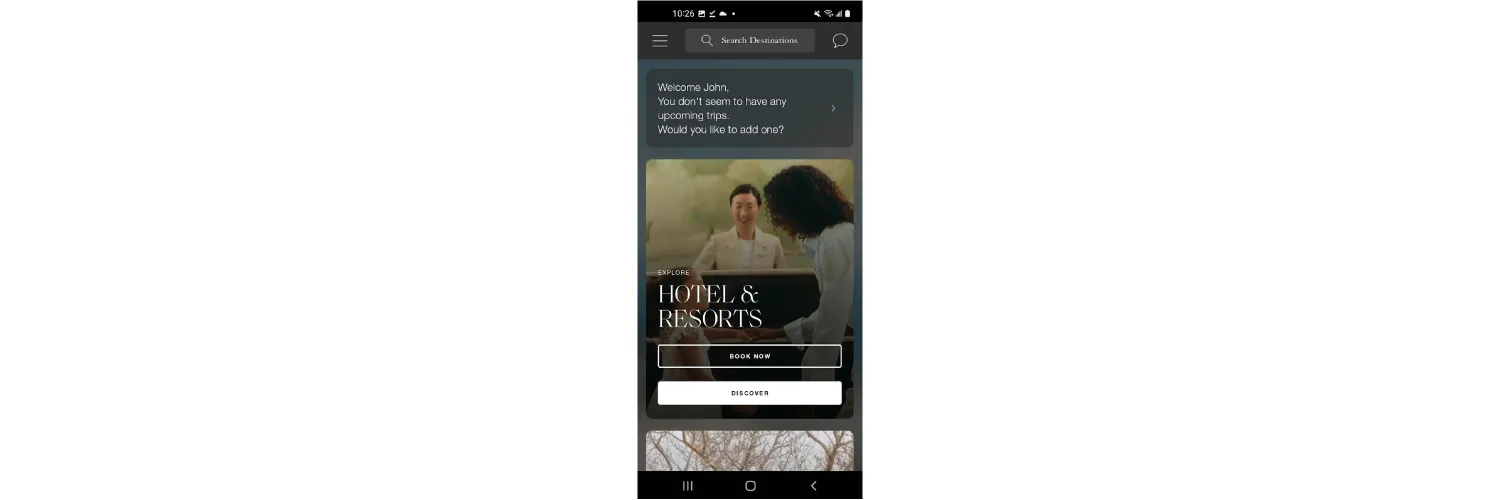

Many hotels now use digital concierges built into their apps to handle such requests. These tools can manage simple tasks, speak the guest’s preferred language, and automate services like meal orders, transfers, or reservations at a restaurant or spa.

Many hotels, including Four Seasons, use their app as a personalized touchpoint to interact with registered guests.

For secure experiences, IDV is essential when handling high-risk actions like payments. For example, hotel apps can use facial recognition to match a live selfie with check-in data before completing a service request. This ensures that only users authorized in the guest verification system can order room service or extend their stay, reducing fraud risk.

Guest verification also plays a key role at resorts with adult-only services, such as a casino. In these cases, access must comply with anti-money laundering (AML) regulations, typically requiring IDV checks at entry.

Automated IDV tools like Regula Document Reader SDK simplify this. They capture and verify identity data, then feed it into AML systems that check external watchlists and compliance databases.

Check out this real success story on guest verification: How Regula Helped INSPIRE Entertainment Resort Modernize Casino Entry

#4 Personalize customer loyalty programs and upselling

In this highly competitive market, returning guests are one of the most valuable assets for hospitality businesses. That’s why well-designed loyalty programs are so important.

Forward-thinking companies are now going beyond simple point collection. By linking loyalty IDs to verified digital identities, they can instantly recognize returning guests, offer tailored rewards, and upsell relevant services.

This works especially well through hotel apps or digital platforms, where data like booking history, guest verification sessions, purchases, check-ins, preferences, and feedback is stored. Analyzing this data allows hotels to offer more personalized customer experiences and targeted rewards.

Tip: Once a guest completes full IDV during their first stay, their details and forms can be reused in future visits. This speeds up booking and enhances guest satisfaction. For example, Regula IDV Platform supports the concept of a persistent identity—a framework where all IDV interactions between a guest and a company are logged and stored throughout the customer lifecycle.

Verified identities also allow hotels to connect multiple stays across different locations under one profile, even if the bookings come through third‑party sites. This means guests can be greeted by name, find their favorite drinks waiting, or get activity suggestions based on past stays.

Identity as the first step to hospitality personalization

The guest journey starts long before check‑in. With modern IDV, hotels, guest houses, and rental providers can build trust from the very first interaction while also meeting security and privacy standards.

Verified identities make it possible to recognize guests across visits, speed up check‑ins, offer seamless digital services, and power highly personalized loyalty programs.

Choosing the right IDV partner is the first step in making this transformation real. Regula’s fully customizable on-premises solutions, deployable separately or as a unified guest identity verification platform for document and biometric checks, are built to support your needs—whatever they are.

Let’s talk about how we can help—schedule a free call with our team.