In 2024, Cifas members in the UK recorded 34,476 cases where behavior indicated money muling, making it one of the most common misuse-of-account patterns in the National Fraud Database. Public polling for the UK government paints an even starker picture: only about one person in four realizes that money muling is illegal at all, and recruiters have been caught targeting children as young as eleven on social media and gaming platforms.

This means one thing: money muling is still a serious problem for anti-money laundering (AML). But can it be solved with robust ID verification?

In this article, we will provide a balanced overview of what ID verification can and cannot do for money muling prevention, as well as explore what money muling is, with the help of real-world examples.

Subscribe to receive a bi-weekly blog digest from Regula

What is money muling?

The UK Home Office’s Money mule and financial exploitation action plan gives one of the clearest current definitions. It describes money muling as a situation where an individual, the money mule, moves criminal proceeds on behalf of others, usually in exchange for a benefit.

Funds can pass through a personal bank account, several accounts, crypto wallets, or as cash withdrawn and passed on. The mule may also hand over account control to the criminals so that transfers appear to come from a regular customer profile.

Let’s cover the basic questions people ask:

What is money muling? — Using apparently legitimate accounts to move or layer criminal funds.

What is a money mule? — Any person whose accounts, credentials, or identity are used for that purpose, whether they are complicit, coerced, or unaware.

Money mule networks are involved in financial exploitation, where vulnerable people, including children, are pressured or deceived into acting as a money mule without understanding the legal risk.

In simple words, money muling is defined by the movement of funds for others (often criminals). But it’s also important to distinguish it from other forms of financial exploitation.

Money muling vs. smurfing vs. structuring

Structuring is similar to money muling, but it’s not identical. The FFIEC BSA/AML Manual’s Appendix G describes structuring as breaking up transactions into amounts, times or locations that keep them under reporting thresholds, with the aim of evading Currency Transaction Reports and related obligations. The definition stresses that any pattern of currency transactions used to dodge those thresholds counts, even if no single transaction crosses the threshold.

Meanwhile, smurfing is a technique which falls under the definition of structuring. A pot of stolen money is divided among many “smurfs.” Each smurf deposits or transfers small amounts through their bank account so that each institution sees only low-level activity. Only when all the small transfers are viewed together does the fraud scheme stand out.

Money muling can use smurfing, but it does not require it. In 2025, many money muling scams moved value via instant payments, card rails, and exchanges, with no cash deposits at all. They still qualify as money mule fraud, because a network of money mules passes criminal proceeds along.

Criterion | Money Muling | Structuring | Smurfing |

|---|---|---|---|

Nature | Use of personal or business accounts to move criminal funds for others, often under the guise of normal transfers. | Breaking transactions into smaller pieces to avoid triggering legal or supervisory reporting thresholds. | A form of structuring that uses many small transactions, spread across multiple people or accounts, to disguise a larger criminal amount. |

Actors | Money mules (complicit or deceived), mule recruiters/herders, controllers who direct where funds go. | One person or a small group using their own, front, or controlled accounts to fragment transactions. | Numerous “smurfs” acting on instructions from organizers, each seeing only a small part of the fraud scheme. |

Objective | Distance funds from the original crime and blur the audit trail by cycling them through apparently legitimate accounts. | Avoid detection and reporting obligations tied to transaction size or frequency thresholds. | Scale structuring and spread risk by distributing the total amount across many small, seemingly low-risk movements. |

How does money muling work in real life?

Now that all the definitions are clear, let’s turn our attention to what shape money muling takes in real-world conditions. The process can be broken down into three key steps:

1. Recruitment and social engineering

According to reports, only a minority of young people recognize money muling scams as criminal behavior, even though many have seen them. That is why almost every modern money mule scam starts in casual online spaces.

People are targeted on social platforms, messaging apps, or gaming communities with offers to “work from home,” “test payment systems,” or “collect a prize” for someone abroad. The script often frames the work as helping a business that cannot easily access local banking. In romance scams, the pitch can also be wrapped in a relationship story, and the victim ends up acting as a money mule for someone they believe they know.

At this point, the future money mule still sees themselves as a helper or employee, not a criminal.

2. Account acquisition and control

Once that line is crossed, controllers need accounts to move money. They usually do one of two things:

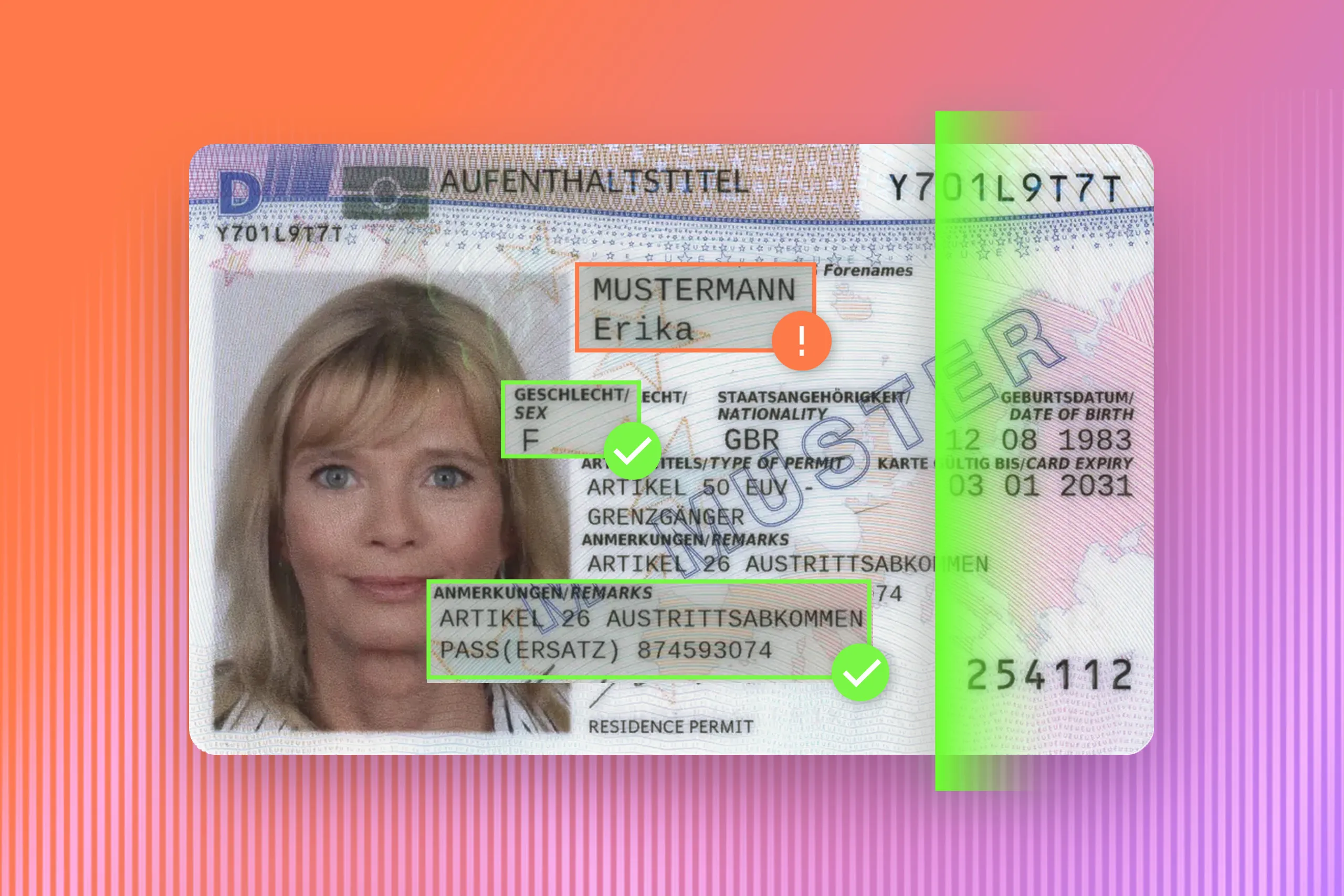

In some money mule schemes, they persuade recruits to open new accounts at several financial institutions, often digital-first banks that allow remote onboarding. In the 2025 Romanian case reported by Eurojust, hundreds of recruits travelled from Romania to the UK to open local accounts that later moved the proceeds of an online fraud scheme worth at least 3 million euros. Forged residence documents and local SIM cards were used to raise acceptance rates.

The money-muling case in Romania has made headlines across Europe this year.

In other cases, the recruit simply hands over access to an existing bank account. The criminal group receives credentials, device codes and cards, then operates the account directly while keeping the real holder ready to answer calls and pass any biometric prompts. From a monitoring perspective, the customer suddenly receives money from many unrelated parties and starts transferring money out just as quickly.

3. Movement of funds through the network

The Romanian network combined compromised business emails and fake invoices. Victims’ funds were sent into first-line mule accounts, then cascaded down the chain.

The Spanish crypto investment fraud ring dismantled in June 2025 illustrates the same pattern at a corporate level. Fraudsters ran fake investment platforms and call centers, took deposits from about 5,000 victims, and laundered roughly 460 million euros through a mix of corporate bank accounts and exchange accounts before cashing out. Here, straw directors and controlled companies functioned as money mules in legal form, even when there was no individual forwarding transfers on a phone.

In such cases, the flow repeats in slightly different guises:

First-tier accounts receive money from fraud schemes or stolen money from other crimes.

Those accounts rapidly send and receive funds to a wider web of accounts, often in other countries, and often through instant payment rails.

Later in the chain, accounts focus on sending or receiving money into cash, high-value goods or crypto assets.

By the time law enforcement freezes a given account, the bulk of the funds has already left. This explains why many classic controls struggle to keep up with money mule activity.

Can ID verification and authentication systems protect against money mule fraud?

Short answer: yes and no. In this section, we will talk about how IDV can prevent money muling, while in the next we will explore some existing limitations.

Realistically, ID verification sits almost exclusively at the very beginning of the fraud chain and at a few points later on. It cannot detect most of the behavior described above, but it does influence how easy money muling scams are to scale.

Document checks and synthetic identity resistance

There are many benefits to document checks where verification goes beyond basic OCR and visual review, and includes full-page capture, security feature analysis, and, where applicable, chip reading.

For money muling prevention, the impact of strong document checks is three-fold:

They make it harder to mass-open mule accounts with forged or heavily altered documents. In the Romanian case, forged residence permits were part of the toolkit. Banks that invest in full-page document capture, security feature analysis and RFID chip reading are better placed to reject those attempts and cut one supply of accounts for money mule schemes.

They raise the cost of opening accounts in victims’ names. Some money muling scams rely on identity theft, where stolen document scans are used to open new accounts. Combining document inspection with biometric comparison against a fresh live capture disrupts that pattern and reduces one attack surface for money mule fraud.

They produce structured identity data. Every time an onboarding or step-up session succeeds, the outcome is more than a “pass” flag. It can include document fingerprints, risk scores and context such as device and IP. That data can then be fed directly into shared utilities like the Bank of Thailand’s Central Fraud Register, which look for recurring patterns of money mule activity.

In summary, good document checks do not “catch money mules” by themselves. They make it more expensive to supply accounts and give later analytics a reliable identity baseline.

Biometrics, context and account control

Biometrics give even more control over who can authorize sensitive actions, as liveness-checked facial recognition at onboarding ties a real person to a document. Re-used later, it helps separate genuine sessions from scripted ones. In the context of money muling scams, this matters in several ways:

If an account that has been quiet suddenly starts sending or receiving money in large amounts, a bank can trigger step-up authentication or re-authentication before allowing new beneficiaries or large transfers. These measures may include a biometric check, which makes it harder for mule recruiters to operate purely with stolen credentials.

If multiple accounts are accessed from the same devices or locations, biometric checks help determine whether those accounts belong to different real people (e.g., a shared household) or are being controlled by a single individual running multiple mule accounts.

When law enforcement finally traces a scheme back to specific accounts, having a chain of biometric events tied to high-risk actions gives stronger evidence about who was acting as a money mule, and who was only a victim of credential theft.

That said, biometrics still do not reveal intent. For instance, someone who thinks they are working a “payment processing” job will willingly pass every biometric prompt while transferring money. But tying sensitive actions to strong identity evidence narrows the room that mule recruiters have to hide behind weak authentication.

ID data as fuel for mule detection systems

A less visible contribution of ID verification is the data that supports special tools for money muling prevention.

Complete identity verification (IDV) processes produce:

Verified personal attributes from the document.

Risk scores and failure reasons from document and biometric checks.

Device, IP and telecom context at onboarding and high-risk events.

Shared utilities like the Bank of Thailand’s Central Fraud Register depend on this material. They join identity-level data with transaction patterns and flags from many institutions to detect clusters of mule accounts and repeated money mule schemes.

When that data is clean, consistent and granular, money muling prevention stops being a single-bank problem and becomes a sector capability.

Limitations of ID verification vs. money muling

If ID verification could solve money mule fraud on its own, money muling scams would likely be quietly fading. However, there are a few technical reasons this cannot happen (at least for now):

Mules with genuine documents

A lot of money mules use genuine documents: they pass KYC, clear biometric checks, and later let their accounts be used for transferring money.

Some know they are working for criminal groups. Others are deceived by romance scams or fake employers.

In all these cases:

The document is real.

The biometric sample matches the person.

The account profile, at onboarding, looks ordinary.

ID verification can only check identity attributes and presence, which means the checks will turn out positive.

Rented identity vs. synthetic identity

Synthetic identities and high-end document forgery still matter, but public statistics and central bank commentary suggest that rented identity is more common in money muling. Criminals find it cheaper to recruit money mules than to maintain full identity factories, especially once guidance on remote onboarding has made forged documents easier to spot.

Naturally, investing in better document forensics is still necessary to keep synthetic mule accounts under control, yet the bulk of money mule activity will still come from people who walked through a fully verified onboarding flow.

Building a money muling prevention stack with ID verification

If ID verification is not enough on its own, how should financial institutions treat it in their money muling prevention plans?

First, treat IDV as infrastructure for data quality. Every document and biometric decision should feed structured attributes into an internal identity graph: document quality indicators, device and network context, and links to accounts. This graph then supports transaction monitoring, cross-institution data sharing, and responses to law enforcement on money mule fraud cases.

Second, tie ID checks to higher-risk events. When an account suddenly receives money from many unrelated senders, a biometric step-up combined with device checks gives much better context on whether the genuine customer is acting as a money mule.

Third, combine ID data with behavioral and network analytics. Typology-based rules for mule scams, graph analysis that links shared devices and counterparties, and central fraud registers all depend on clean identity anchors. They look across many institutions to find repeated patterns where the same mule recruiters, devices or contact details recur.

Finally, feed lessons back to public authorities. The Romanian and Spanish cases were only solved because banks and payment firms were willing to share detailed identity and transaction data with law enforcement. When institutions can show, with evidence, how money mule schemes recruit money mules, move money and exploit onboarding processes, regulators are more likely to support cross-sector tools.

How Regula can help prevent money muling

Money muling works because criminals can still find people willing or vulnerable enough to let their accounts be used, and because they can still slip those accounts into networks that move stolen money faster than controls can react.

In this context, although not sufficient on its own, ID verification really matters. It raises the bar for synthetic identities, cuts some identity-theft-based schemes, and gives financial institutions solid evidence for analytics and law enforcement work.

An all-in-one solution like Regula IDV Platform can be that extra layer of defence: it’s an end-to-end framework for ID verification and user identity lifecycle management, adaptable to any KYC/AML needs:

Document verification backed by the world’s largest database containing 16,000 templates from 254 countries and territories, along with advanced biometric verification including face matching and liveness detection.

Flexible identity workflows covering KYC, onboarding, biometric access, and other verification scenarios.

Automated AML and PEP screening as well as custom watch lists, using trusted global data providers.

Structured user data management and audit-ready evidence for ongoing monitoring and future investigations.

Smooth integration with your existing tech stack via flexible connectors.

Overall, Regula IDV Platform can tighten controls around accounts opened with weaker evidence, re-verify identity if behavior changes, and feed clean, structured identity events into fraud and AML systems that watch how money moves.

To learn more about how Regula can support your KYC/AML activities, contact our team.