Say you’re a bank. Or a travel agency. Or a hospital. Or any other organization that has to process and verify the identity documents of their clients. Nowadays, it’s quite a typical procedure in plenty of cases: customers present their IDs to prove their identity, and companies scan and check them to provide access to their products and services.

If it’s done quickly, everyone is happy.

The set of technologies that enable such automation differs depending on the organization. However, there is one thing in common—Optical Character Recognition technology, or OCR for short.

In this article, we’ll see how OCR works in the context of identity verification (IDV), and take a look at its benefits and challenges.

What is OCR?

OCR technology converts different types of documents—such as scanned papers, PDF files, or images captured by digital cameras—into machine-readable, editable, and searchable data. It can also transform hand-written texts into digital formats. A typical application of OCR is automated data entry, which comes in handy in many business processes, from onboarding to invoice handling.

In IDV scenarios, OCR is a crucial technology that automates the processing of identification documents such as passports, driver's licenses, national ID cards, and other government-issued IDs. For example, the OCR technology in Regula Document Reader SDK can recognize and read data in nearly all types of IDs from 250 countries and territories.

How OCR works

Before OCR can read a document, the document must be digitally scanned. Previously, the technology used to work with the image, scrutinizing it for every single character. However, modern OCR skips this stage and starts working directly with the text in a given document. Generally, there are three stages of document processing by OCR:

Text detection. At this stage, the technology launches a text detector, which is a special algorithm that pinpoints text areas within the document.

Text recognition. Then, a recognition model proceeds to analyze the identified text. OCR technology uses pattern recognition and/or advanced machine learning algorithms to match characters in the text to letters and numbers in the chosen fonts and languages. The modern form of the technology can self-train in the process, improving the quality of text recognition with every processed document.

Post-processing. At this stage, the OCR engine prepares data to export and store. This is also the point where the recognized text is validated and corrected. This may involve comparing the results with a dictionary or database to correct errors, checking the logical structure of data, or formatting the text based on predetermined standards.

Advanced modern OCR systems extract data from virtually any place within a document. They recognize and interpret not just the character sets but also the context of the data based on its position within the document or its relation to other data elements. However, all this is feasible only if the image quality is good enough for the technology to process it.

Subscribe to receive a bi-weekly blog digest from Regula

How OCR works in identity verification

The general principles for identity document OCR are the same: scanning, recognizing, and checking. But there are definitely some nuances.

OCR in IDV is not limited to data recognition and extraction, it should also include validation and verification. For example, not only does this technology read the name of a passport holder (plus birth date, etc.), but it also checks that the data is printed in a specific font, format, and place, according to the particular document type.

Regula’s OCR recognizes not only data, but fonts as well

OCR technology knows which ID data to look for and where, thanks to templating, or simple masks for specific documents. Such masks are like detailed maps that show every minuscule piece of information that can be found in an identity document. By creating masks for every single ID type, IDV software developers make OCR perform in the most efficient way, enhancing the speed and precision of document checks.

Depending on the ID type, its holder’s data is printed differently: addresses, dates, names, etc. So, the OCR technology should know exactly which data it will find in a specific document field, and in which format. If there are some discrepancies between what is found and what should be there, the OCR will raise a red flag, notifying the user about potential fraud.

Furthermore, some pieces of information in certain documents may be coded, depending on the standards of a country, state, or even a specific ID. For instance, there may be a number instead of the full name of the issuing authority, or the eye color may be put down as “GRN” instead of “Green.” This makes it imperative for the OCR to know how to decode such data in order to properly perform document reading.

ID data and its format is validated against a corresponding document type in an identity document database. The larger such a database is, the more precisely the OCR can read and check document data.

Advantages of OCR technology

By automating data reading and extraction, OCR significantly streamlines operations, elevates the accuracy of data processing, eliminates errors related to manual data entry, and improves the overall efficiency of many procedures. However, there are other beneficial implications of introducing OCR for document processing.

First of all, OCR enhances customer experience. The technology expedites interaction and saves clients from tiring and error-prone manual form filling. In the financial sector, for instance, OCR enables customers to swiftly upload and authenticate their identity documents for online account setup, thereby enhancing user convenience and reducing delays.

Secondly, OCR technology improves data searchability and accessibility. The logic is simple: once documents are converted into digital text via OCR, they can be easily indexed and searched using keywords. Plus, digital documents can be accessed remotely, which fosters collaboration among teams and improves workflow efficiency.

For strictly regulated industries, such as Finance or Legal for example, OCR helps ensure compliance by providing accurate, searchable, secure, and controlled data management solutions.

On top of this, by implementing OCR, organizations can substantially reduce their costs related to manual labor (since data processing is automated), physical storage (data is stored on servers or in distributed systems), paper, and printing. In addition, going digital minimizes carbon footprint and supports corporate sustainability goals.

Why is OCR important in online identity verification?

In today’s “all-remote” world, online identity verification is available nearly everywhere, regardless of the industry. The vital question is how to ensure the security of the process and prevent fraud.

There are plenty of advanced tools that help combat identity fraud in remote onboarding. However, it is often OCR that starts this robust process of verification. One may say that OCR simply reads data and translates it into machine-readable format. But there’s more to that.

Indeed, when it comes to identity documents, OCR technology reads data in two zones: visual and machine-readable (MRZ). Also, when specially adapted, the technology is capable of accurately reading perforated data, which is quite common in many IDs.

However, Regula’s OCR goes further. Not only does it read and extract information, but it also checks that the data is placed correctly and appears in the ID as it should in a genuine document. This includes checking the vertical and horizontal positions of each line containing personal information. Thus, the technology ensures that the data is printed precisely down to the pixel. Otherwise, any mismatch is a red flag in the IDV process.

Plus, Regula’s OCR checks if the MRZ data in the ID is printed with OCR-B font, a special monospace font developed to facilitate OCR operations, which is now globally used in MRZs in many types of identity documents. This check helps to ensure that no illegal or suspicious alterations have been made to the data.

In Regula IDV solutions, OCR is always coupled with a lexical analysis module, a special feature that checks the relevance and validity of the personal information in the identity document. It does this by comparing data, language, font, and format against the corresponding template. If anything does not match up, the system will notify the user. For example, if the birth date should be formatted as DD.MM.YYYY but appears as MM.DD.YYYY, Regula solutions will flag this as potential fraud.

As long as OCR processes ID information accurately and extracts it from several document zones, there is a possibility of further data cross-checking, which is crucial for making IDV trustworthy. Cross-checks help to ensure that data across the document is consistent. Discrepancies between the same pieces of information in different zones may be a sign of fraud. It’s rather easy to change any data in the visual zone, but it’s way more tricky to do the same in the MRZ, for example. Less skilled fraudsters may try to do a simple job, leaving the MRZ data as it is. By spotting this type of inconsistency, it is possible to stop fraud at early stages.

By cross-checking data, the IDV solution ensures its consistency across the document, and spots suspicious mismatches

The challenges for OCR in IDV

In order to fully take advantage of OCR in identity verification, the document must be in good condition, and it must be properly scanned. Poor printing, wear and tear, suboptimal scan quality—all these factors affect the accuracy of OCR readings. That is why we at Regula automate the process of ID scanning as much as we can so as not to depend on the user's photography skills.

Regula’s OCR detects an ID card shot at a skewed angle and automatically repositions it for accurate processing

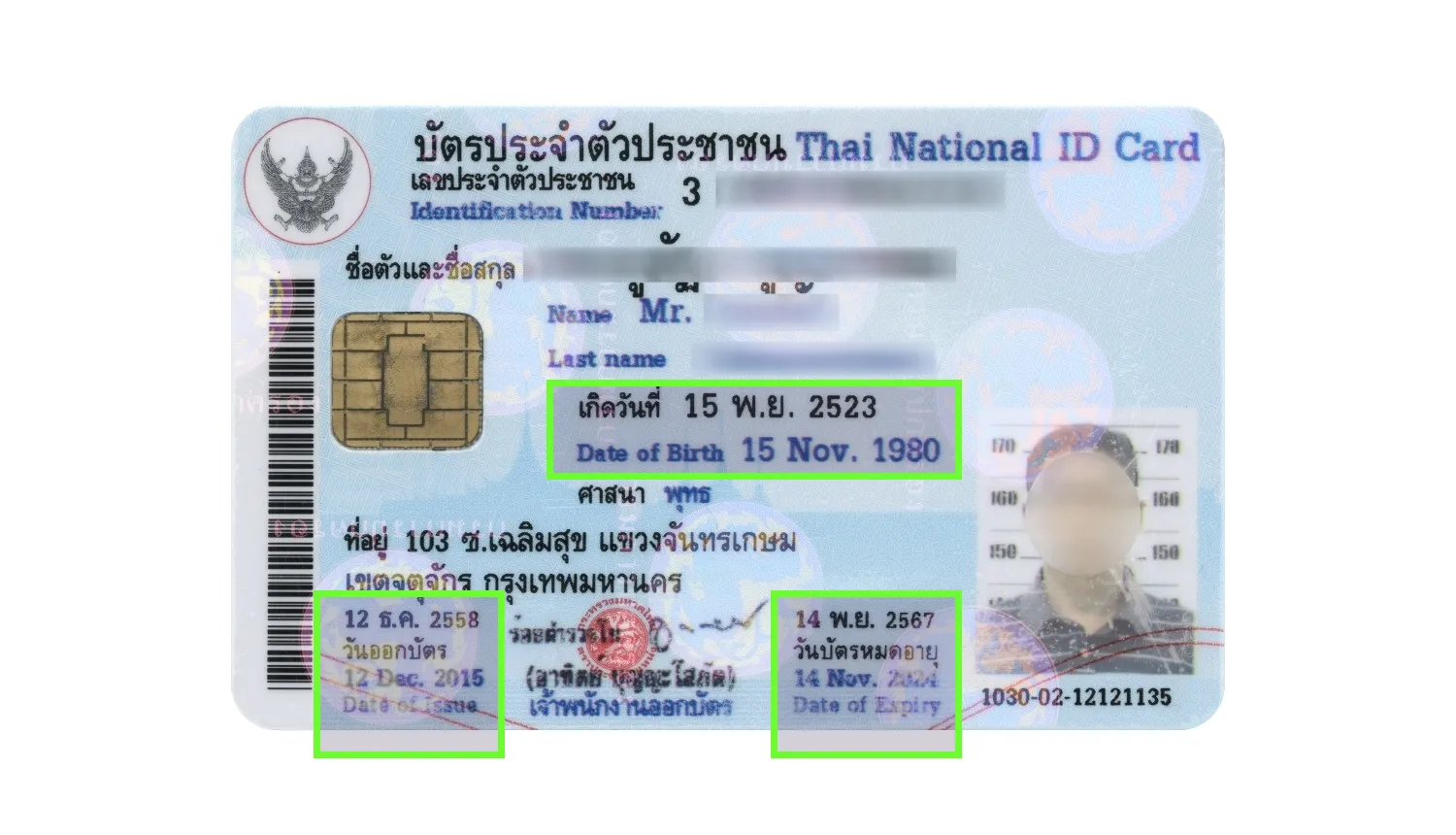

Other challenges derive from the great variety of languages and scripts that can be found around the world. Various national languages and their alphabets (some of which are really complex, like Khmer in Cambodian IDs) can create difficulties in recognizing certain pieces of data. There is also quite a common issue with dates that are put in IDs in accordance with local calendars, like in Thai documents, for example. So, not only must OCR be trained to read various languages, but also to understand even the subtlest nuances of local names, dates, and other ID data.

Dates in Thai identity documents are represented in the Thai calendar and duplicated in the Gregorian calendar

Apart from the abundance of languages, there are plenty of document layout variations. The same ID type—for instance, a driver’s license—differs not only from country to country but even within one state, like in the USA or Mexico. So, OCR should know for sure what document it’s processing, and which data should be found in certain fields.

Every Mexican state issues its own driver’s licenses, so there are at least 32 different designs and formats for these documents in the country

It’s also quite a typical task in IDV to train OCR to recognize text against various unusual backgrounds used in documents, or to read data that is interrupted by holograms and other security features (which usually never happens in a plain text document), or understand multicolor and specialized fonts designed for specific documents. Another serious issue is the overlapping of personal data onto the form text (field labels), which sometimes happens when IDs are issued carelessly.

All these challenges can be overcome if an IDV vendor has a sufficient database and resources to train the OCR technology.

Final thoughts

OCR technology has significantly transformed the way we process various documents. It provides a fast, reliable, and cost-effective solution for automating data entry and enhancing security measures. There are still identity documents in the world that contain nothing but printed data—no MRZs or barcodes. However, they also need to be recognized and verified. For such IDs, OCR is the only option.

Here’s the key takeaway: OCR deals mainly with visual zones in IDs; however, this zone was created not for machines, but for us humans. What does that mean?

There are certain parts of a document that are designed to be machine-readable, such as MRZs and barcodes. They contain checksums to confirm that all the data has been correctly scanned. If the checksums is properly read, and is formatted according to standards, then the verification is done. And a computer can do it in a split second.

When it comes to the visual zone, however, there can never be 100% precision when it is read by a machine. That’s because there are no control marks which can prove that the data has been recognized and read corrently, and hasn’t been altered. No checksum, no trusted certificate, only computer vision—which, like humans, can’t be trusted completely.

OCR is a bridge between analog and digital systems, and it must be supported by a range of other technologies and cross-checks to enable robust and trustworthy identity verification.