The concept of a single digital identity credential that individuals can use repeatedly across multiple services has been gaining serious traction. One industry analysis projects the market for reusable identities will grow to a whopping $266.5 billion by 2027, as governments and businesses seek more efficient and user-centric ways to meet KYC requirements.

But how exactly would the universal adoption of reusable identity change the ID verification industry? Would it practically wipe out traditional IDV methods, or would the two only benefit from each other?

In this article, we will answer these questions and more: we’ll delve into what reusable identity means today, how it compares to traditional IDV methods, and how the two can coexist.

Get posts like this in your inbox with the bi-weekly Regula Blog Digest!

What is a reusable identity?

A reusable identity is a portable digital identity that carries verified information about a person, which can be presented on demand to different parties. In practical terms, it usually takes the form of a digital credential stored in a digital identity wallet. For example, after a user completes identity verification once with a trusted provider, they receive a cryptographically signed digital credential. The user can then present this credential to other organizations without needing to submit documents and personal data over and over.

Reusable identities are typically implemented using Verifiable Credentials (VCs) and a decentralized identity architecture. In the standard model, there are three roles: the issuer (an authority that issues the credential), the holder (the user who keeps the credential in their wallet), and the verifier (any service that needs to check identity). Modern reusable ID systems use public-key cryptography so that verifiers can instantly authenticate credentials offline or via blockchain/registry lookup, without having to contact the original issuer each time.

.svg)

Notably, reusable ID credentials are user-controlled—the personal data is stored on the user’s own device or a cloud under the user’s control rather than scattered across provider databases. A reusable digital ID could be stored in a smartphone wallet app protected by the user’s biometrics or PIN, and whenever proof of identity is needed, the user can selectively disclose the relevant information.

Recent developments in reusable identity

Recently, we have seen significant advancements and pilot programs in reusable identity worldwide. First, standards have matured: the W3C’s Verifiable Credentials data model was updated to v2.0 in March 2025, with mostly technical improvements such as clearer semantics and separation of the core data model from proof mechanisms.

Second, government-led digital identity management initiatives have risen as a major driver of progress: for example, in Europe, the latest version of the eIDAS framework and the European Digital Identity (EUDI) Wallet are the trailblazers of the reusable identity framework. The EUDI Wallet (planned for EU citizens by the late 2020s) will allow individuals to store government-issued digital ID credentials and share verified attributes with both government and private services. Elsewhere, we’re seeing similar efforts with Singapore’s Singpass Mobile, where millions of citizens already have reusable digital IDs that can be used to access multiple services.

Third, biometric technology itself has also advanced to aptly support reusable identity initiatives. Over the past few years, vendors like Regula have improved their systems to catch synthetic identities and manipulated videos, addressing concerns that fraudsters might try to trick the “verify once” stage. That is important, as document liveness detection and deepfake-resistant facial recognition can be built into credential issuance and used to prevent fraud.

Reusable identity vs. traditional IDV

Reusable identity and traditional IDV shouldn’t necessarily be contrasted, since either can tremendously expedite and automate the ID verification process to a large degree. Not to mention, the best IDV framework should include them both (but more on that in the later section).

Now let’s take a closer look at some of the major differences between the two and see what tradeoffs to expect:

Architectural differences

In traditional identity verification, each organization typically performs identity proofing separately. When a user signs up for a new bank account or service, that company (or its IDV vendor) collects the user’s ID documents, runs checks (document authenticity, database queries, etc.), and stores the necessary data or results. The process is then repeated: your identity gets verified again for each new relationship—one bank’s verification is not readily trusted by another bank unless there’s a specific arrangement in place. The absence of mutual trust can be considered an advantage, as there is no dependency on external issuer trust frameworks.

By contrast, a reusable digital identity system uses a credential-based architecture. After the initial verification, the user holds a credential that can be recognized by multiple parties. The data flow is user-centric: the verified data goes to the user (in the form of a credential) rather than residing solely with the verifier. When the user needs to prove their identity to a new service, they transmit the credential directly to that service, usually via an encrypted presentation or QR code scan, rather than uploading documents again. The verifier then uses the credential’s digital signature to check authenticity, and may consult a public registry for the issuer’s public keys or revocation status.

Security differences

Traditional identity verification risks can be described as “contained”: each organization independently vets the user, so if one verification is fooled by a fake ID or deepfake, it affects that organization alone. However, the drawback is that users’ personal data is submitted and stored in many places, increasing the attack surface for breaches. Requiring every service to keep copies of IDs leads to lots of targets for hackers, and indeed, many breaches of ID databases or document images occur. Users also often have to share more data than necessary (e.g., sending a full ID scan to verify just one attribute).

Reusable identity emphasizes data minimization and cryptographic security—identity credentials are digitally signed and tamper-proof. There is also an opportunity to reduce what data is shared: a reusable credential can be designed to only reveal the attributes needed for a given transaction. Additionally, because data stays with the user until needed, organizations don’t necessarily need to retain as much personal info. However, these benefits come with a big tradeoff: a single compromised credential has a much broader potential impact. If a reusable digital credential falls into unauthorized hands, the same credential could be accepted by multiple relying parties.

User experience differences

Traditional verification means form filling, document uploads, or in-person presentations every time you engage with a new service. These onboarding flows tend to be simpler compared to setting up a digital wallet for reusable identity, particularly so with the help of automated ID verification solutions. On the other hand, a digital identity wallet only needs to be created once—and all services are then available. Additionally, with traditional verification, users often have no say in which data a company keeps—they hand over a full ID document scan and other info, which the company stores.

Reusable identity makes identity verification nearly instant after the initial enrollment. Once a user has that credential in their digital wallet, signing up for a new service can be as simple as clicking “Share my ID.” As for data control, if a user finishes using a service, they could revoke the service’s access to their credential. Moreover, users are able to keep custody of their data locally rather than trusting each company to safeguard it.

The benefits of reusable identity

When implemented well, reusable identity offers a win-win: users spend less time proving themselves and keep more privacy, while businesses and institutions get high-assurance identity proofs with lower friction.

Fewer onboarding abandonments

Businesses can onboard customers much faster when those customers already have a “trusted identity” to present, which typically leads to higher conversion rates and less abandonment. One study cited that nearly 1 in 4 would-be banking customers drop off during traditional onboarding—a reusable identity can cut down the tedious steps contributing to that. This also extends to ongoing interactions: if a user needs to re-verify their identity for a high-risk transaction or account recovery, having a credential means it’s a quick check rather than going through the full identity verification process again.

Fraud reduction

Digital signatures on credentials make them tamper-evident—any alteration invalidates the signature. Credentials can also incorporate checks like issuer cryptographic proofs: a government issuing a national ID credential can sign it with its private key, and verifiers can then use the key to confirm authenticity. Also, because credentials often include metadata about how they were verified (for example, whether a biometric match was done and what level of assurance was attained), verifiers get a rich, machine-readable risk signal. And if one credential is identified as fraudulent or compromised, it can be revoked or flagged, and multiple relying parties benefit from that knowledge, instead of the fraud going undetected.

User empowerment

Users benefit by sharing less data and having more control: for instance, a reusable digital identity system can employ attribute-based verification, where a user can prove “I am over 21” or “I have a valid driver’s license” without revealing unrelated details. This is a practical privacy win and reduces the amount of personal information floating around. Additionally, the ability for users to revoke consent or limit usage of their credentials further protects against misuse.

Interoperability

With a reusable ID, one credential can unlock access to many services. This is convenient (one doesn’t need to manage dozens of login identities) and can also promote inclusion. This way, someone who has obtained a government digital ID could use it to access financial services that were previously out of reach due to a lack of traditional paperwork. In developing regions, a verified digital identity stored on a smartphone could allow people to identify themselves even if they are far from the issuing authority or don’t have physical documents on hand.

How biometric verification ties into a reusable identity ecosystem

The concept of reusable digital identity doesn’t imply that document authentication or biometric checks are no longer necessary; it simply changes when and how these traditional IDV elements come into play.

Issuance

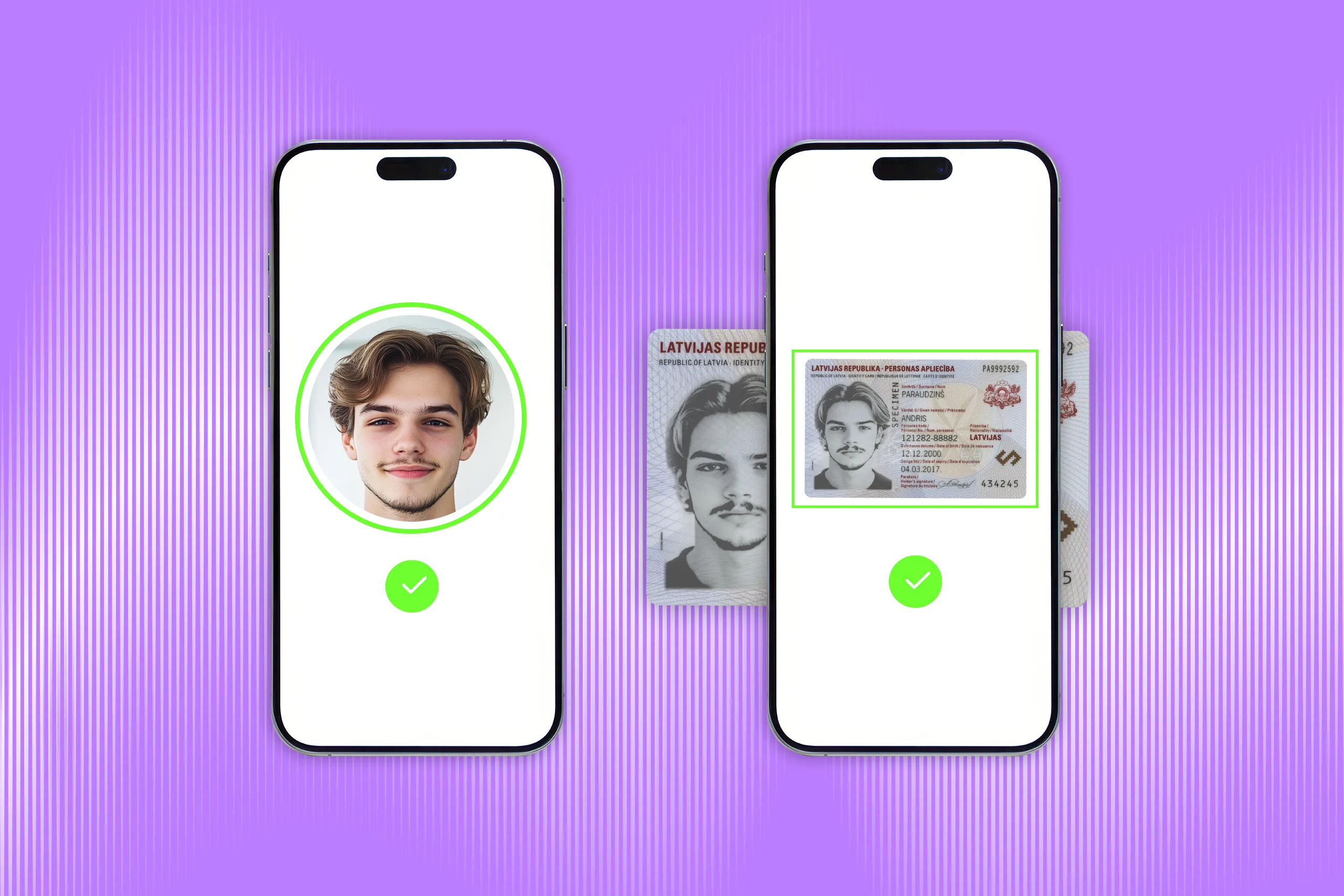

To create high-assurance reusable identity credentials, one must first vet the person’s real identity, often using the same methods as conventional KYC. This means verifying a government-issued identity document (like a passport, ID card, or driver’s license) and matching the person’s live face to the document photo. For this purpose, an identity verification vendor might use solutions like Regula Document Reader SDK, as it will check the authenticity of the ID (detecting forgeries and reading security features) and then use face matching software to compare the user’s selfie to the passport photo. Once the document is confirmed as genuine and belonging to the user, the verified personal data can be packaged into a digital credential. In short, strong document and biometric checks make sure that “verify once” truly establishes the correct identity.

Many national digital ID schemes follow this model too: when governments issue digital IDs, they often require the person to scan their physical ID and do biometric verification through an app or at an enrollment center. This way, the physical document check isn’t eliminated; it’s just used to complement the digital credential.

Presentation

When a holder needs a reusable credential to identify themselves, there can be a biometric step involved for user authentication. For instance, if you have a digital ID in your mobile wallet, you may have to unlock it via fingerprint to share it. In high-security scenarios, the relying party might even ask for an additional live selfie to compare with the photo that was originally verified. This is similar to how some mobile payment apps can require a biometric check, even though the card is already stored. A solution like Regula Face SDK is a facilitator of this process, as it can perform advanced facial recognition with liveness detection to verify users and prevent fraud.

Digital ID verification

Another emerging need is verifying digital documents themselves, such as a mobile driver’s license or a digital passport (known as a Digital Travel Credential). Many IDV vendors have responded to this by updating their software to handle these cases—for example, reading a 2D barcode or an NFC chip from a digital ID to validate its issuer signature. In the same way, Regula’s toolkit can authenticate a physical document’s security features, and it can be extended to verify the digital signatures on an mDL or other credential. On top of that, Regula Document Reader SDK can actively generate the Virtual Component of a DTC (DTC-VC) by extracting the data from an RFID chip and creating a digital replica of the physical document.

Regula’s solutions to complement reusable identity systems

Reusable identity is redefining how identity verification is handled, but it isn’t about discarding traditional methods outright; rather, it builds on them. Physical identity documents and biometric verification form the backbone of initial trust, which is then encapsulated into reusable digital credentials.

This biometric identity verification procedure can be carried out by solutions like Regula Document Reader SDK and Regula Face SDK, which can easily integrate with your existing mobile or web applications.

Regula Document Reader SDK processes images of documents and verifies their real presence (liveness) and authenticity. The software identifies the document type, extracts all the necessary information, and confirms whether the document is genuine.

At the same time, Regula Face SDK conducts instant facial recognition and prevents fraudulent presentation attacks such as the use of static face images, printed photos, video replays, video injections, or masks.

Regula is here to help you make your identity verification compliant, secure, and customer-centric. Book a call to learn more about our solutions!