Updated 26 November, 2025

In the identity verification industry, “digital ID” is a buzzword that means different things to different people. For some, it’s a secure login across government platforms; for others, it’s a digital version of an ID card stored on a smartwatch.

But one thing is clear: digital IDs are the next stage in the evolution of identity documents. We can influence this shift only to a certain extent, but we definitely can’t stop it.

In this article, we’ll break down what digital IDs really mean, and review their current status across different countries.

Get posts like this in your inbox with the bi-weekly Regula Blog Digest!

Regula’s survey on the state of digital IDs

In early 2024, we conducted a study on digital IDs to understand how businesses in aviation, finance, government, technology, and telecommunications across Europe, North America, and the Middle East perceive this concept.

Why these industries?

Government agencies often act as “topic starters,” developing the idea and driving the adoption of digital ID systems. The rest are typically early adopters of technological advancements.

The survey revealed that 81% of respondents had a basic understanding of digital ID technology. What’s more, 42% of the companies were already integrating those technologies into their systems.

However, several challenges remain. Cybersecurity threats (50%), data privacy concerns (44%), and a lack of global standards (74%) were key factors slowing implementation. As a result, 35% of respondents still viewed physical documents as irreplaceable for identity verification.

On the positive side, 75% of companies saw improvements in user and citizen experience, while 74% noted improvements in the IDV process. Additionally, 71% believed digital IDs enhanced security and fraud prevention.

To sum up, many organizations were ready for the shift but cautious about the hurdles and outcomes.

What exactly is considered a digital ID?

Before we go further, it’s important to define what we mean by digital ID. After reviewing multiple definitions available online, we can describe a digital ID as an identity that consistently includes these characteristics:

It exists in a digital format.

It serves as proof of identity (containing personal data), fully replacing a physical ID.

It enables authentication and authorization through a unique identifier.

In this context, ICAO’s Digital Travel Credentials (DTCs) are a good example. They represent a person’s identity in digital form and include an identification dataset. To generate a DTC, the user verifies their physical passport via NFC-enabled device, which confirms the chip’s authenticity and data integrity. DTCs enable carriers to identify passengers at boarding using a quick facial recognition check at the gate, matched with DTC data—no physical passport required.

What about security?

Just like passports and ID cards have built-in security features, digital IDs are stored in specialized applications often referred to as digital wallets. These apps use encryption and other protective measures. The identification data itself is typically protected with advanced cryptographic methods, as is the case with DTCs.

This makes digital IDs a safer and more convenient alternative to physical documents, which can be lost, stolen, or tampered with. (Of course, a mobile phone with a digital wallet can also be lost or stolen.)

The role of ISO standards in shaping Digital ID frameworks

Digital ID systems increasingly rely on internationally recognized standards to ensure security, interoperability, and user control. ISO/IEC 29003 sets the foundation for identity proofing and enrollment by outlining how personal information should be collected and verified.

Complementary standards such as ISO 27001 and ISO 31000 provide guidance on managing security and risk. Meanwhile, ISO 20022 and ISO 19115 support interoperability in financial messaging and geographic data, respectively. Together, these standards establish a solid base for building secure and scalable digital identity infrastructures.

Launching digital ID at the national level requires a specific infrastructure for issuing and verifying digital identities. This is typically referred to as a digital ID system. It brings together key stakeholders—governments, service providers, and individuals.

To participate, service providers usually need accreditation that confirms they meet requirements for privacy, security, accessibility, risk management, and fraud prevention. Individuals (citizens or residents) simply sign up, verify their identity, and gain access to the system.

Next, let’s explore existing digital ID systems and see how they work in practice.

Which countries have already launched their digital ID systems?

Countries began developing digital IDs at different times. Some, like Estonia, pioneered the concept decades ago. Others are only now beginning to navigate this space. As a result, there are many variations of what can be called a “digital ID”—ranging from electronic extensions of physical national ID cards and driver’s licenses to fully standalone digital identities.

However, projects like Ireland’s myGovID account or Australia’s myID—which offer a single login to access public services after verification—can be considered a transition point. These options can’t be used in person as official proof of identity; they only grant access to selected online services. Nevertheless, these projects may evolve into fully functional digital IDs in the future.

Another example is “digital IDs” that can be obtained through online or in-person registration in a government-run digital ID system. These documents include personal details and a QR code that can be scanned during verification. Holders can either print them or store them as an e-file, using them instead of physical ID cards in many verification scenarios. Examples include India’s e-Adhaar and the Philippines’ ePhilID.

Since these are often printed and used as physical documents, they aren’t pure digital IDs—they represent another transitional form in the shift toward fully digital identity. That’s why they’re not included in the list.

Disclaimer! This list of digital IDs by country doesn’t represent the entire picture. It highlights the most mature projects and reflects the current state of implementation globally. This list will be updated regularly.

In an attempt to create a sort of updated map providing information about digital ID initiatives across the globe, we represent only existing projects, which can be at different launch levels:

| Country | Digital ID |

|---|---|

| Austria | ID Austria |

| Bhutan | NDI |

| Bosnia and Herzegovina | e-IDDEEA |

| China | The National Online Identity Authentication Public Service |

| Costa Rica | IDC-Ciudadano |

| Denmark | mitID |

| Estonia | e-ID |

| India | Aadhaar |

| Singapore | Singpass |

| South Korea | Mobile IDentification App |

| Spain | MiDNI |

| UAE | UAE Pass |

Austria

Austria began this journey toward digital ID with a mobile phone signature system called Handy-Signature. In 2023, it transitioned to a full digital ID system known as ID Austria, implemented through several apps like Digitales Amt (Digital Office) and eAusweise.

The system offers two levels of functionality:

Basic: Retains all features of the former mobile signature.

Full: Enables digital ID use on a smartphone and supports EU-wide recognition.

The dedicated eAusweise app is part of the ID Austria digital ecosystem. It can serve as digital proof of identity and store a digital driver’s license and vehicle registration certificate for use within Austria.

To access the full version, individuals must schedule an appointment at a government registration office. They must present an official photo ID, such as a passport, identity card, driver’s license, or another document proving residency in Austria, along with any required supporting documents for identity verification.

With full functionality, ID Austria allows users to prove their identity anywhere in the country, verify themselves online, access digital services, and conduct secure online transactions.

Bhutan

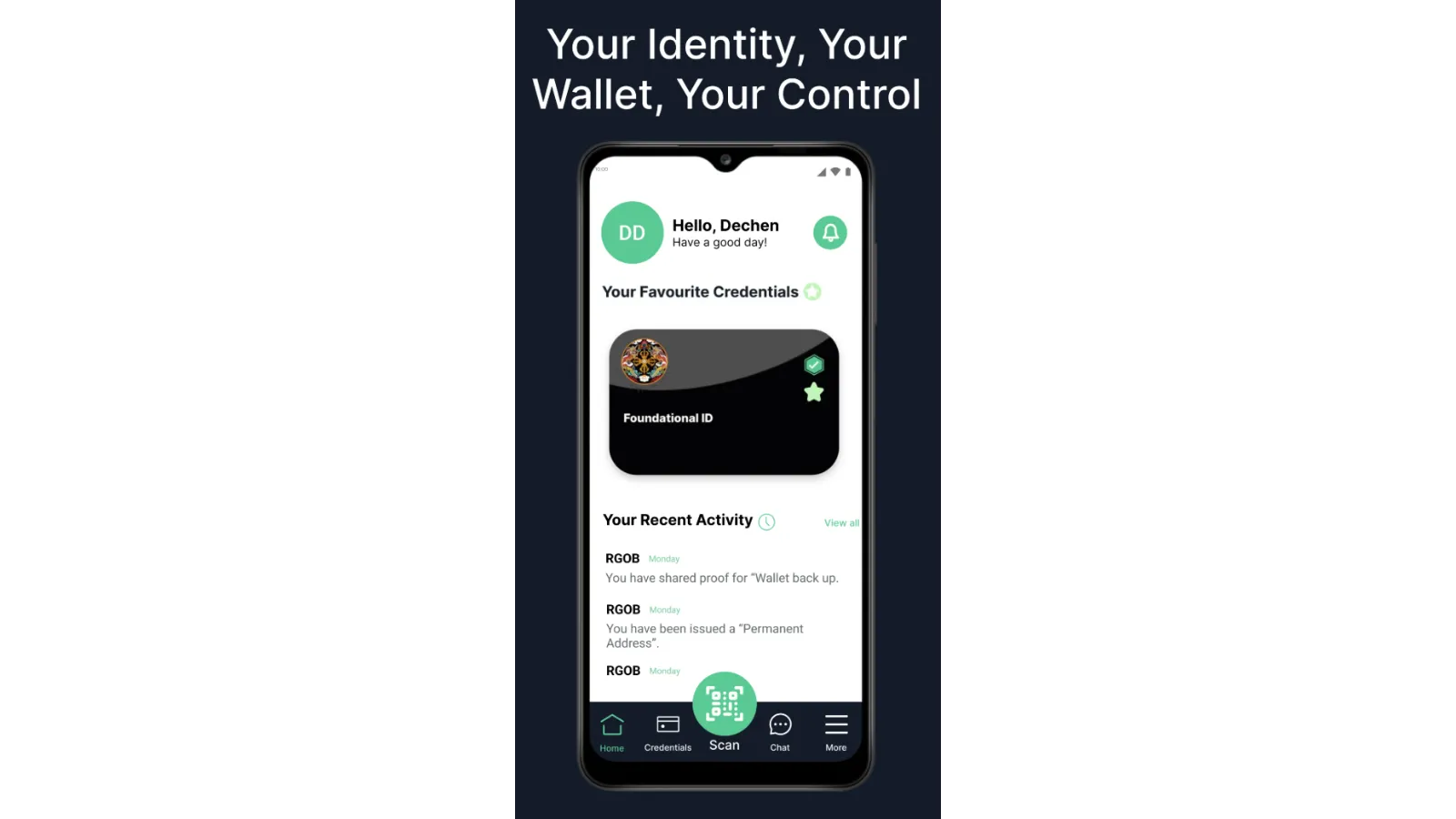

Bhutan’s National Digital Identity (NDI) was formally introduced to the public on February 10th, 2025. Throughout 2025, the administration has been running advocacy and onboarding programmes: in Samtse, for example, local officials have been helping residents install the app, complete registration and learn how to present credentials, with a particular focus on people who are less confident with smartphones.

According to official statements, NDI credentials are already connected to more than forty services in sectors such as banking, health care, education, telecoms and transport, and additional issuers are being added.

In October 2025, the NDI team and Bhutanese authorities announced that key parts of the system had been anchored to the public Ethereum blockchain. Public material on the project describes it as the first national-scale digital ID system to use Ethereum in this way, with migration of existing credentials expected to run into early 2026 and coverage projected at close to 800,000 residents once the process is complete.

Bosnia and Herzegovina

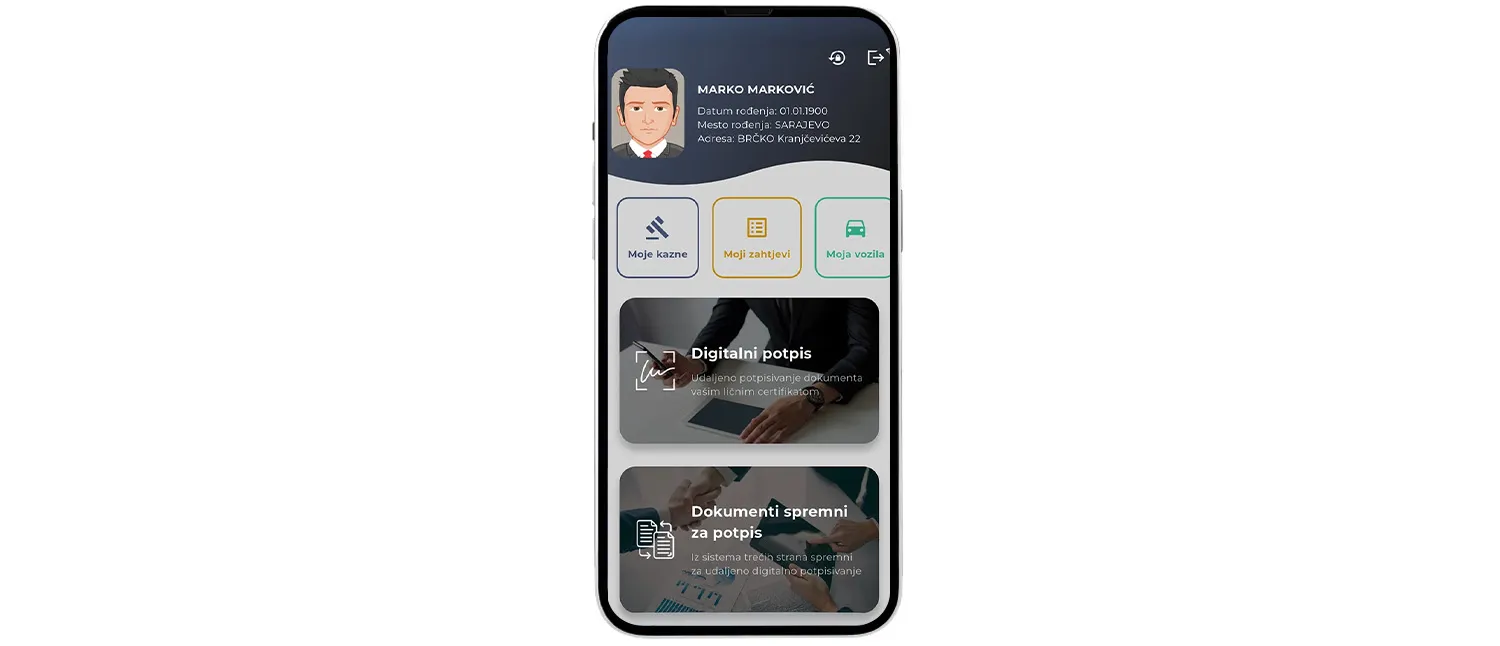

The country has launched a mobile app called e-IDDEEA, which lets citizens issue digital versions of their passports, driver’s licenses, or ID cards. Like other EU member states, Bosnia and Herzegovina ensures that the app meets eIDAS requirements for electronic identity documents.

Besides digital IDs, e-IDDEEA also provides qualified electronic signatures that can be used remotely across connected services. These include both government agencies, such as for tax payments, health insurance, or childbirth benefits, and commercial organizations like banks and telecom operators.

Bosnian citizens can also digitally sign documents using the IDDEEA app.

To register, users must apply in person at authorized IDDEEA registration offices. After registration, they receive credentials to log in to the app.

China

Although this type of digital ID currently exists only online and doesn’t support offline verification options, it’s worth highlighting as an example that stands out for both its privacy approach and technical implementation.

Starting July 15, 2025, China launched a government-controlled digital identity system called the National Online Identity Authentication Public Service. Citizens can voluntarily register to receive a unique online identity token—reffered to as a network number. This token, combined with non-explicit identification data, can be used for identity verification and signing up for digital services across the web.

The service is available as a mobile app. To register, users must complete full identity verification, including government-based ID and selfie checks. Notably, residence permits are among accepted IDs, making the service available to international residents in China. The digital ID is also tied to the user’s mobile phone number.

The ID check involves NFC technology because Chinese identity cards—the most commonly used documents—are biometric, but their non-standard chips can only be read by authorized inspectors.

According to the official statement (available only in Chinese), the system is designed to support trusted digital identification and protect personal data. It complies with several key regulations, including the Cybersecurity Law, the Data Security Law, the Personal Information Protection Law, and the Law on Countering Telecommunications Fraud.

Costa Rica

The country introduced its digital ID card—a full alternative to the physical one—in September 2025. This digital document can be used as valid proof of identity across a range of institutions, including banks, telecom providers, public services, and other businesses. One exception is the 2026 election, where only physical ID cards will be accepted.

Some organizations, such as Banco de Costa Rica, are already prepared to support digital IDs. Others have up to six months from the launch date—Septermber 9, 2025—to offer this option to their customers.

Launched in early fall 2025, Costa Rica’s digital ID card can be used in many everyday situations.

To get a digital ID, Costa Rican citizens must register online through a dedicated website using their email and identification number. After registering, users can download the app called IDC-Ciudadano and activate their digital ID card using facial verification.

Denmark

Denmark offers several digital ID options. The primary one is the national eID, MitID, which is used to log into public services and online banking. To obtain it, users can verify their identity either through passport authentication in the MitID app or by visiting a Citizen Service Center for in-person verification.

In addition, Denmark has digital versions of their driver’s license and health insurance card, both legally accepted as replacements for their physical counterparts.

The country has also announced the development of an eIDAS-compatible digital wallet. This will enable features like age verification and the use of a MitID, both online and offline. It will also support cross-border acceptance of Danish eIDs within the EU.

The EUDI Wallet

The EU is currently building an open-source prototype for a digital wallet. Each Member State will use it to develop a national app based on local systems. A Europe-wide rollout is planned for 2026.

Estonia

Estonia is a pioneer in digital ID implementation, with its national e-ID system in operation for over two decades. This country represents a unique evolution in digital identity, where the “digital ID card” began as a type of physical document.

Unlike the standard Estonian ID card, the digital ID card wasn't valid for travel or in-person identification. Instead, it enabled users to vote online, sign documents digitally, access healthcare records, manage banking and business, shop securely, and more, using specialized portable smart card readers and software.

As of May 1, 2025, the Police and Border Guard Board stopped issuing new digital ID cards. However, previously issued cards remain valid until their expiry date.

In Estonia, digital ID cards (right) were issued alongside standard ID cards (left).

Estonia also offers Mobile-ID, a SIM-based digital ID used for the same purpose as physical IDs—logging into e-services, confirming payments, signing documents, and accessing government portals. Mobile-IDs include security certificates valid for five years, and are issued by local mobile operators Telia, Elisa, and Tele2 at their service points. While service fees and conditions vary, all providers comply with the national standards.

Today, Estonia—alongside other EU member states—is working on the EUDI Wallet, which will support identification, digital signing, and document storage, contributing to a unified digital ID framework across the EU.

India

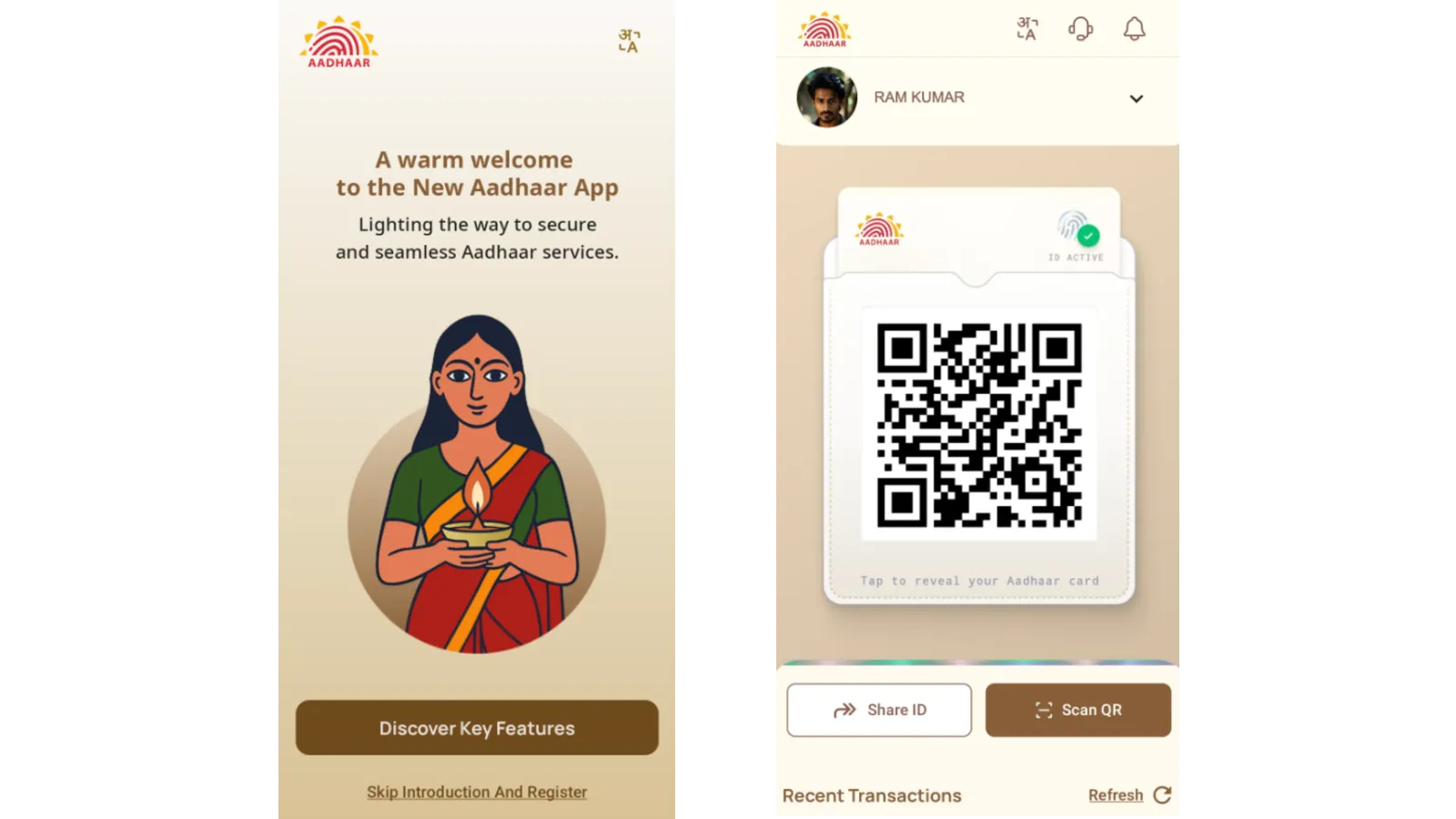

India’s Aadhaar system has existed since 2009, and in 2025 authorities began to place more emphasis on using it directly as a digital credential on smartphones.

On 8 April 2025, the government publicly unveiled a new Aadhaar mobile app. The announcement described an application that allows residents to verify Aadhaar details digitally using QR codes and face authentication instead of handing over photocopies of their card. The first release was a beta, available on Android and iOS, with the explicit goal of gathering feedback before a wider roll-out.

Throughout the second half of 2025, the Unique Identification Authority of India (UIDAI) has focused on making the new Aadhaar sufficient for many verification scenarios.

In November 2025, after several months of early access, the new Aadhaar app became broadly available for Android and iOS users through the main app stores.

To get started, residents download the app, enter their Aadhaar number, confirm it with a one-time password sent to the registered mobile number, then set a six-digit PIN and, optionally, switch on face-based sign-in. At the same time, Aadhaar still requires in-person enrolment, physical letters and cards remain in circulation, and commentary on the new app stresses that many institutions will need to update processes and train staff before offline verification becomes standard practice.

Singapore

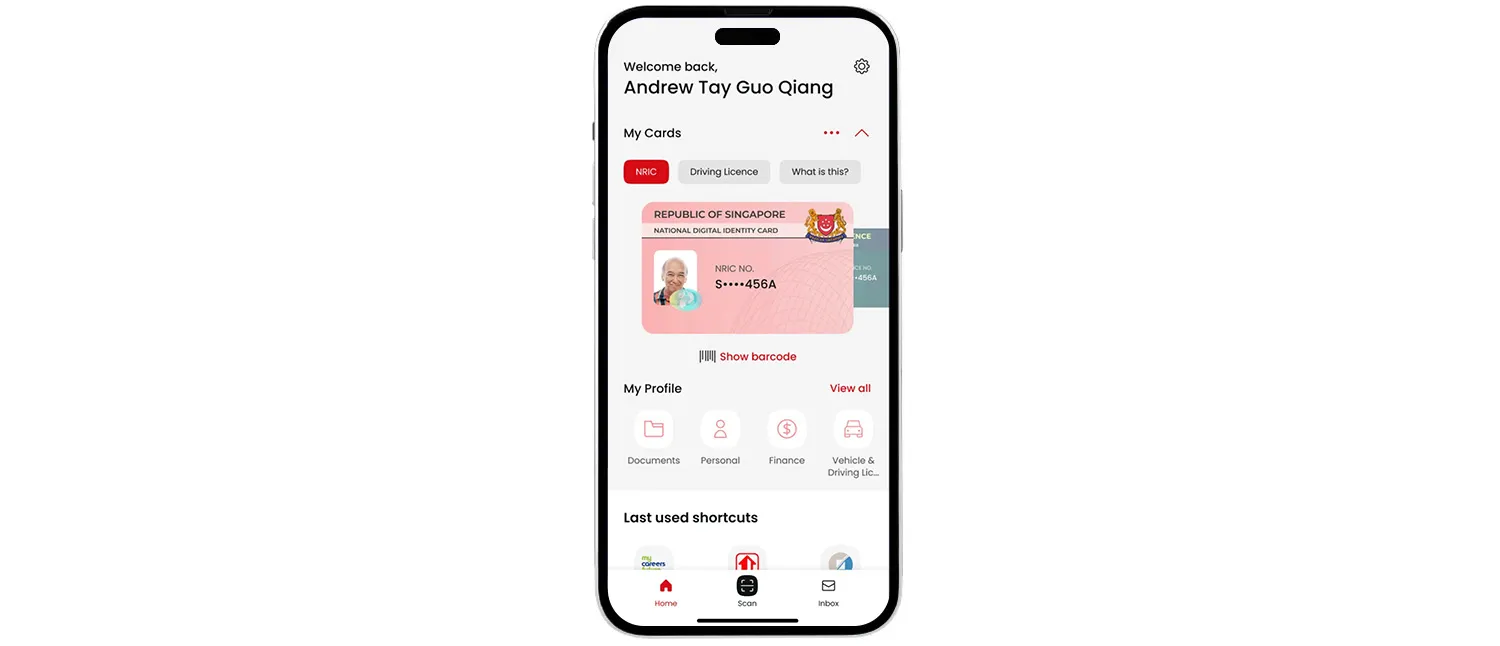

Singapore’s national digital identity system—Singpass—offers individuals a wide range of capabilities, from proving their identity (including in-person scenarios) to signing documents digitally. Available as a mobile app, the service includes a watermarked digital ID and provides instant access to a plethora of services.

The Singpass app stores a digital ID that grants access to government, public, and commercial digital services.

To obtain a Singpass, residents must register through the official platform. Interestingly, the process can be completed via face verification, after submitting personal details such as identification number, name, and mobile number. Once registered, users can access the full functionality of the service via the web platform or mobile app.

South Korea

Launched in 2025, the digital version of South Korea’s resident registration card is available to all citizens and registered residents. Secured with blockchain and encryption in the Mobile IDentification App, this digital ID fully replaces the physical card—initially for use in mobile banking and financial transactions.

South Korea’s digital ID is stored in the Mobile IDentification App, available for Android and iOS devices.

Users can obtain this ID by completing NFC verification of their electronic physical card (applicable for IDs issued after January 1, 2025) via a mobile phone or by registering at a local community center. Biometric verification is also required to prevent identity theft.

Each South Korean digital ID is tied to a specific smartphone, meaning users can deactivate it through their telecom provider if the device is lost. This model differs from Singapore’s approach, where a single digital ID can be used on multiple devices such as smartphones or tablets.

Spain

Spain offers a mobile-based digital ID system called MiDNI, allowing citizens to store and use their national ID cards on mobile devices. Currently, the app supports identity verification for accessing government services. The next phase will expand its use to include online identity verification and electronic signatures. Once fully rolled out, MiDNI will enable users to vote, open bank accounts, check into hotels, rent cars, and more—completely online.

The MiDNI app allows Spanish citizens to store their DNI (Documento Nacional de Identidad) digitally, complete with essential personal details.

To register, users can go to a dedicated website, an on-site documentation unit, or a self-service police update station. In all cases, registration involves email verification and confirming identity using a physical national ID card.

The United Arab Emirates (UAE)

UAE Pass, the national digital identity, is available to citizens, residents, and even visitors. In addition to storing identification data in digital form, the app offers a wide range of features. Users can sign documents digitally, access public and private online services with a single sign-on, request or renew official documents, and more.

The UAE Pass app offers a wide range of features—from digital signatures to seamless identity verification.

To register, users can download the app and activate it using facial recognition along with ID verification—via Emirates ID, Gulf Cooperation Council ID, or passport. Alternatively, they can use a self-service kiosk that captures fingerprints.

mDL as a form of digital identification

This list doesn’t include mobile driver’s licenses (mDLs), which are already issued by local departments of motor vehicles, rather than by federal governments, in countries like Argentina and Mexico.

The reason is that mDLs usually serve limited purposes—such as identity verification during traffic stops—and often complement, rather than replace, physical documents. Typically, mDLs contain a QR code with personal details needed to verify both the driver and the vehicle. This code may be secured with digital signatures or other protective technologies.

In Mexico, the digital format is available only for commercial driver’s licenses—a special category used by Mexican carriers operating internationally.

All of this makes mDLs a specific use case, distinct from the nationwide digital ID systems discussed in this article. Nevertheless, ISO/IEC 18013-5—a standard defining specifications for mDLs—enables secure storage, offline validation, and user-controlled data sharing, making mDLs a potential component of broader public-sector digital identity ecosystems.

What slows down the global use of digital IDs?

To make digital IDs as universal as ICAO-compliant travel documents, we need both unified standards and shared frameworks. Standards define requirements for data formats, datasets, and security features. Frameworks provide the trusted infrastructure where digital IDs can be safely used and verified.

But current systems—like the EU’s eIDAS—are regional, and there are many of them. Most digital wallets today are state-backed apps with limited interoperability across borders.

That’s why the absence of a clear, global vision for digital wallets—highlighted by Regula’s 2024 survey respondents—remains the main barrier. And it’s why physical IDs will still be around for years to come.

The physical ID legacy

Standard document and biometric checks remain essential—even in this new digital world. Getting a digital ID still requires presenting and verifying a physical document and/or face.

In online settings, liveness detection for both IDs and selfies is critical. It connects traditional ID verification with a more secure digital future—making advanced IDV providers like Regula a key part of this transition.