Risk-based authentication (RBA) is an adaptive security framework that has seen rising levels of adoption in recent years. The global RBA market reached an estimated $5.0 billion in 2023 and is projected to triple to $16.5 billion by 2032 (14% CAGR)—a growth driven by escalating identity fraud.

Biometric verification (or biometric authentication) has now become a vital part of this framework, as businesses seek security measures that are both very reliable and non-intrusive for users. Procedures like facial recognition have extremely low failure rates while still taking just a few seconds and not demanding too much of the user.

In this article, we’ll provide an overview of risk-based authentication, how biometric verification is integrated into it, and what it ultimately achieves for businesses.

Get posts like this in your inbox with the bi-weekly Regula Blog Digest!

What is risk-based authentication?

Risk-based authentication is a login security framework that dynamically adjusts its requirements based on the calculated risk of each attempt. If the perceived risk is low, the authentication is rather simple (perhaps just a password). But as the risk level increases, the authentication process becomes more stringent.

Key factors in the risk calculation include:

Device and network context: The system checks the device and network being used. A login from a trusted device and familiar network (with a known IP address and expected geolocation) is low risk, whereas an attempt from an unfamiliar device or unusual location (e.g., abroad or on a new network) raises red flags. The time of day can also sometimes be considered—access during an odd hour or from behind an anonymizing proxy might be deemed riskier.

User behavior and history: Risk-based authentication compares the attempt to the user’s normal behavior profile. Deviations from routine—performing actions that the user doesn’t usually do—will increase the risk score. If necessary, the system can also factor in the history of previous security issues on the account and the sensitivity of the requested operation.

Behavioral biometrics: The way a user types, moves the mouse, or swipes on a touchscreen can serve as a biometric signature. If the cadence or pattern doesn’t match the usual user (e.g., drastically different typing speed), an advanced system may suspect an impostor even if the correct password was used.

Transaction characteristics: Even after login, RBA can assess risk for specific activities. A high-value or unusual transaction will be flagged as high risk and could trigger an extra authentication step before completion.

All these inputs are weighted and combined to produce an overall risk score; and based on that score, the system triggers various scenarios. A routine login from a known device might require only a password, but a login with multiple red flags (new device, strange location, multiple failed attempts) would result in a step-up challenge or denial of access.

How biometric verification in RBA works

The integration of biometric verification into RBA seems like a natural evolution—biometrics are tied to the user’s physical presence and are hard to steal or forge.

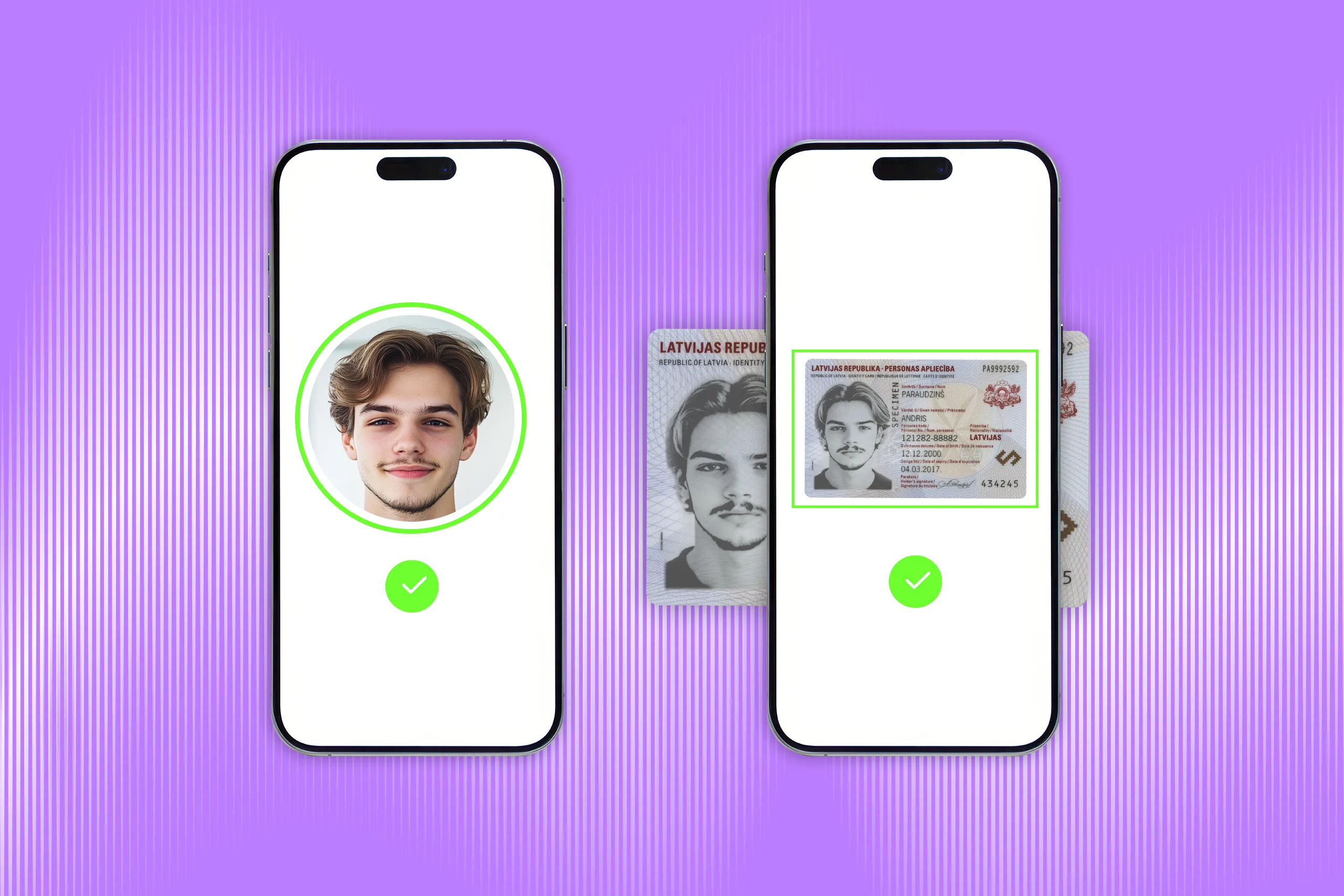

Biometric verification uses a person’s unique biological traits (like face, fingerprint, or voice) to verify their identity. In an RBA system, biometrics are typically used as a step-up authentication method when a login attempt is deemed high risk. This means that for most routine, low-risk logins, users will authenticate with something simpler like a password or device token. But if the system’s risk engine flags an attempt, it will additionally prompt the user for a biometric check.

That said, one of the first major cases of biometrics in risk-based authentication followed the complete opposite logic. The INSPASS system, installed in a number of US airports during the 1990s and early 2000s, was meant to serve pre-screened low-risk travelers. The system utilized hand geometry biometrics to expedite the entry process for this demographic, as they would pass through customs without undergoing an interview by inspectors.

Facial recognition

Facial recognition is commonly used on smartphones for user-unlocking, and is increasingly leveraged by web authentication via standards like WebAuthn (using the device’s face unlock). In risk-based authentication, it’s often the go-to for verifying identity in suspicious logins or transactions, because it’s stronger than a PIN yet not too burdensome. It’s also good for remote verification (e.g., digital onboarding or password resets) because nowadays a face can be captured virtually anywhere.

At the same time, face biometrics can be sensitive to the environment, as poor lighting, camera quality, or extreme pose angles can affect performance. There are also privacy concerns; some users are uncomfortable giving face data, perhaps associating it with surveillance. Additionally, the fact that people’s faces are often public (on social media, etc.) means attackers have more to work with for spoofs, which makes robust liveness detection absolutely essential.

Luckily, modern solutions like Regula Face SDK are not only capable of instant facial recognition, but also prevent all types of known presentation attacks such as the use of static face images, printed photos, video replays, video injections, or masks. They can also operate effectively in almost any lighting conditions and are compliant with data privacy laws.

Fingerprint scans

Fingerprints have been used in security for decades and are great for local device unlocking that participates in a broader RBA scheme. For example, if a login is high-risk, the system might push a notification to the user’s phone and require them to scan their fingerprint on the phone to approve. This is also why fingerprints can be used on the PC without needing an actual fingerprint reader.

Modern fingerprint scanners (capacitive or ultrasonic) are fast and small, and are found on billions of smartphones and many laptops, keyboards, door locks, etc. The user experience is seamless, since just a touch on a sensor can log you in without even lighting up the screen in some cases. Fingerprints as a factor are also something users have grown accustomed to for unlocking devices and payment authorizations (Apple Pay, etc.), so user acceptance is high.

There are some considerations still, as dirty or injured fingers can cause false negatives (didn’t read properly), and some people have worn fingerprints (e.g., due to manual labor) making it harder to capture consistently. Interestingly, latent fingerprints can also be lifted from objects a person touches and used to create molds—this is a known attack which Hollywood often exaggerates but is feasible with certain materials.

Voice recognition

Voice biometrics excel in banking and customer service scenarios, and they are also being explored for authenticating in IoT contexts (e.g., logging in to your car by voice). In risk-based authentication, voice might be used when other factors aren’t available; for instance, if a user calls support, the system may do a voice verification since it can’t perform a face or fingerprint check over the phone. For web/mobile logins, voice is less commonly used as the primary step-up, but it still could be offered as an alternative for accessibility or if camera/fingerprint are not options.

Barclays is considered to be one of the pioneers of voice recognition in banking—back in 2013, they deployed a voice biometrics solution, allowing customers to be identified through natural conversation. Within a year since its introduction, more than 84% of Barclays’ customers enrolled, with 95% of those customers successfully verified upon their first use of the system. Customer feedback has also improved, with 93% of customers rating Barclays at least 9 out of 10 for the speed, ease of use, and security of the new system.

The main advantage of voice authentication is that it can be done with just a microphone, which every phone and many computers have. The voice is also a biometric that can be verified passively during a conversation, meaning it can be very non-intrusive. However, voices can vary more than fingerprints or faces due to health issues (a person with a cold might not match their normal voiceprint well). Background noise and call quality can also heavily impact accuracy, which contributes to slightly higher error rates than fingerprints or faces historically.

Additionally, the voice recognition systems of today must be advanced enough to fight off replay attacks and AI clones alike. Outside of a live conversation setting, a replay attack can be countered by a random challenge; but as for AI attacks, many systems have shown to be vulnerable at times.

Other modalities

There are a number of other methods that are worth mentioning, although they’re not nearly as common. They are suboptimal for general authentication due to their hardware needs, but in high-security or high-throughput environments they might be part of an RBA strategy, if necessary.

For example, iris scanning is extremely accurate and is often used in border control (e.g., immigration kiosks). It’s a bit more cumbersome, as it requires an IR camera close to the eye, but offers one of the lowest false match rates of any biometric.

Retina scans (scanning blood vessels at the back of the eye) are even more intrusive and rare outside of the military.

Palm vein scanning (infrared vein pattern in one’s hand) is also used in some products and by some businesses because it’s very secure and still contactless.

How biometric verification in RBA is challenged every day

As biometric verification gets more traction, attackers respond with more sophisticated tactics to fool it. Let’s now outline the major threats and biometric authentication systems and how they impact RBA deployments:

Presentation attacks

Attackers can use a number of spoofing techniques to trick biometric systems:

High-res displays and video loops: An attacker who somehow gets a video of the target might use a high-resolution tablet to play it and face it toward the camera. Sometimes, they may even loop a blinking sequence to try to beat simple liveness checks.

3D masks and prosthetics: On the more physical side, there have been demonstrations of hyper-realistic masks (printed in 3D from a person’s image) that can fool systems that lack depth detection. AI can aid here by generating 3D face models from 2D photos, which can then be 3D-printed. These mask attacks are not common due to the expense and the need for physical presence, but in targeted attacks, one can’t rule it out.

Voice replay and cloning: For voice recognition, simply replaying a recorded voice clip of the victim can sometimes work if the system doesn’t use a challenge-response mechanism. Attackers can compile voice samples of a target (from YouTube, voicemail, etc.) and use AI voice cloning services to synthesize responses in the target’s voice.

One classic example of spoofing was the BBC twin test on HSBC’s Voice ID back in 2017. A reporter’s non-identical twin brother was able to mimic his voice and gain partial access to the bank account by repeating the passphrase, after several attempts.

AI-generated deepfakes

Perhaps the most disruptive threat is the rise of AI-generated deepfakes—realistic fake images, videos, or voice recordings of a target individual, created to impersonate them during a biometric check. If a deepfake fools an authentication system, the attacker can log in as the victim without ever having met them or stolen any physical factor. Deepfakes also present a challenge in that they can be attempted remotely at scale—an attacker could keep trying different AI-generated variants to see what sticks.

One striking incident occurred in early 2024: criminals created a deepfake of a company’s CFO and other employees to trick a finance officer. In a video conference, the staff member saw what appeared to be their CFO’s face giving instructions. Believing it was genuine, they subsequently wired $25 million to the attackers’ accounts before the scam was uncovered.

In response to that, many biometric vendors like Regula are implementing deepfake detection into their products. Additionally, secondary confirmation can help; for very sensitive actions, some institutions may want a human in the loop (e.g., a video call with an agent) if anything looks off.

But from an RBA perspective, the system might treat the mere possibility of a deepfake as a risk factor. For example, if the facial recognition confidence is normally 99%, but in a login it drops to 80% and the system suspects something odd about the image, it can deny access or require an alternative factor. Some banks have also started incorporating document liveness authentication alongside face biometrics, where the user must show a live ID document as well.

Making biometric verification secure

Your ID verification process can greatly benefit from robust software solutions that make it not only secure, but also user-friendly and compliant. For instance, face biometrics with liveness checks can be carried out by solutions like Regula Face SDK.

Our cross-platform, fully on-premises biometric verification solution features:

Integration with existing systems: The SDK integrates with a wide range of physical devices and mobile apps to seamlessly fit into your environment.

Advanced facial recognition with liveness detection: The SDK uses precise facial recognition algorithms with active liveness detection to verify users, preventing spoofing through photos or videos.

1:1 face matching: This matches a user’s live facial image to their ID or database entry, verifying identity at a 1:1 level.

1:N face recognition: This scans and compares the user’s facial data against a database, identifying them from multiple entries at once (1:N).

Face attribute evaluation: This assesses key facial attributes like age, expression, and accessories to improve accuracy and security during identity verification.

Adaptability to various lighting conditions: Operates effectively in almost any ambient light.

Multilingual support: Available in over 30 languages for easy localization.