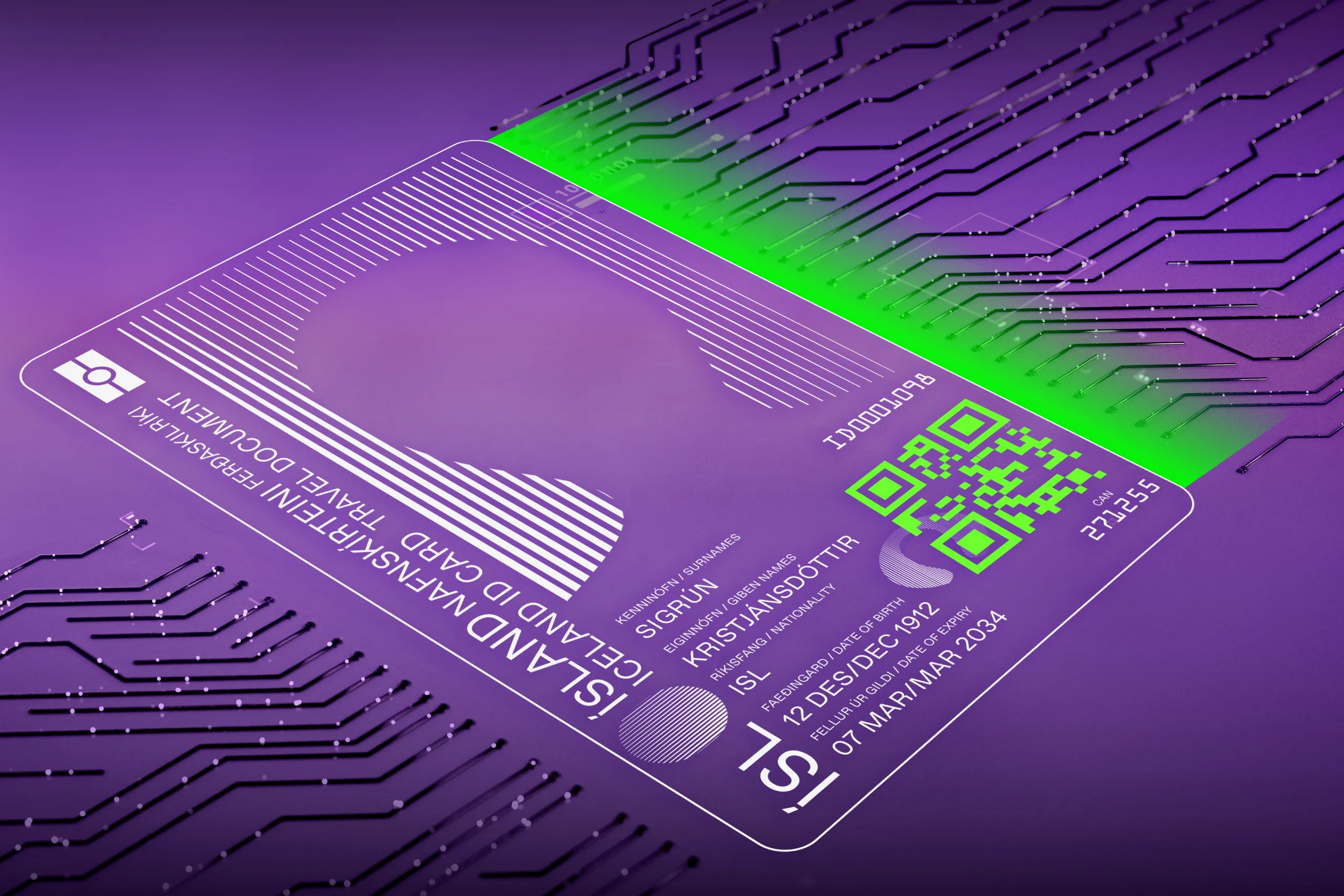

With the rise of generative AI, creating forged IDs has become more affordable than ever. For trained experts like border control officers, spotting fakes remains a routine task they can complete effectively, regardless of the tactics used.

For many businesses, document authentication is not a primary focus. Companies—especially those in non-regulated sectors—often use identity documents simply as a source of personal details, proof of age, or formal identity confirmation. In such cases, human inspectors may overlook a fake passport or driver’s license when advanced forgery techniques are used to mimic a genuine ID.

This is where document fraud detection tools—both hardware and software—come into play. They not only help organizations speed up the collection of personal information but also verify IDs with forensic-level accuracy.

This guide explores the document fraud detection tools businesses can rely on in daily operations.

A warm-up quiz: Can you outsmart the fraudster?

The best way to understand the challenge is to step into the shoes of an identity verification professional. Imagine your job is to catch scammers before they slip through security at an international airport. How many fakes can you spot?

💡Don’t hesitate to share your results on social media to raise awareness among your colleagues and industry peers about the threat of document fraud!

What is document fraud—and why should you care?

Counterfeit, forged, and pseudo identity documents—as well as terms like fake and false IDs—are often used interchangeably in articles on the subject. However, the differences between them are clearly defined in official guidelines.

According to Interpol, here are three key definitions:

Counterfeits—Unauthorized reproductions of genuine documents created entirely from scratch. These are illegally manufactured using improvised methods to imitate security features, often replacing secure printing with standard printing. Counterfeiters may also use more advanced techniques similar to those in authentic passports and IDs, but the quality is usually lower.

Forgeries—Genuine documents that have been altered in some way. For instance, a fraudster might replace a page with personal data, substitute a photo, or change a name to mislead authorities about the holder’s identity.

Pseudo documents (fantasy documents)—Identity documents that don't formally exist. Unlike counterfeits, which imitate real IDs, pseudo documents are entirely fabricated. They may look realistic but lack authentic data and security features, or they may contain meaningless information. Fraudsters rely on inspectors not knowing exactly what a genuine ID should look like.

In short, all fake IDs are false to varying degrees. While a counterfeit is a fake from the ground up, a forgery is a genuine document that has been fraudulently modified.

Fraudsters use many techniques to alter or create fake IDs. Recently, generative AI has entered their toolkit, enabling the creation of deepfakes—realistic-looking images of ID data pages. However, traditional methods are still popular: in 2024, 58% of companies surveyed by Regula reported encountering fake or altered physical documents in their systems.

In practice, changes typically target:

Personal data such as photos, names, or other identifiers. These may be replaced for impersonation, using someone else’s identity or a fully synthetic one.

Security features such as holograms, machine-readable zones, barcodes, or electronic chips. This is especially common in counterfeits, where fraudsters try to imitate mandatory security components to make the document look genuine. In forgeries, the security features containing personal data are altered first.

Document fraud detection tools focus on verifying both the data and the security features of an ID. But the holder is just as important—an authentic document is worthless if it doesn’t truly belong to the person presenting it.

Subscribe to receive a bi-weekly blog digest from Regula

Types and key capabilities of document fraud detection tools

Companies typically rely on one of two main types of identity verification flows—on-site or online. These may involve human inspectors or be fully automated.

For instance, a hotel guest may present their ID to a receptionist, or check in through a self-service kiosk.

In a digital environment, a new customer of a banking app may confirm their identity using their smartphone, either through ID and selfie verification or during a live video chat with a bank representative.

Different use cases require different document fraud detection tools. Regula’s product line addresses this need with both hardware and software solutions.

Let’s take a look at the best fits for various business scenarios.

On-site checks: Regula document readers

When it comes to on-site document checks in business, there are two main use cases.

Companies from non-regulated sectors, such as rentals, hotels, and healthcare providers, employ data entry automation to speed up user registration. In this scenario, personal details are recognized and sent to a database immediately after ID scanning.

Regulated businesses—for instance, traditional banks or insurers—typically require full identity confirmation, where document authentication plays a critical role. In addition to recognizing identification data, they must ensure that the presented document is genuine.

Regula's document readers support both scenarios. They scan documents under multiple light sources—visible, infrared, ultraviolet, and coaxial—and automatically perform authenticity checks. Designed to read identity documents in various formats—passports, identity cards, driver’s licenses, etc.—they come in different engineering dimensions:

Compact standalone devices

Embedded devices for self-service kiosks

For example, the compact Regula 70X7 reader is available in multiple modifications equipped with one to three light sources. This makes it suitable for tasks ranging from simple data entry automation to in-depth ID authentication under UV or IR illumination and NFC verification.

The authentication process remains straightforward, as all Regula readers are powered by advanced ID scanning software. Regardless of the document type, the software recognizes and runs authenticity checks to confirm it’s genuine.

Regula readers are trusted by border control officers, banks, airlines, visa centers, immigration services, and other businesses where daily ID verification is essential.

Online checks: Regula software solutions for document and biometric verification

Online ID document authentication is a distinct use case. In digital environments, document fraud is becoming more sophisticated, with newer threats emerging, such as deepfakes and presentation attacks. This calls for a specific verification flow that anticipates all fraudulent tactics.

The digital identity verification process typically includes five key steps:

In this framework, document authentication is always paired with a biometric check to ensure the ID holder is both a real person and the legitimate user. Here are the steps that help digital businesses verify this:

Document image capture: First, a user scans their ID (primarily the data page) with a smartphone. It’s essential to capture a high-quality image on the first try. With Regula Document Reader SDK, this is achieved through advanced document capture and image quality assessment. Image preprocessing techniques help obtain a sharp, accurate shot using mobile devices, web cameras, or passport readers.

Document assessment: The software runs authenticity checks to confirm that a physical, valid ID is presented. Regula SDK reads not only the visual inspection zone but also machine-readable data from barcodes, machine-readable zones, and security features like Multiple Laser Images. Also, ID liveness detection can be applied to protect from an injection, on-screen image, or printout.

Document data extraction: All textual data from the ID is recognized and sent to a database for further processing. In biometric documents, the software also checks and reads data stored in electronic chips, and performs server-side verification for zero-trust-to-mobile cases.

Selfie capture with a liveness check: Once the ID is verified, the holder’s identity is confirmed via selfie verification. Liveness detection, performed by Regula Face SDK, can involve deep analysis of a static selfie or a short video with random movements (smiles, head turns, etc.)

Face comparison: Finally, the selfie is compared against the ID’s portrait to ensure it’s the same person.

These five steps may seem straightforward, but achieving reliable results in seconds requires advanced technology and fine-tuned settings.

Document type recognition is one of the main challenges. There are thousands of identity documents suitable for verification. A user may present a passport, identity card, driver’s license, or voter card to open a bank account, buy a SIM card, etc. Businesses in banking, hospitality, and mobility services often serve international customers, doubling the number of ID templates needed as references.

Regula Document Reader SDK addresses this challenge with the world’s largest ID template database—over 16,000 items from 254 countries and territories.

User experience is another critical factor. Customers may have concerns about data privacy or may be not tech-savvy. That’s why Regula SDKs are 100% on-premises and fully customizable, offering localization in 30+ languages and seamless integration into existing workflows across multiple platforms.

Regula SDKs serve businesses worldwide in different sectors including banking, fintech, and aviation.

Choosing document fraud detection tools: A practical toolkit

Regula solutions are among many options currently available on the market. Moreover, companies often use products from multiple vendors in their IDV workflows at the same time, as KuppingerCole Analysts noted in a recent report.

To make the right choice, you can follow this framework:

Define the key characteristics of your IDV system. This free PDF with a 9-step approach to choosing IDV solutions can be helpful at this stage.

Decide on a deployment model. Generally, there are two options: SaaS or on-premises. One of the main differences is how personal data is processed and stored—in the cloud or in the client’s environment. Your choice should take into account both regulatory requirements and business needs.

Run real-world tests.This step is critical for both biometric and document verification checks. Trial runs with actual IDs and customers in your typical scenarios reveal more than marketing materials ever could.

Evaluate ease of use and implementation. Trials also highlight the practical aspects of IDV and help you track key metrics. Consider where the software can be deployed, what customization options it offers, and whether it is accessible. These factors should not be overlooked.

Assess support. Vendors differ in help desk availability during and after implementation, as well as in whether they use in-house or outsourced teams. For instance, Regula uses a swarming support model, which we find most effective for our customers. However, the best choice depends on your specific case.

Combating document fraud with Regula

Document fraud will continue to evolve—and so will the defenses. As new ID formats and forgery methods appear, it’s crucial for businesses to stay one step ahead with reliable, up-to-date tools.

Regula’s hardware and software solutions provide a comprehensive shield, combining a global document knowledge base, advanced fraud detection algorithms, and user-friendly integration. This enables organizations to confirm identities with confidence.

Book a call to explore your options.