As deepfakes—AI-generated fake digital assets mimicking real people and identity documents—gain traction, they’re becoming an increasing threat. Due to the democratization of generative AI tools, deepfakes are spreading rapidly across industries, affecting businesses of all sizes and setting new identity verification trends.

In this article, based on Regula’s expertise and the latest data, we explore why deepfakes are emerging as one of the biggest threats in recent years. How are they impacting businesses, and how are companies fighting back?

Key takeaways

In 2024, half of all businesses have experienced fraud involving audio and video deepfakes.

Additionally, 66% of leaders believe deepfakes pose a serious threat to their business.

- On average, businesses across industries have lost nearly $450,000 to deepfakes.

Meanwhile, 58% of companies encounter “traditional threats”—fake or altered physical documents—in their systems.

- 42% of companies consider identity theft as the greatest risk associated with deepfakes.

Why are deepfakes the focus of the study?

Deepfakes are increasingly being used in fraudulent activities, and concern is growing as the technology becomes more advanced and affordable. Criminals can now easily create convincing fake identities and perform presentation attacks, such as displaying a deepfake on a screen during verification.

This presents a serious challenge for online identity verification (IDV) across many industries. To understand which types of deepfakes businesses encounter most and how they combat this threat, we conducted a study across five countries, including the US, Germany, Singapore, the UAE, and Mexico, across industries like Aviation, Crypto, Financial Services, Healthcare, and more.

In our previous study published in early 2023, we identified deepfake fraud as one of the challenges businesses had to address. These new deepfake survey results allow us to observe how this trend is evolving, plus showcase different approaches and perceptions of this threat from companies of various sizes around the world.

Global overview: Which countries are most affected?

In the past 12 months, 92% of businesses worldwide experienced identity fraud, a figure consistent with Regula’s 2022 research on emerging identity fraud trends. The key difference now is the growing prevalence of deepfake fraud.

The 2024 survey, which includes a larger sample size and additional regions, shows that 49% of companies experienced both audio and video deepfakes, up from 37% and 29% respectively in 2022.

In 2024, companies are experiencing more deepfake fraud compared to 2022.

Interestingly, 44% of businesses had already identified video deepfakes as a growing threat two years ago. Now, they show the largest increase— 20%—compared to other forms of sophisticated identity fraud.

Note! Easily accessible generative AI tools have become a new weapon for fraudsters.

This issue affects most businesses in the UAE and Singapore, where over 50% of companies have encountered deepfakes in their systems. Mexican companies appear less affected by this threat.

Importantly, deepfakes are just one of many challenges businesses must address. Let’s take a closer look.

Fake or modified identity documents

Despite technological advances in recent years, a significant number of counterfeit or fraudulently modified physical IDs continue to be detected globally.

Note! Identity document counterfeiting remains a key threat for companies worldwide.

This “old” problem is particularly prevalent in Mexico (70%), UAE (66%) and Germany (59%). Notably, the German passport is one of the most frequently updated identity documents in the EU, highlighting the severity of this issue at the state level.

Physical IDs remain a key part of the identity verification process in many companies that fraudsters use.

Synthetic identity fraud

Over half of UAE businesses (51%) struggle with synthetic identities, which fraudsters exploit for online scams. This problem is also critical for the US businesses (49%) where criminals often create a fake “person” to target banks and financial services companies by combining real and fake identifiers, such as Social Security numbers (SSNs).

Synthetic identity fraud is also prevalent in Mexico (43%), Germany (41%), and Singapore (39%), where mobile banking is widely used.

Synthetic identity fraud, once a major threat primarily for US businesses, is now becoming a global issue.

Deepfake perceptions by industries

Video deepfakes are impacting IT companies (57%), law enforcement agencies (56%), and Crypto businesses (53%) the most. While Healthcare organizations report fewer cases of this type of deepfake, the percentage is still significant—41%.

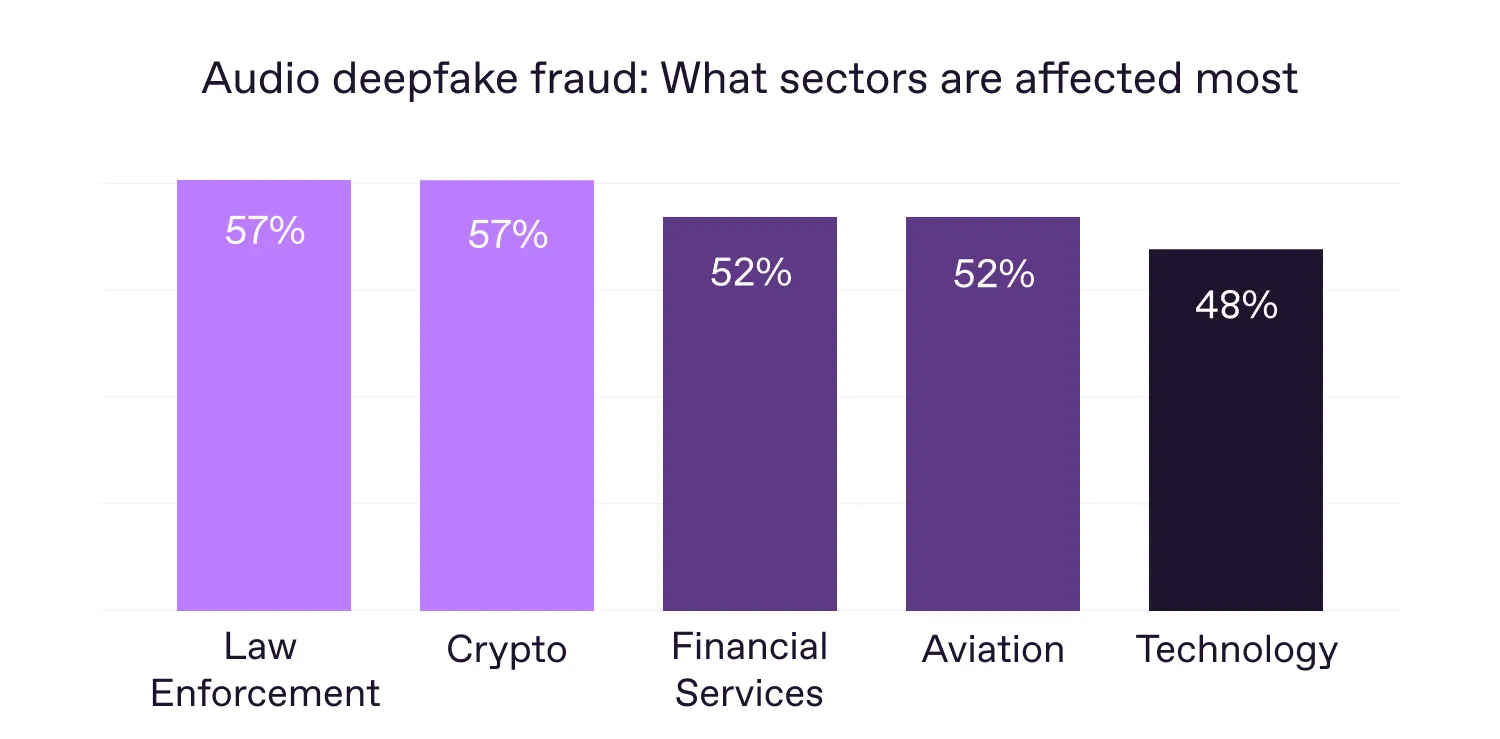

This trend is mirrored in audio deepfake fraud. Law Enforcement and Crypto organizations top this list (both 57%), followed by Financial Services and Aviation (both 52%). IT companies come in third.

Companies reporting many audio deepfake fraud attempts are mostly from sectors where most or all identity verification procedures are performed digitally.

There is also a correlation between the number of deepfake incidents and company size. Organizations with up to 100 employees reported fewer cases of audio (32%) and video deepfake fraud (37%) compared to companies with 1,000 or more employees (57% and 51% of respondents, respectively).

Note! Fraudsters target large enterprises more frequently than small and medium-sized businesses.

Medium-sized businesses (100 to 1,000 employees) fall in the middle. For instance, in the 251-500 employee range, 39% and 48% of respondents reported audio and video deepfakes, respectively.

The lower number of fraudulent attempts detected by SMBs may suggest a difference in their preparedness compared to larger enterprises. This makes it essential to explore responses from all three groups regarding their confidence in current deepfake detection methods. Surprisingly, over half of respondents expressed strong confidence.

Company size does not affect the confidence level in the current anti-fraud measures.

However, there is a gap between owners' and managers' confidence in the anti-deepfake measures in place. While 76% of owners are confident in their business’s ability to detect these threats, only 47% of managers share this opinion.

What do companies lose due to deepfakes?

On average, businesses across industries have lost nearly $450,000 to deepfakes. The largest group of respondents (28%) reported losses between $250,000 and $500,000. When looking at losses by country, Singapore and Germany show the most significant differences.

These losses may include compensation for fraud victims who are customers of affected businesses. Government agencies are now considering legislative changes that would hold banks, telco companies, and social media platforms responsible for ensuring protection against scams.

In Singapore, a Shared Responsibility Framework (SRF) was proposed in 2023 to address online phishing scams, which can now be enhanced by deepfakes. The SRF suggests cases where local businesses may bear the full loss incurred by scam victims. For instance, if a Telecom company fails to block fraudulent SMS messages impersonating a bank representative, the company would compensate customers who inadvertently disclosed their bank account details to scammers.

Interestingly, 45% of Telecom companies reported losses between $250,000 and $500,000 due to deepfake fraud schemes.

Note! None of the respondents reported experiencing no financial loss due to deepfake fraud.

When it comes to financial losses by industry, there are some notable trends. Most respondents in Banking estimate deepfake losses to exceed $1,000,000, while Healthcare companies generally face losses of up to $250,000. This may be linked to reputational risks and the potential loss of customers, which many financial institutions prioritize as major business threats.

| Deepfake fraud costs by industry (extremes) | |

|---|---|

| Aviation (43%) | $100,000 to $249,999 |

| Crypto (37%) | $500,000 to $999,999 |

| Financial Services (23%) | More than $1,000,000 |

| Healthcare (24%) | Less than $99,999 to $249,999 |

| Law Enforcement (36%) | $250,000 to $499,999 |

| Technology (29%) | $250,000 to $499,999 |

| Telecoms (45%) | $250,000 to $499,999 |

Additionally, small companies incur lower costs for fraud incidents compared to enterprises. For instance, 34% of respondents from organizations with up to 100 employees reported losses of $99,000 or less. In contrast, only 11% of companies with over 10,000 employees said the same, while 26% of large enterprises reported losses exceeding $1,000,000.

When examining how deepfakes affect business costs, the top three expenses are reputational damage, business disruption, and penalties or fines.

These priorities vary by industry, reflecting operational specifics. For instance, reputational risk is the main concern for Telecoms (51%) and Financial Services (44%), both highly competitive sectors. In Banking, a regulated industry, 38% of companies also cite penalties and fines as significant costs. Half of IT companies, which rely heavily on infrastructure stability, identified business disruption as the biggest risk. In Aviation, where businesses are often customer-centric, the loss of current or potential clients (38%) is the top concern.

Note! The way businesses perceive the deepfake threat reflects the working environment of their respective industries.

Other ways deepfakes impact companies

As an independent phenomenon, deepfakes affect various sectors of the economy and social life. Companies also point to different areas of their business where deepfakes can arise.

Note! Identity theft is the top deepfake-related risk for 42% of businesses worldwide.

Here are the key ways deepfakes affect companies:

Identity theft

Businesses are primarily concerned that advanced deepfakes can bypass biometric security systems, such as facial or voice recognition. This is a critical risk for companies in Mexico (50%), the US (45%), and the UAE (44%). By industry, Technology (51%), Healthcare (47%), and Banking (46%) are the most affected.

Phishing and fraud

Deepfakes can enhance phishing attacks by making fraudulent messages more convincing, especially in voice or video formats. Businesses in Mexico (48%), Singapore, and the UAE (both 40%) report this as their greatest threat. Financial institutions (40%) also consider deepfake fraud a major risk.

Misinformation and fake news

Deepfake technologies can alter data or create entirely false information, potentially harming an organization's reputation. This is the biggest concern for businesses in Singapore (41%) but is less critical in Mexico (only 25% of respondents). Aviation (44%), Telecoms (37%), and IT companies (35%) are particularly worried about this threat.

Evidence tampering

Deepfakes can be used to fabricate or alter video evidence in legal disputes, making verification difficult. This is the top concern for Law Enforcement organizations (32%) and a serious issue for Crypto companies (31%).

Investment scam

Deepfakes spreading false information about companies can affect stock prices, leading to financial losses. This is especially critical for Aviation and Telecom businesses (both 29%). Geographically, investment scams are most critical for companies in Singapore (36%).

Recruitment scam

Finally, deepfakes can interfere with talent acquisition by creating false candidate profiles or faking interview responses. In the era of remote work, companies need to strengthen employee identity verification. Interestingly, Crypto businesses (27%) report this as a greater concern than other sectors.

How companies address the threat

Many businesses are well-equipped with advanced technologies to mitigate deepfake-related risks. In fact, 84% of companies surveyed by Regula use multi-factor authentication (MFA) and biometric verification, such as image scans and fingerprints, to detect fraudulent attempts.

Note! Selfies and fingerprints are the most frequently used biometric identifiers in MFA.

Interestingly, most companies combine several methods to boost effectiveness.

Most companies have already integrated biometrics into their customer verification process.

Additionally, businesses are advancing IDV algorithms and adding more authenticity checks to enhance deepfake detection and prevention. For example, 47% of respondents use AI and machine learning models, which play a key role in facial recognition.

With more companies interacting with clients online, digital document verification has become commonplace. To secure these interactions, 50% of respondents use liveness detection as part of their anti-deepfake strategy.

Note! Liveness detection for identity documents presented online is now a common practice.

How will the new reality look?

Deepfakes and AI technologies are here to stay. To guide their development and use, multiple stakeholders must be involved: governments, businesses, and media. Each should choose and play their role.

Want more details on the state of deepfakes? Get a free copy of Regula’s study.