Identity verification (IDV) has become a key challenge for companies in an increasingly digital environment. In Latin America—particularly in Chile—this challenge is intensified by specific government regulations.

In this article, we break down the local requirements of digital IDV procedures, using Chile as a representative case, and present effective solutions for overcoming these challenges.

How digital businesses in Chile verify IDs, and why the process isn’t perfect

Many local companies use document scanning on customers’ mobile devices for online IDV. This approach is especially common among Fintech, E-commerce, and digital Banking businesses to meet IDV requirements for onboarding and regulatory compliance.

Typical online IDV flows use traditional technologies like optical character recognition (OCR) or machine-readable zone (MRZ) reading to identify ID type and parse data. Some organizations also leverage third-party verification services to access customer information from financial or telecom databases.

For biometric verification, companies often compare a customer’s uploaded photo ID with their selfie, as this is their only option. In fact, businesses in Chile can’t access the Civil Registry's photo database to perform 1:1 or 1:N comparisons with an official source.

This gap in identity validation widens opportunities for fraudsters, who increasingly rely on digital methods, including deepfakes, when preparing presentation attacks.

Between January and July 2022, the national police (PDI) reported 2,081 cases of card fraud, primarily exploiting stolen personal data used for identity theft. Fraud involving credit and debit cards remains both significant and costly, with institutions like BancoEstado and Santander experiencing thousands of fraud cases, resulting in losses of millions of dollars.

This surge in electronic fraud underscores the growing vulnerability in digital transactions, compounded by limitations in IDV processes.

Deepfakes are on the rise! Find out the Key Trends in Deepfake Detection and Prevention from Regula’s 2024 study.

Who else in Latin America struggles with the same problem?

The lack of access to official databases for biometric verification is not exclusive to Chile. Businesses in Argentina, Colombia, Ecuador, Bolivia, Uruguay, and Paraguay face similar challenges.

In Argentina, Documento Nacional de Identidad (DNI) cards—biometric national IDs—are widely used for digital IDV. However, private organizations can’t access the official database’s facial or biometric data, forcing them to rely on customer-provided documents, manual processes, photo verification, and basic scanning tools. Fraud is often detected too late, causing delays and customer churn.

In Colombia, the process is identical. Although national ID cards (Cédula de Ciudadanía) are prevalent, access to biometric data for third parties is limited, increasing reliance on manual methods or outsourced solutions.

Peru’s IDV landscape is more advanced. Through the National Registry of Identification and Civil Status (RENIEC), businesses can access a biometric database to verify facial data, fingerprints, and other customers’ identifiers in real time. This cross-checking significantly reduces fraud risk, unlike in many neighboring countries.

Yet, despite RENIEC’s biometric access, Peruvian companies face a critical limitation: the connection to the RENIEC database is often unstable. Frequent interruptions and failed queries reduce verification success rates, which hinders the system’s overall effectiveness despite its advanced capabilities compared to Chile or Argentina.

Subscribe to receive a bi-weekly blog digest from Regula

Is RFID technology the silver bullet for Chile?

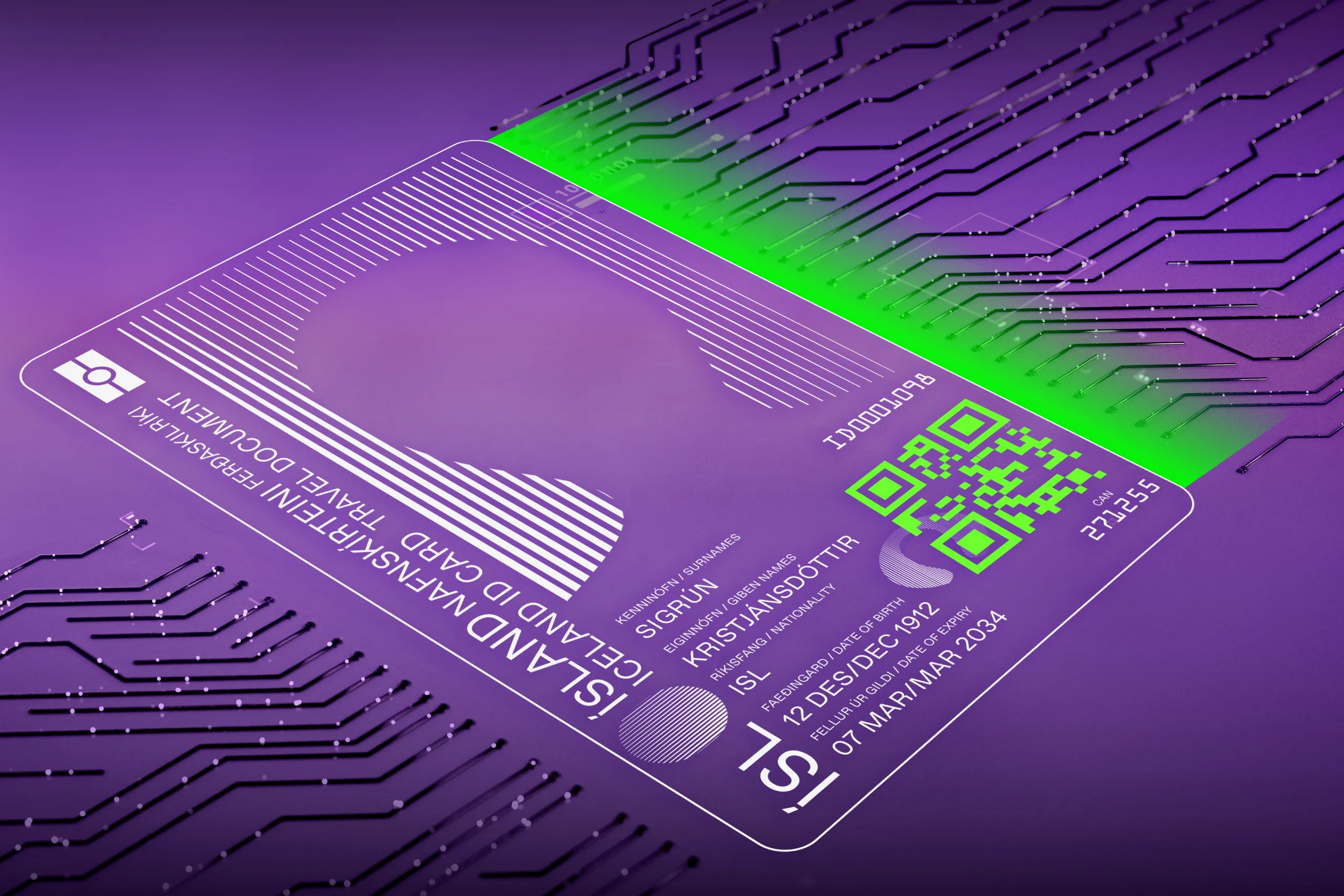

RFID technology provides a robust alternative for IDV by wirelessly reading data stored in chips embedded in ID documents. In Chile, both ID cards and passports can be verified using this technology. While passports serve primarily for international travel, the ID card is the main domestic document used for daily verifications.

Chilean passports and ID cards (shown: 2013 series) are biometric, and they support NFC verification.

The RFID chips in these documents meet ISO/IEC 14443-B and ICAO standards, ensuring secure, reliable storage and transfer of biometric and personal data. These chips hold essential information like the ID holder’s name, ID number (RUT), date of birth, and portrait from the document’s issuance.

Accessible via NFC-enabled mobile devices, this technology allows quick, secure IDV without additional hardware. Users verify their identity online by scanning the RFID chip on their document and completing the process with a selfie. This approach enhances accuracy, reduces fraud risk, and doesn’t require direct government database access—an advantage in Chile, where such access is limited.

With most Latin American countries now issuing biometric IDs and passports, this method can be scaled effectively across the region.

How Chilean companies can benefit from NFC verification

As companies in Chile and Latin America look for ways to combat identity fraud, technologies like those offered by Regula are becoming essential.

Enhanced security

RFID technology can significantly improve how companies prevent identity fraud by ensuring faster and more reliable verification. With a secure, self-contained data source in the RFID chip, businesses can greatly reduce fraud risks. Combining facial biometrics with physical and electronic document verification adds an extra layer of security, enhancing both onboarding and user authentication.

Streamlined and cost-effective process

RFID chip reading and biometric verification not only improve accuracy but also accelerate the verification process. The user simply presents their ID to an NFC-enabled device, which instantly reads, verifies, and matches the chip data with biometric information. This automated process takes just seconds, minimizing errors and reducing the need for manual checks or external databases, making it a cost-effective solution for businesses.

Customer-centric approach

NFC and RFID technologies are transforming IDV in sectors like Fintech, Banking, and Insurance, providing a smooth, fully online verification experience. This approach is especially appealing to younger, tech-savvy users who value quick, digital-first solutions. Companies targeting these demographics benefit from NFC technology’s ability to create a fast, seamless, and user-friendly verification process.

In addition to speed, this method enhances customer trust and satisfaction by offering a frictionless, modern alternative to traditional, time-consuming methods, ultimately boosting customer retention and loyalty.

Regula’s solutions cater to these needs, providing effective tools for independently verifying customer information:

Customizable cross-platform software for ID and biometric verification: Regula Document Reader SDK and Regula Face SDK.

Comprehensive authenticity checks, including RFID chip reading and verification.

Liveness detection for selfies and identity documents.

Extensive document template database with over 16,000 items from 254 countries and territories.